Yawn.

With all due respect to Mr Buffet, let’s be honest.

Do you seriously think that we really don’t get the fact that we have to save more and spend less.

The whole point is “most of us” get it. But to put it into action is where the difficulty lies.

Why??

The complex explanation..

Saving money is very hard, as we compare something that we can get right now to something abstract that we might be able get in the future. And for this we need to forgo the purchase and save the money instead.

The no nonsense explanation..

In a world of instant gratification, it is all about today..

The future is a problem for another day.

Desire first. Discipline later.

We want everything now. Period!

And all this means one simple thing,

Saving money is going to be far more difficult in the future if it isn’t already!

Along with that, our dreams of that “someday when we have enough money and courage to go out and do things that really matter to us” also becomes a lot more distant.

If you haven’t realized it yet, the war against “our savings” and “our future dreams” has already begun and we have a group of very strong and intelligent enemies to fight against!

To ensure that we are well prepared for this war, let’s take the help of the famous war strategist Sun Tzu.

So let’s decipher the first part of his advice..

Know Your Enemy:

Our enemies want us to save as little as possible and instead spend as much as possible. And unfortunately we have 4 of them

- Social Media

- Digital Money

- Banks

- Marketers

So the first step is to know our 4 enemies well enough.

1. Social Media

It’s a normal mundane Wednesday evening. I open my Facebook feed. And these are few pics which pop out.

Immediate Reaction: “Whoa. When my friends are doing this, why not me ??”

Now this does two things- one it suddenly plants the temptation of a vacation in me (which wasn’t there earlier) and two it raises my aspirations to an international exotic location. But can I afford it ? Why worry. I have my credit card!!

A similar social pressure hits me every time I see some friend of mine showing off his new sedan, that Royal Enfield Himalayan, that new biker jacket, that awesome party, that get together at the newly opened pub, that fancy meal at the new restaurant etc.

“Nearly 40% of American adults with social media accounts say that seeing other people’s purchases and vacations on social media have prompted them to look into similar purchases or vacations ” – American Institute of Certified Public Accountants.

So, more often than not we start comparing our lifestyle and spending habits to others via social media and end up spending money to “keep up with our peers and our increased aspirations“

The bad part is that the more number of people we start comparing ourselves to, the harder it becomes to keep up. This can lead to a feeling of financial inadequacy and a desire to spend money we might not have. The fact that many people are purposely projecting a more larger-than-life image on social media only adds to the woes.

Thus given the inherent aspirational nature of social media, we encounter many budget-breaking temptations with increased time spent in social media and hence remains a strong enemy to “our savings”

Additional reading : 1) How social media sites make you spend more 2) Why social media makes us spend more money

2. Digital Money

Whenever you buy something, have you noticed that paying with cash feels a little different compared to paying with your credit card or debit card. Think about the last time a restaurant didn’t accept card payments and you had to pay in cash.

Did you notice that when you paid by cash instead of a credit or debit card it felt more painful though logically the amount still remains the same.

Welcome to the world of behavioral economics. This is a concept in behavioral economics known as the “pain of paying.”

Simply put, it says that

- Whenever we part with our money it causes a feeling of agony or psychological “pain.”

- This “pain” happens irrespective of how big or small the amount of money you are paying

- This “pain” is higher if you pay in cash instead of credit card or an automatic payment

Strange.. Buy why?

- It’s not exactly about using cash but rather about the transparency and tangibility of the payment

- The more the transparent (read as visible) and tangible your payment is, the more is the “pain of payment”

- The transparency of a payment in cash transactions where you can see the money moving out of one pocket and into a hand, increases the amount of pain of paying associated with a payment

- On the other hand, the pain of paying is significantly reduced by electronic forms of payment (think digital wallet like Paytm, credit card, debit card etc) – which allow us to instantly receive pleasures of consumption while making payments even more invisible and intangible

- Lower the transparency = Lower the pain = More money spent

“You’re not faced with actually spending that cash and to think about it. It kind of just disappears… It makes it easier to ignore what you’re paying, what your bank account looks like when you’re making that payment… You can avoid bad news easier.”

Queen’s University professor Nicole Robitaille

Key takeaway:

Though the amount is the same, it feels ‘less expensive’ and “less painful” to pay with the card or digital wallets vis-a-vis cash

More money tends to be spent if you use an electronic payment vis-a-vis cash as the reduced pain of payment can lead us to spending more freely and not taking note of all our expenditures

If interested you can check out the video from the popular behavioral economist Dan Ariely to understand the concept in detail –

Current Scenario in India

- No of mobile wallet users > No of mobile banking users

- No of mobile wallet users > 3X no of credit card users

- Total payments through digital instruments – to increase 10X by 2020

- Proportion of non-cash transactions is estimated to overtake cash by 2023

Source: BCG-Google study

So going by the rate of adoption for digital wallets, in a few years from now, majority of our cash transactions would be replaced by digital wallets. The advent of domestic players such as Paytm, Mobikwik, global giants such as Apple Pay, Android pay and others will only add to the acceleration in adoption.

The good news:

Digital payments simplify our lives by make spending hassle free, trackable and more flexible

The bad news:

However eliminating all the friction that comes with spending cash and swiping credit cards – i.e removing the “pain of paying” means that people will find it extremely easy to spend and as a corollary “saving for the future” becomes even more tougher.

“Saving money is already very hard. Do we really need to make the process of spending any easier?” –

Dan Ariely and Merve Akbas

Thus digital payments is our second big enemy who will make us spend more (as spending becomes far more convenient and less painful) and thereby as a corollary “savings” that much more difficult!!

Additional Reading: Here’s proof you’ll be spending more money in 2016

3) Banks and other lenders

There is an additional element to the “pain of paying” concept.

