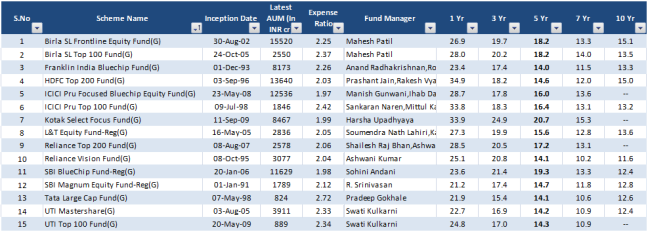

Last week we had filtered out 15 large cap funds from our initial list of 52 large cap funds. In case you missed it, you can read it here

Source: MOSL, as on 17-Mar-2017

Applying Filter 5 – Capturing Lower downside + Reasonable upside

We shall use Mr Buffet’s help for this –

“Any superior record which we might accomplish should not be expected to be evidenced by a relatively constant advantage in performance compared to the Average. Rather it is likely that if such an advantage is achieved, it will be through better-than-average performance in stable or declining markets and average, or perhaps even poorer- than-average performance in rising markets.” – Warren Buffet Letters to Shareholders

The ability to fall lesser during bearish phases indicates the quality of the portfolio and also makes it relatively less difficult to hold on to the fund during market declines. Further if the fund also manages to outperform during market rallies then we are home.

We will measure this using the capture ratios (provided by morningstar)

Upside/Downside Capture ratios measure the degree to which a given fund has under or outperformed a broad market benchmark based on monthly returns during periods of market strength and periods of market weakness.

You can read more about them here

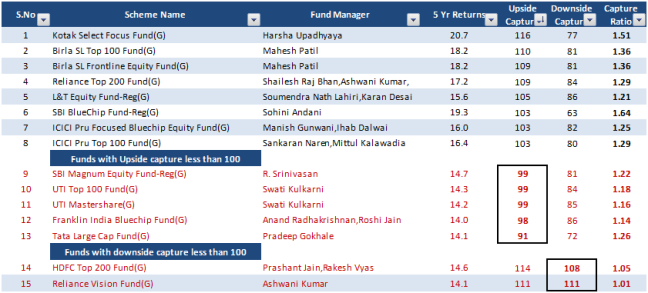

Now let us apply the upside and downside capture filter for our 15 funds

Source: Morningstar

Both HDFC Top 200 and Reliance Vision get filtered out because of high downside capture ratios (>100% i.e they fell more than their benchmark during periods of decline)

5 funds get filtered out due to low upside capture ratios (<100% i.e they under performed during market rallies)

Thus this leaves us with 8 funds to analyze.

The “No-Brainer” fund selection technique

Now before we move ahead, just take a minute to answer this:

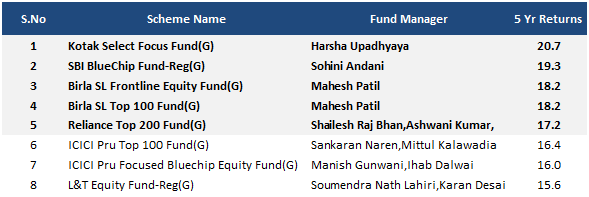

How will you select the funds if you saw the above table?

Instinctively, most of us (which includes me of course) would go by past returns. So all we need to do is simply sort the funds say based on 5 years (which we will assume is a reasonably long period). Pick the top 5 funds.

Hey Presto!! The fund selection is done!!

Overcoming the lure of past returns..

While this method sounds extremely logical and intuitive, unfortunately for us, this method of selection has historically not been a great indicator of future returns. Most of us realize this a tad too late after we start investing.

If you are wondering why – please refer to my earlier post here where I have explained this topic in detail.

The key takeaway from my earlier post is this:

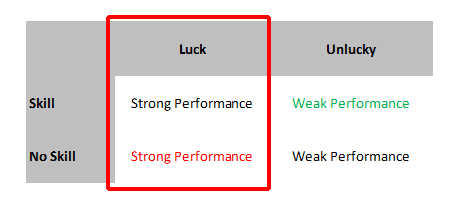

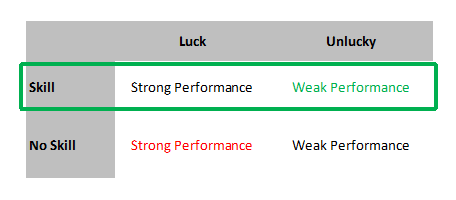

Performance outcomes are a combination of fund manager skill and luck.

When we evaluate only using the past performance, we are not sure if the performance is due to luck meeting fund manager skill (which is what we want) or a fund manager without skill getting plain lucky (which is what we don’t want)

Luck is generally mean reverting – which means if we unfortunately ended up selecting a not-so-great-in-skill fund manager who got lucky – we are most likely to get disappointed with future returns of the fund.

This is the reason why we shouldn’t have past returns as the only metric to select funds.

