What a fancy title. Well, that’s just about it. Fancy !! Please don’t take it too seriously. You have every right to think about real estate without reading this article. I am just dabbling around with some “how to make a sexy headline” articles and henceforth the dumb attempt. Please excuse me 🙂

Anyway, let me start this post with an honest confession. I am not an expert in real estate. Rather, I am your average 30 year old, just married, neighborhood guy who is currently going through the usual pressures of “Why haven’t you bought your own house yet?” from his lovable mom, grandpa, granny, aunties, uncles and every other human hierarchy in that order.

Since a real estate investment is generally one of the largest investments for most of us, a wrong decision can have a significant impact on our lives. Hence, it is extremely important to try and understand some underlying fundamentals of real estate investing. The article is my attempt at understanding real estate investing.

First things, first. Why do you want to buy real estate. Are you buying a home where you can live or are you investing for future returns and have no plans of staying at the place you are buying. Now if you are buying a home to stay, this article ends just here for all practical purposes. You cant put a price to the joy of owning an own house, the joy of watching your kid scribble across the walls..blah blah..and so on goes the argument. An own house is like an IPhone. While both definitely have some practical purpose, you never try justifying their price vis-a-vis the features !! An “own house” is not an investment , its a feeling 🙂

Now if you are not a part of the “it’s a feeling” gang, the rest of the article is for us.

Common belief : Real estate always provides you great returns. Prices never fall.

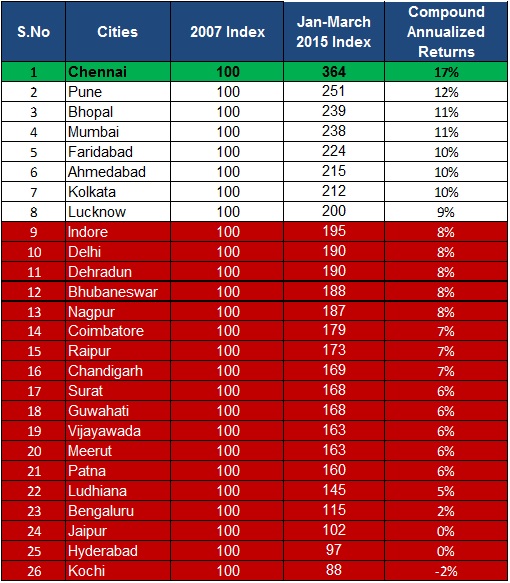

As always, we turn to evidence. Lets see how real estate prices across different cities have moved in the last 8 years.

Source: http://www.nhb.org.in/Residex/Data&Graphs.php

NHB RESIDEX tracks the movement in prices of residential properties on a quarterly basis. This is being done since 2007

I have taken 2007 to be the starting date as NHB Residex data is only available from then and has been updated only till Mar-15 (courtesy, the lazy folks at NHB)

As seen above, Chennai has been the top performing Real state market with a whopping 17% annual returns. But if you look at other major cities, 7 out of 26 cities have had returns between 9 to 12% which while not very attractive has at least stayed ahead of Inflation (7-8%). But the shocker is that, 18 out of the 26 cities have had returns equal to or below 8% not even covering for inflation !!

Just to ensure, that the evidence is concrete, let’s confirm the pricing trend from another source – Magic Bricks National Property Index which again confirms the subdued returns from real estate in the last few years.

Source: http://property.magicbricks.com/microsite/buy/propindex/index.html

So going back to our first statement – “Real estate always provides you great returns”.

The evidence doesn’t support this as most of the cities have had dismal price appreciation in the last 8 years (the above lines at this juncture apply only to chennai folks like me 🙂

Now addressing the second part – Do real estate prices fall?

Rewind to year 1997..

Read this India Today Article Real estate business in india faces unprecedented crisis as prices plummets

Real estate price crashes are pretty common across the world – Japan in 1990, US in 2007 etc. As seen in the above article even Indian real estate saw a sharp price decline during the 1996-2002 period.