The pain of paying is reduced when there is a period of time gap between when the purchase is made and when the money actually leaves your bank account.

This essentially means paying by your credit card or taking a loan via EMI (easy monthly installment) to purchase something, significantly reduces the guilt and pain associated with the spending and tempts us to spend more.

Also,

The pain of paying is further reduced as the payments are made in small installments

The Indian context

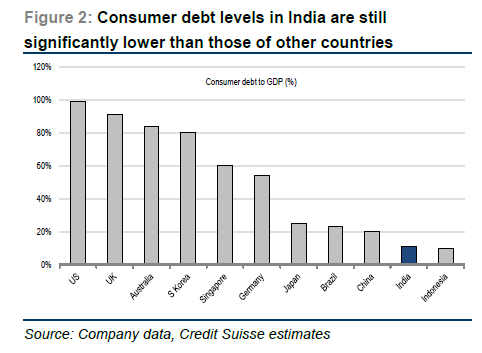

Our consumer debt is significantly low compared to other countries..

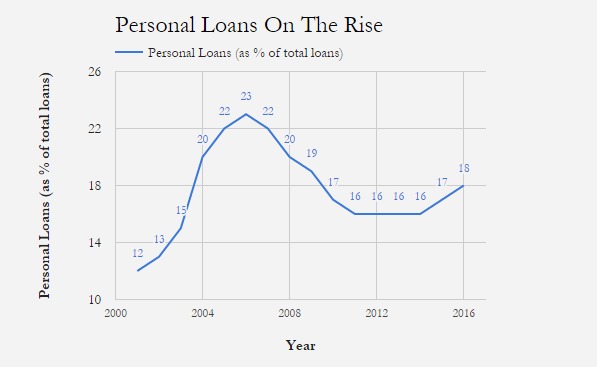

Further, since the loans that Banks have lent to corporate companies haven’t fared well in the last few years (Eg Mr Mallya’s Kingfisher Airlines) most of them have turned their focus on us (i.e retail credit).

Simply put – THE BANKS ARE COMING FOR US!!

They want us to borrow more and spend more!!

Add to it the new breed of disruptive lenders who make it damn easy to borrow

And a data rich future which will make it easier for many to take loans..

Source: www.exploringstartups.com & Link

Thus Banks and other lenders are our third enemy as they will tempt us to spend more and lure us into the EMI paying trap.

4.Marketers

One of the basic assumptions that I got wrong in my life till date was that

“I was in control of all my purchase decisions and was rational”

But thankfully after being introduced to behavioral finance and psychology, I slowly started realizing that most of my buying decisions are secretly manipulated by marketers.

Marketers know how to encourage us to spend and how to work out natural impulses to increase our willingness to part with our cash.

The topic on the techniques that they use is an ocean in itself. So, instead of reinventing the wheel, let me share a few mind blowing articles which will give you a sense of how our purchase decisions are being manipulated by clever marketers.

- The 7 sneakiest ways corporations manipulated human behavior

- 9 secret ways stores seduce us into buying

- 9 subtle marketing tricks we fall every time we shop

- 21 Ways advertisers manipulate us into buying their products

As seen above marketers have been developing several techniques over decades and will continue to develop new, more targeted and more sophisticated strategies to separate us from our money.

Out of all the four enemies, I personally think marketers are the most deadly and will be extremely difficult to consistently keep off from their manipulations.

Conclusion:

Now an honest confession. While I have identified some of the most important enemies for our savings habit, at this juncture, however I do not have an exact solution on how to fight them.

So going back to Sun Tzu’s valuable advice:

“Know your enemy and know yourself and you can fight a hundred battles without disaster”

Now while we have known our enemy, the next key step is to “Know Yourself”

This means figuring out our various behavioral biases and decision making patterns which most often are exploited by our enemies to manipulate us.

I shall cover some important behavioral biases and their impact on our financial lives in the coming weeks. And most importantly on how we can attempt to give a strong fightback in this war against our savings.

If you like the content, it would be awesome if you could consider following the blog. 🙂

Till then happy investing as always!!

True & well written.

LikeLike

Thanks Ashok

LikeLike

Nicely written, but the flip side of this argument is that a certain level of consumption would be required to power the Indian economy. People who can practise delayed gratification and invest in consumption stocks and stocks of businesses which make it easy to practise instant gratification ( a la Bajaj Finance ) can benefit 🙂

LikeLike

True Nishanth 🙂

LikeLike

Very nicely written arun. I am reading Thin, slow and fast by Daniel Kahneman and i can relate how behavioral bias afffect our decision making . I would wait for further posts on this topic from you.

LikeLike

Thanks a ton for your kind words Mukul

LikeLike

Hi Arun,

It’s a very interesting article. I’ve read the following book which talks about similar aspects of how our brain works.

Book title: Your Brain at Work

Author: David Rock

Also, I’ve read similar ideas on a online email-based course called ‘financial wellbeing’ on Highbrow.

Maybe you could also write a course on Highbrow…check it out.

LikeLike

Thanks for the suggestions Veronica. Your Brain at Work looks like an interesting read. I will pick that up for sure 🙂 And Highbrow seems to be an interesting platform for delivering content. Let me explore that too. Thanks once again

LikeLike

Superb and so relevant in todays world.

LikeLike

Thanks a ton, Dharmendra 🙂

LikeLike

Money saved is money earned. Live with this moto & you will lead a happy life.

LikeLike

Well and ‘lightly’ written…The challenge as always is not to (fully) fall prey to temptations (nay enemies) and still end up saving – however small the pie may be…And it’s always fun to be ‘richer’ by your experience…

LikeLike

Hi Arun, Excellent article. Is the second part out

LikeLike

Not yet. I am still working on it 🙂

LikeLike