In our last post, we figured out the basics of liquids funds and how to select an appropriate liquid fund (Link). Today let us move on to our next category – Ultra Short Term Funds.

Ultra Short Term Funds:

Ultra Short Term Funds (UST) are very similar to Liquid Funds in terms of their conservative nature. UST funds invest predominantly in debt securities which have a maturity of more than 91 days and less than 1 year. Due to the slightly higher maturity of underlying securities in UST funds compared to a liquid fund (which invests in debt securities which mature in less than 91 days) UST funds may have marginally higher returns over liquid funds. Logic being when you lend for a longer time frame you will require a higher interest rate from the borrower. This will be visible in the YTM (Yield to maturity) of the fund.

Typically we can use this fund for short term investment horizons of more than 3 months. (I use it up to to 2 years)

As always, by applying our simple framework (Link) we will primarily need to check for

- Interest rate risk that UST funds take to improve returns:

The funds mostly have a modified duration ranging between 0.3 to 1 year (There are also few funds which are classified under UST and have modified duration as high as 1.8 years). Since we look at this category for short term and want only marginal levels of interest rate risk to improve returns, let us stick to funds which have modified duration less than 1 year. - Credit Risk:

Typically since this category is meant for short term investments, most of the funds maintain a high credit quality in their portfolios i.e they have a high percentage of Sovereign (govt. bonds) and AAA and equivalent rated bonds (AA bonds can also be included unless you are ultra conservative). But that being said, there will always be some funds which invest a portion in lower quality debt securities (below AA rated) to have a higher YTM and hence show higher returns. Hence we must check for these funds which take credit risk. I personally don’t want credit risk when I invest in UST category as it is meant for short term and “return of capital” is the priority over “return on capital”. But for investors who clearly understand credit risk and are willing to take the risk to generate additional returns, they can consider those funds with higher YTM. - Expense ratio:

The expense ratio is generally around 0.10 to 0.60% for the category for direct plans. The lower the better.

How to select the right UST fund ?

Honestly there is nothing such as the “one right” fund. What may be right for me might not work for you. So I shall take you through my logic of selecting the funds. Instead of focusing on the funds that I choose I would request you to check if the logic appeals to you. Once you are fine with the logic, you can either go with ones I choose or tweak around to figure out your own funds.

One of the biggest issues I face with the mutual fund industry is the mammoth no of choices it offers when it comes to choosing funds. While rationally, it looks like a great situation to be in, as you have large no of choices and hence can make better decisions. But unfortunately the truth is that more no of choices actually cause decision paralysis. If interested you can read about this interesting phenomenon called “Paradox of choice” here. Most of us (of course that includes me) will get into this decision-making paralysis. Hence the key is to remember that our selection process intends to find a “good enough” fund and not the no 1 fund (and the hard truth is no one can predict the no 1 fund of the future..why ?? well that is one of my favorite topics and I reserve it for another day)

So lets get to business..

The screener options in value research and morningstar do not provide Modified duration and hence to manually collate data for each and every fund is a nightmare. Finally I have found a reasonable hack to get through this.

Motilal Oswal Research publishes an excel report called Most Mutual Fund Daily. You can download it here . We will be using this for our selection process. While the sheet does have some problem as not all the cells are getting filled up and there is also a slight mismatch between some of its data and value research. However this is the closest I could get to a decent screener and hence kindly adjust with this at this juncture.

There are a total of 61 Funds classified as UST funds.

Step 1: Knock off all schemes less than 1000 cr. Since debt mutual funds are an Institutional dominated segment (i.e mostly it is the corporates who park their surplus cash in debt funds) I would prefer a larger sized scheme which will be able to handle the impact of sudden redemption (selling) pressures if any. 27 funds get knocked off and we are left with 34 funds.

Step 2: To check for credit quality – Knock off all schemes with % of AAA+ Sovereign + Call & Cash < 80%

Another 11 funds get knocked off and we are left with 23 funds

Step 3: Knock off funds with Modified duration greater than 1 year

You can keep your own cut off here. I end up removing another 3 funds and I am left with 20 funds.

Step 4: Sort it according to 1Y, 2Y, 3Y returns and observe the max and min returns

Range of return outcomes:

1Y = 7.6% to 9.0%

2Y = 8.1% to 9.1%

3Y = 8.5% to 9.6%

Putting that in perspective, for every 1 lakh you invest in UST the difference between the lowest and highest return fund in our final list in the last 1 year works out to be Rs 1,400 (for 2 years it is Rs 2,172). So the most important thing to notice is that the outcome ranges are pretty narrow and even if you end up with the lowest return fund it is definitely not catastrophic!!

Takeaway – once you have arrived at this stage – remember the “paradox of choice” and we are only looking for a “good enough” fund !!

Step 5: Stick to major AMC’s with reasonable track record and good debt fund management teams

I prefer funds from IDFC, ICICI, HDFC, Reliance, Axis, Birla Sun Life. In fact I have a bias towards IDFC as they are the only fund house where the fund manager regularly communicates (you can find them here) and hence as investors it is easy for us to understand what is happening in their funds. I sincerely wish other AMCs follow suit (Axis does a decent job but still not upto IDFC).

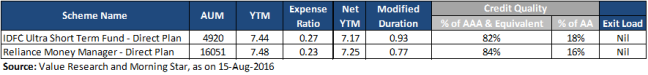

Now technically you are free to pick any fund within these 20 schemes. I would prefer IDFC Ultra Short Term Fund – Direct Plan and Reliance Money Manager – Direct Plan (Reliance has a nice app which allows me to easily invest in their direct scheme. Check the details here . Again just to clarify, I have no connection with neither IDFC or Reliance AMC and you are free to pick any fund of your choice)

In effect what we are essentially trying to do is to reduce credit risk, emphasize reasonable size, take moderate interest rate risk and stick to good fund managers!!

I hope you found this useful. In our next post, let us cover short term debt funds and how to select a “good enough” short term fund.

Happy investing folks 🙂

(P.S – In case you have a better screener source, method or suggestion, feel free to add it in the comments section. As always, I would love to be wrong and hope to keep learning from my mistakes. Looking forward to learn from all of you)

Disclaimer: No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments

Thanks for nice write-up

LikeLiked by 1 person

Hi arun, how about ICICI Prudential Flexible Income Plan. Is it on par with funds you have suggested?

LikeLike

Its a decent fund. You can also check my post on the eight factor framework to get a better idea on evaluating the fund.

LikeLike

brilliant! To the point!

LikeLike

Thanks Anando Chatterjee 🙂

LikeLike

This is a great primer for those looking to create a vacation fund or a leisure/travel fund. I ended up using your steps to drill down on some choices and then use a fund by a known AMC. Thank you.

PS – I chose UST over Liquid due to my fund having a rolling usage i.e. every 4-5 months when I usually travel for pleasure.

LikeLike

Great to hear that Tejas. Happy investing 🙂

LikeLiked by 1 person