“No asset class or investment has the birthright of a high return. An asset is only attractive if it’s priced right.”

― Howard Marks

So lets get our basics right,

Real Estate does not provide high returns at all points in time and can go through periods of decline or long periods of stagnant prices (time correction) !!

Real Estate prices just like any other asset goes through cycles (historically around 14 years with 7 years of high returns + 7 years of low returns according to JP Morgan Research) – there are periods of high returns inevitably followed by low returns.

Source: JP Morgan

The timing of exact turn in the cycle is extremely difficult. However an approximate evaluation of whether we are near the peak or the bottom of the cycle should be possible. Given the fact that real estate investing involves a large capital and significant loan component (at least for most of us), we need to be extremely careful and it is important to ensure that we are buying at the right price (read as valuation).

So, how do we go about evaluating if the prices are right ??

I will be using the Chennai market as an example. Given that Real estate markets are highly localized, you may apply the same framework for your respective location.

The first task is to make sure we are not caught near the peak of the cycle. But, how??

Test 1: Invert !!

The great 19th century mathematician Carl Jacobi was fond of saying that when you encounter a tough problem, “Invert, always invert.” So let us invert our problem and start with asking a simple question “What returns do we expect from our real estate investment?”

Going by the last 8 years, a lot of us would expect Chennai real estate to repeat the same 17% annualised returns. Let us invert this and see if this is possible.

A decent 2 BHK, 1200 sq ft apartment within the city would easily cost anywhere between 1 to 2 cr based on the locality. Hypothetically assuming you get an 20 year EMI for the entire amount (generally loans are provided only for a portion – around 80% of the house cost), at the current rate of 9.6% (Source: Bank Bazaar Link) it works out to approximately 94,000 to 1,88,000 every month. Assuming you require a salary that is at least twice your EMI amount and thus you must be earning at least 1.8 lakhs to 3.7 lakhs per month to buy a decent house within the city !!

Now assuming we want our property to appreciate by 17% for the next 20 years, this implies the price should multiply by 23 times or in other words a house worth 1-2 cr should become 23-46 cr. And for someone to buy it after 20 years, the EMI at the current 9.6% would work out to be 21-43 lakhs per month. Thus the buyer’s salary must be around 43-86 lakhs per month after 20 years !!!

A similar calculation at:

- 15% return expectation, works to a monthly salary requirement of Rs 30 to 61 lakhs

- 12% return expectation, works to a monthly salary requirement of Rs 18 to 36 lakhs

- 10% return expectation, works to a monthly salary requirement of Rs 12 to 25 lakhs

- 8% return expectation, works to a monthly salary requirement of Rs 8 to 17 lakhs

My head is already spinning.. Now don’t ask me what is the right price. But one thing clearly stares at our face. Real Estate prices in the long run must be a reflection of aggregate salary growth. The future salaries required to justify current chennai real estate prices look a little too unrealistic in my opinion. The past glory days of 15% plus returns in Chennai real estate look highly unlikely unless there is a new industry like IT which can manage to employ a lot of us and pay exorbitant salaries !!

Test 2: Rental Yields vs Home Loan Rates

One of the simple ways to evaluate if the property you are buying is reasonable or expensive is to compare the rental yields with home loan interest rates. Rental yield refers to the annual rent received from a property as a % of the total price of the property. Property price market is an illiquid market where generally the sellers in case of correction do not sell and mostly postpone their selling decision. Further even the real estate builders tend to not reduce prices even if demand is weak and try to wait out the period by getting support from banks who lend to them. Add to it the component of black money involved, the prices in real estate in India do not exactly respond to the economics of demand and supply as seen in other asset classes. However the rental market in comparison, is a lot more dynamic as tenants can easily shift between houses and hence responds to the demand scenario in a much better manner. Generally, in a fairly priced real estate market, the rental yield tends to be somewhere close to the cost of borrowing. Thus comparing the gap between the rental yield and home loan rates provides a good way to evaluate if real estate is cheap or expensive

