I had written an earlier post here on how real estate markets have become very expensive (especially in Chennai) and the need to be cautious. As expected and oblivious to whatever I write, the usual pressures from my family to buy a home continues and lectures on real estate from my mom have become a routine.

Being from the financial industry (which also makes me biased against real estate), I have the opinion that equities are better over the long run vis-a-vis real estate to create wealth. But when I look around, almost everyone around me has a real-estate-made-me-rich-story. I hardly hear stories of normal-neighbour-next-door kind of people who have made wealth from equities.

Am I missing something ??

In order to solve the confusion, let me seek the help of one of the greatest minds Mr Charlie Munger.

If interested, you can read the entire article in detail here

Applying this advice to our problem,

My opinion: Equities are better than Real estate to generate long term wealth

So let me try and argue on the opposite viewpoint i.e “Real Estate is better than equities to generate long term wealth” to see if I am entitled to hold my opinion.

The Wealth Creation Ingredients:

If you remove all the bells and whistles, wealth creation boils down to the simple formula:

Wealth = Invested amount * (1+returns)^no of years

Thus, wealth creation needs three ingredients in place:

- Long time horizon

- Adequate Investment Amount

- Reasonable returns

So we shall evaluate “real estate investment vs equities” in terms of ability to create wealth through these three parameters:

1. Long Time Horizon:

In my personal opinion I think this is probably the biggest advantage for real estate vis-a-vis equities.

While this is anecdotal, you would agree that majority of people who have created wealth in real estate have held it over decades. 10,20,30 year investment periods are numbers that you commonly hear when it comes to real estate.

In fact our own properties bought by my parents have been held for over 20 years and I don’t think for the next 10 years anyone is even thinking about selling.

The major reasons that contribute to this long term holding is primarily the emotional connect a home creates, the fact that Indian society still sees an own home as a status symbol and the inherent belief that over the long term, home prices will definitely keep going up. The lack of liquidity, taxation, black money etc are few other reasons I can think of for the long holding period.

Unfortunately this is not the case with equities. Thanks to the volatile nature of equity markets, most of us are not able to hold equities over a long time period. You hardly see people who are able to hold on to equities for long periods.

But what’s this fuss about longer time horizons. Why is it such a big deal ?

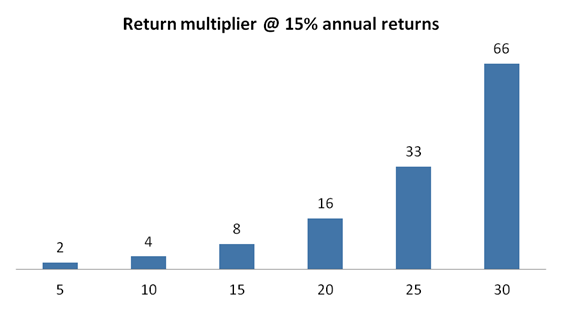

Let us understand this with an example of someone who makes 15% annualized returns

While the effect of 15% returns on your investment is gradual in the initial years the impact magnifies dramatically as your investment period increases.

The logic is pretty simple – you can see that the money approximately doubles every 5 years. As you move past the first 20 years, in the next 5 years your doubling effect is phenomenally magnified given that you already have a 16 times initial amount as your base. Similarly between 25 to 30 years the multiplying effect is doubling on a 33x base which gives you a 66x returns. See that!!

So as seen, an additional wait of 5 to 10 years brings about a significant change in your final investment value or put in other words, the mutiplier impact is dramatic as the time frame increases.

Hence the key thing to remember is:

Compounding or the multiplier effect is back ended

While most of us don’t realize this intuitively, real estate investing and the “my property multiplied by so much” stories are simply a reflection of this humble boring concept commonly referred to as compounding.

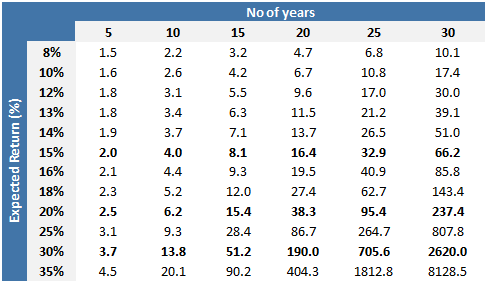

You can refer the table below to see the “multiplier effect” at various returns for various periods.

So when it comes to the first ingredient of wealth creation – long time horizon, real estate scores over equities hands down!!

2.Adequate Investment Amount

Most often than not, the first real estate investment for most of us happens around the age of 30 given the immediate pressures from our folks after getting married. The story generally goes like this – 20% down payment via our savings and some money from our families and the remaining 80% through a bank loan. Then for the next 20 years or so, you are forced to save in order to pay for the EMIs (Equated Monthly Installment).

While this of course is not something very enjoyable (and personally I am not a big fan of this working-your-ass-off-to-pay-emi’s-concept), you actually end up benefiting from the most essential behavior for wealth creation – the discipline of consistent savings!!

Equities have been trying their hand at implementing this behavioral change through the concept of SIPs (i.e Systematic Investment Plan) in mutual funds. While its a great start, I still think the forced saving which an EMI creates is just simply too powerful.

One one side, there is a sugar patient and on the other, someone like me who wants to reduce weight by avoiding sugar – the intent is the same – but who do you thing is likely to avoid sugar !! (I hope you are not checking my pics to confirm the answer)

Again the amount in play i.e your invested amount is significantly large in case of real estate. A long time frame + large investment amount is a deadly combination (assuming you get the returns part reasonably right).

In equities, it takes most of us some time to warm up to the idea of stocks or mutual funds. Most of us are testing waters with small amounts in the initial stages and take some time to get comfortable in deploying large amounts. Not able to do leverage is another disadvantage (and please.. taking leverage for equities is the last thing you should do)

So again, I guess real estate scores over equities in our second parameter – adequate investment amount as well.

(However if you are someone who has already saved enough and don’t need to take a loan for buying real estate then your ability to invest a large amount is the same be it in equity or real estate. In this case both equities and real estate have the same advantage.)

3.Reasonable returns

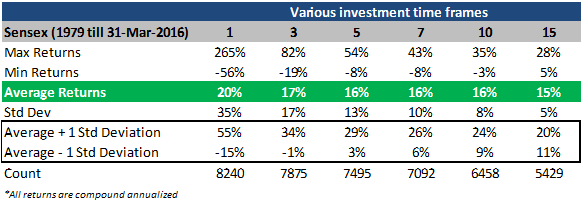

Equities definitely have an edge over real estate when it comes to long term returns. The zero long term gains tax post 1 year is the icing on the cake. Historically, equity returns in India as seen in the Sensex index has been around 15%. (Mutual Funds have given 2-4% above the Sensex)

Source: My own post here 🙂

Real Estate Returns have historically been around 10-12% over long periods (Source: How to Buy a House by E.Jayashree Kurup). And as seen below you can see that for most periods equities have comfortably outperformed Real estate returns.

Source: Forbes Article

More than the data, my fundamental premise for believing that equities will have better returns over long term is that – ultimately equities are a proxy to entrepreneurship. And entrepreneurs logically should continue to make more money than an apartment.

After all isn’t it only fair that someone with the ability to generate ideas, convert them into viable products/services, market and sell them profitably, employ people, deploy land etc should generate a higher return at least more than the input costs (real estate is an input cost).

So finally, on our third parameter of long term returns, equities score over real estate.

Parting Thoughts

Thus putting all these together,

Real Estate in terms of wealth creation has the inherent advantage of long investment time horizon and large investment amount. So the key is to ensure that you don’t get it wrong on the third component – reasonable returns. Most important is to not blindly believe that real estate returns are always great and just like all asset classes, real estate also goes through cycles and the key is to buy when valuations are reasonable. (Read more on how to evaluate real estate investments here )

In Equities, while long term returns are good, the real problem lies in the fact that not many of us can hang on for a long period (as in real estate) and most often the capital in play is also not adequate. So as investors we need to start thinking more on “how do we survive the volatility” and “how do we inculcate the discipline to save and invest regularly”.

All other issues such as which stock to buy, fund selection, expense ratio, index vs active, direct vs regular, how to time equity markets blah blah.. which take up most of the media and blogging space is a clear example of missing the tree for the woods. While its good to read about these issues, lets make sure that as 80:20 investors we get our long term investment horizon and savings discipline in place first before we start worrying on these issues.

So thus by applying Munger’s framework and thinking through my mother’s advice, I have finally come to a conclusion.