Source:

http://reports.ambitcapital.com/reports/Ambit_Economy_Thematic_RealEstate_14Jul2015.pdf

http://www.globalpropertyguide.com/Asia/rent-yields

Now the above data is from a Jul-2015 report. Applying current home loan rates of 9.6% and rental yields of around 2.5 % (I am taking my current rented place yield. Generally the range is between 2-4%) the gap works out to be ~7% which is pretty expensive compared to other global markets where the range is around 2-3%. So either rental yields should go up or home loan rates should come down or a combination of both should happen for real estate prices to become attractive.

In India, we also enjoy tax benefits* on home loans and hence adjusting for them, a simple rule of thumb can be:

Buy: when home loan interest rate – rental yield < 4 to 5%

Sell: when home loan interest rate – rental yield > 7%

Thus applying this metric, again the verdict is – Real Estate in Chennai is expensive

*To understand in detail the tax benefits in a home loan read the following article http://emicalculator.net/understanding-tax-benefits-on-home-loan-updated

Test 3: If last 7-8 year returns are damn good then be cautious

Again, Chennai Real Estate has had phenomenal returns in the last 7-8 years . Caution !!

Test 4: If everyone says real estate will always go up and come up with their own stories of how they multiplied their money in the last few years – Your danger signalling siren should be at its loudest !!

In Chennai markets, the siren is still loud enough…

Phew a long post. But, nevertheless let me sum it up

- Real Estate Investing Returns = Rental Yield + Price Appreciation

- Real Estate Prices aren’t destined to go up always and can fall or go through long periods of time correction

- Real Estate just like any other asset class goes through cycles – periods of high returns followed by low returns

- When buying a property:

- Evaluate future affordability by applying “inversion”

- Evaluate “Rental Yield vs Home Loan Rates” – Buy when its less than 4-5% and sell when it is above 7%

- If past 7-8Y returns are very high, then be cautious

- Add to it, if everyone is gung ho on real estate, then be extra cautious

- Verdict on Chennai Real Estate – looks damn expensive – need to be extremely cautious

P.S:

Being from the financial industry, there is a natural bias built within me against real estate.While I have tried to be as rational as possible, I may have missed out on some perspectives given my biases. If you think I have missed out something or don’t agree with my thoughts, please feel free to share your thoughts in the comment section. I am consciously on the lookout for contradicting evidence and would love to be wrong !! Thanks for dropping by and happy investing 🙂

Good post Arun. like the effort on substantiating every point with its evidence/source.while factors such as loan interest rates and rental yield are primary, this applies more to the Apartments and societies. there are several subjective factors i feel also drive these decisions. Compare cities like Mumbai and Delhi to the Chennai, Bangalore, Hyderabad sub urban. there are ample opportunities for expansion, growth, commutation improvement through Metros, Bus stands, example: Outer ring road in chennai has the max scope with plan for metro in the same line, connecting guduvanchery south, to west, to ennur port (north).investing disposable income on these plots could be risky bets worth taking. secondly most of the price appreciations have happened by the NRI money invested in our cities and not necessarily the salaries provided by our own employers. huge land parcels are owned by NRI and politicians for whom money supply has never been a shortage.Government Guideline value + delta of market value through a survey on the locality can be an ideal indicator for measuring the true value of purchase. Real estate is best bet for an layman investor considering major ignorance on direct equities or IPOs or structured investments and boon for black money investor. moreover other subjective/cultural aspect or our lineage demands realestate as also an forced son-in-law eligibility criteria :). one negative factor is the capital gain tax incurred while selling.