My earlier opinion:

Equities are better than Real estate to generate long term wealth

My revised opinion:

Equities are better than Real estate to generate long term wealth only if you can hang on for a long time period and have a reasonably large investment amount in play

As always, happy investing folks..

Disclaimer: No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

True. I cringe when I see SIPs of 1000s. If someone is reading stuff on the internet in India, I guess they can at least do 5000s etc. It’s difficult to convince even seasoned folks to plonk say Rs. 100,000 pm into SIPs as opposed to say 100,000pm EMI for a villa.

LikeLike

Thanks for dropping by Gov. I guess it will take some more years before we get comfortable with investing larger amounts in SIP

LikeLike

Hey Arun,

Great post. I love the reference to nuggets of wisdom and implementing it, making reading the article novel and refreshing thank looking at plain data.

Following the dictum of Charlier Munger, If I have to argue for real estate here are my views

1. From behavior perspective, Real Estate Trumps Equities, as people are more disciplined to pay loan EMI’s than investment SIP’s.

2. The second major advantage I would say over equities is the risk of “outright loss of capital invested” is lesser in real estate. We’ve seen frauds like Satyam cases and if one doesn’t diversify enough in equities, can lose the principal amount. Whereas in real estate, the land I own don’t disappear overnight, unless you get conned on legal titles – which can be prevented by legal due diligence and also during the loan process. Though investors are being given the shorter end by builders in under construction projects, a completed property over a rightful land is more secure. Sure property prices can drop, but they won’t come to zero. The volatility of real estate can be much lower than equities.

3. Land can store real value and have longevity – for living & shelter, generating food if agricultural land. In times of distress, companies may vanish, land won’t. Very few companies can survive for centuries, land once owned can be passed on for eternity unless private property gets abolished and seized by State or Government of the day. Land is more certain to store value and grow at inflation. There were periods in US where equities gave no real returns for 17 years! Leaving behind Estates of land can be more lasting for next gen than leaving behind billions of shares who can turn them to dust in no time.

4 Real estate is a passive investment and more suitable for people who can’t actively monitor equities. Sure there are mutual funds which are working now as quasi-active investments, but when market becomes very matured and efficient, passive investment in equities isn’t a safe strategy.

Hmm…so many advantages. Guess, I’ve to change my opinion as well. A diligently done real estate investment can provide stability, can help one survive in distress, and can act as a hedge against Equities at times. I’m more at ease with equities, but if a person is real estate type, he shouldn’t be discouraged. Best is to include both equities and real estate in one’s portfolio. The downside is real estate won’t have the power to make substantial wealth within decades which equities can offer.

I wish to own a farmhouse on the outskirts of a bustling city, where I can grow my own food, connect with nature and enjoy a peaceful life. Pretty expensive real estate dream I must say!

LikeLike

I completely agree with all your points mentioned Obu . Earlier I used to argue only on the returns part when it came to the real estate vs equities debate . But once I realised that most of us wont be capable of holding equities for a long period , my perspective on real estate changed . As you rightly mentioned , a combination of both equities and real estate would be a good strategy for most of us.

LikeLiked by 1 person

Good article. Real Estate is ill-liquid because of the emotional attachment. What is the use of Crores of appreciation , if one does not want to sell his property and meet emergencies or real needs like marriage or education. Equities offers high liquidity- even if I am emotionally attached to Colgate shares ( because I got them in the initial allotment !! ) I can sell fraction of the holdings .

Perhaps , we can compare Real Estate and Equity , only when the Investor owns the second house as an Investment for generating Rentals and sell it off as and when required.

LikeLike

Thanks Ravindran. Great to know that you still hold on to the Colgate shares bought at IPO. While liquidity looks like an advantage for equities over real estate, this is also responsible for most of us selling out of equities midway (during intermittent market falls) and losing out on the compounding effects. We need to figure out a way to behaviorally stay put in equities for the long run. As of now I remain a humble student of the market in search of the imaginary holy grail 🙂

LikeLike

“Equities are better than Real estate to generate long term wealth only if you can hang on for a long time period and have a reasonably large investment amount in play”

Why is it important to have a large amount in play?

LikeLike

In real estate, generally the investment is large. However most of us when it comes to equities invest comparatively smaller amounts which implies even if returns are higher our actual benefits are not as high as in real estate. In effect, a 10% on 40 lakh property is much better than say a 15% return on 5 lakhs equity investment from an absolute money earned perspective.

LikeLike