LikeLiked by 1 person

Hi Vasu..Thanks for reading..I agree that sub urban areas may provide better returns if the prices are “affordable” + you are able to identify areas where the infrastructure can improve + you are ready to wait patiently. I am not sure about the NRI money driving RE prices.Even if that’s the case, now that they have started seeing poor returns in real estate they may slowly move towards other avenues (such as equities)..Real Estate still will hold its charm to majority of us..All I am saying is that – “Dont just go by what others say..Its your hard earned money and please make sure you are investing with the right expectation and sufficient research !!

LikeLike

There are so many blogs on Personal Finance-but, very few are analytical- I am glad I stumbled on your blog-very thought provoking write-up. Please continue your musings and write-ups. GOD bless you.

Kindly read this article and listen to the video- though it is an attempt to sell an Investment advisory newsletter, you cannot ignore the statistics mentioned in the talk.

I would like an expert comment from you with particular reference to what happens in the Indian Context , if the US stock market crashes.

http://thesovereigninvestor.com/exclusives/80-stock-market-crash-to-strike-in-2016-economists-warn/?z=511246.

LikeLiked by 1 person

Thank you so much for dropping by Mr Ravindran..Glad to hear that you found it useful.. I will have a look at the video over the weekend and get back to you..Do keep visiting..and thanks once again

LikeLike

The article seems to focus on homes/apartments which have rental yield. Land usually carries a higher valuation, greater risk (easier to grab), and no rental yield and is usually the target of lot of RE investments.

Nice blog, keep em coming.

LikeLiked by 1 person

In India, Real estate industry is full of crooks and almost all real estate deals involve black money. It is easy to buy but impossible to sell if you insist on dealing only through cheques and full accountability. That is the primary reason I keep away from real estate.

LikeLiked by 1 person

Arun,

I must commend yyou for the analysis and the authenticity with which you have referred back to your sources. I am currently editorial head of Magicbricks and have spend the btter part of my working life researching and writing about property values and how to use statistics to make the right investments. The Propindex was also an attempt to make data available at the locality level for everyone to use. This is why we have not priced it. Also do refer to advice.magicbricks.com when you need more data.

Firstly I tend to agree with you that if you want to make money off real estate you have to invest in early stage localities which are yet to achieve their potential. As a rule Real estate is a poor second in investing to financial markets. However, most of us enter this market as end users and the house that you purchased for its convenience and ease of use, ends up being the biggest and most expensive asset that you own eventually. This is because real estate is a very complex thing. When you buy at rates that you can afford, you also need to be able to assess its future potential. Being an immovable asset, its value grows because of various infrastructural inouts that can take place in the neighbourhood. Some of it is good to find out before you put the money on the table. Metro, flyovers, Highways and other transport links are sure to bump up values, unless you happen to be in the leeward side of the new infrastructure, so to speak. This happens when a flyover can become a separator and values drop because it is difficult to cross over to the other side. That is mostly because of bad planning, which often happens in our country.

By and large, it is possible to look for growth and returns out of property investments. Howevere, for that you need to sell when prices peak and not when you need the money necessarily. Sometimes holding on to an asset for too long results in your having lost out. The real estate asset rises in value for a period of time and then becomes a depreciating asset as the quality of the property drops. To safeguard against this, you need to buy with developers who also maintain the quality of their assets. Periodic maintenance can lead to consistently appreciating value. After about 10 years, re-engineering the building is a must to upgrade ageing pipes, electrical cables etc. Also lifestyles have started changing dramatically every 10 years at least and the changes or upgrade needs to be more than cosmetic to post a rise.

So property values and analysis have no one solution. You need to consistently understand and read the markets and strategise to get good returns. As you said, it is your money and you need to study the market very carefully before you can get good returns.

LikeLiked by 1 person

Thanks Jayashree Mam. I completely agree with you. Real Estate is probably the largest investment most of us make in our early 30s. Given the emotional and aspirational attachment we have towards a home, sometime we get carried away by the fact that home prices will always go up. As you correctly pointed out, there are a lot of factors which need to be evaluated and unfortunately the data available for evaluation property investments till date are mostly anecdotal. The Propindex by Magic Bricks is a good step in this direction to bring transparency and to let people have objective data on price trends. Let me use this for my future posts on evaluating real estate. Thanks once again.

LikeLike

first of all, kudos for the great post!! so i agree to everything you have just said and have personally taken a decision of staying on rent since long, but there have been few doubts in my mind.

1. there are a lot of people who blindly invest in real estate as compared to equities of mutual funds. it’s a (perceived) safe investments for most of the earning populia. Infact it’s the only place where general people understand mean reversion. so 20 years down the line, there would be people with more savings, if not much higher earnings and the ever-growing migration, population and optimistically speaking, GDP, could take care of the demand side of the real estate for long long time! like comeon, we expect india to be at heights 15-20 years down the line, then why not real estate? so i think it’s still worth investing a part of your portfolio in, but taking a loan is what gets to me. would you recommend someone to take a loan and invest in equities? obviously not! in real estate? why not?

LikeLiked by 1 person

Real estate will still give you reasonable returns over the long run if you get the location and price right. Right now the prices are a little expensive in most of the places and hence historical returns must not be taken for granted . Prudent analysis is required before you commit a big corpus for your investments 🙂

LikeLike

Two issues that I can see with this analysis –

1. The indices are based on cumulative effect of prices across all localities in the region. A real estate investment by an individual on the other hand will be in just one locality. He will likely evaluate future prospects of the locality and other trends before making such investment and therefore is likely to beat the indices more often.

2. This analysis is only based on the ‘white money’ transactions (which is what indices track). If you include the black money effect the returns would be much higher especially in Tier-2 cities.

LikeLike

1. True. But that is the problem with all indices. The same argument holds true for equities where you can say that the buyer would have evaluated and bought a great stock which would have easily beaten the index. The idea was to capture the trends and the returns provided by the index was a close match to returns most of us made in chennai real estate. While I am not sure on the other cities I think the NHB index is a reasonable proxy for the actual returns made by an average investor

2. Black money will always remain an issue will trying to evaluate real estate investments. But my sense is that with the gradual advent of cashless transaction and digital money, eventually if you took a 10-15-20 year view then my guess is that % of black money in real estate transaction will gradually come down. And hence it is better to evaluate Real Estate going forward from a pure demand + supply, location, rental yield, possible infrastructure growth prospects and affordability perspective.

LikeLike

Very succint analysis

LikeLike

Thanks Nishanth

LikeLike

8 years is not good enough to assess the real estate returns. Need atleast 14 years as what JP Morgan says. Return on a leveraged investment in a rent yielding property is better than equity returns in a timeframe of couple of economic cycles. A simple XIRR excel working with actual cashflows (Downpayment, Registration costs, EMI, Rent, Repair, costs, Tax, Sale proceeds) for any 15 year leveraged property investment will prove this. Compare this with your own unleveraged equity investment in a 15 year timeframe.

Buying a property for 1-2 crores for investment purpose is not advisable at all. This market is not active. 50 lac to 1 crore segment is appropriate to access a large pool of prospect tenants and buyers.

Fund Managers target 15% equity returns in the “long” term. A leveraged investment in a rent yielding property yields better than this.

From a Personal Finance planning perspective, it makes sense to upfront get a 1 crore property asset in your personal balance sheet leveraged through the cheapest and longest tenor personal financing product (home loan) and pay EMIs first (and spend the rest) rather than doing an SIP (which needs disciplined mind and has a risk of discontinuing midway) for “long” term to see the same Rs.1 crore asset in form of Equity in your Personal balance sheet.

Wealth Managers generally talk about all asset classes other than real estate because they dont make money out of it. Financial muscle of Fund Management industry is big enough to drive the public to go for Equities as first investment option.

LikeLike

It’s actually a cool and helpful piece of info. I am happy that you just shared this useful information with us. Please keep us informed like this. Thank you for sharing.

LikeLike

I read the full article but still i am confuse.

LikeLike