But let me also state the other case – by using past returns if you are lucky, you may also end up selecting a skilled manager with luck by his side (in which case you are fine).

Since it is difficult to predict luck, our attempt should be to identify skilled fund managers – so that even if a few of them get unlucky in the interim – over the long run luck should average out and skill should provide us above average superior investment returns.

This means our fund selection will also include certain under performers i.e skilled fund managers who were unlucky (this is much easier said than done as it goes against our natural instincts).

Respecting Luck..

Now for those who are still not convinced on the contribution of luck, let us also listen to what few of the best fund managers in India have to say about this..

“Luck is a big part. You can’t say it’s only because of my skills to analyse balance sheets and meet managements that my fund is doing good. If somebody is saying that, he’s fooling himself — rather than lying”

– Anoop Bhaskar – Head of Equities at IDFC Mutual Fund; Read the entire interview here

“The most of what has happened in the last 20 years with the benefit of hindsight I can say that it is more due to luck than by design, so whatever he said about me is probably more due to luck than skill. That is the case for probably most of the people in the market because I think the fact that equities draws too many intelligent people, too many smart people I think in itself negative because these people are too inquisitive, they cannot stand still, they want to keep doing something or the other, and as a consequence most of us have missed out on the biggest bull run we have seen in the last 20 years. We have seen so many great companies being created and we have been bystanders, so if performance has been good or even middling, I think it is more due to luck because we missed out on such great franchises which were created in last 20 years and just by buying these companies and sitting on them, we would have created more alpha then what most fund managers have managed to do in the last 20 years. ”

KN Sivasubramaniam – retired Ex-CIO of Franklin Templeton – also one of the most respected fund managers in the investment fraternity , Source – Ambit Capital

Both of them, have been extremely humble and to be honest, have severely downplayed their phenomenal investment track record, skills and acumen.

But, the key point for us to note here is the acknowledgement that..

“Luck plays a large role in returns”

Time to move focus from “Fund” to “Fund Manager”..

So putting all this together, how do we select funds ?

My thought process is on the lines below..

- Evaluate fund manager for skills and process

- Understand how every fund manager invests and how their styles will fare in different periods. No style will thrive at all times, and understanding when a manager’s style will excel and suffer will help us keep the performance in context.

- Does the fund mandate place any constraints on the fund manager to execute his typical investment style and strategy – size, stock concentration, sector calls,style (mid cap, large cap) etc

- Figure out if size will adversely affect performance. Good fund managers can become mediocre ones if they have too much money to invest.

- All fund managers go through intermittent periods of under performance – so the key is to understand if the AMC (Asset Management Company) is mature enough to support the fund manager during his bad times and the fund manager himself has the emotional stability to withstand the pressure and stick to his style

- And then top it up with some quantitative measures to check for consistency in returns, understand style and strategy

- Finally, identify 3-4 different skillful fund managers with diverse investment styles & strategy and put them together while constructing portfolios

So instead of a quick fix list of funds, we are going to spend each week understanding the background, investment style, strategy and performance track record of each and every fund manager and the fund he manages.

We shall start of with one of my favorite value investors, Mr Sankaran Naren of ICICI Prudential Mutual Fund for the next week. So hang on till I see you the next week.

Happy investing as always 🙂

And here comes the most important part:

I understand it’s a busy world. So thanks a ton for dropping by and if you liked what you are reading, do consider subscribing/following the blog along with the current 1200+ awesome people so that you don’t miss out on the upcoming posts in this series.

Note:

As will all fund selection methods, it is inevitable that some skilled fund managers will get left out in the above method. So in the upcoming posts, we shall also investigate on some flaws in this methodology and the possible remedies.

Disclaimer: No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

I must say , this is extremely well written. I have read a lot of investment blogs and your writing is outstanding.Keep it up

LikeLike

Thanks a ton Nishanth. You made my day 🙂

LikeLike

But as per VRO, Kotak Select focus is multi cap. It has close to 25 % funds in Mid cap companies. i like funds which are true to their lavbel. ex Franklin india blue chip, it never invested in mid caps significantly hence its true to its label

LikeLike

While it is classified as multicap in VRO, Morningstar classifies it as a large cap fund. Honestly, I didn’t want to get too much into the nuances of classifications as different firms follow different methodology. For convenience I have stuck to MOSL classifications. But as I told, the idea is to convey the big-picture thought process and you are free to customize it based on your requirements. Appreciate the feedback.

LikeLike

Great article and information . eagerly waiting for next article.

Just need to check where do you find the daily MF report on site you suggested. Thanks

LikeLike

Thanks Surinder. MF daily report is available in the Research->Market Analysis Reports section of the MOSL website

LikeLike

Sir,

Your blog is extremely educative and very well written. It ranks among the best blogs on personal-finance. Please keep writing and educating us

LikeLike

Thanks a ton for your kind words, Sumal. Glad that you find the contents useful. Do keep visiting 🙂

LikeLike

Arun – the part 1 of filtering to a manageable list was good, so also using the downside ratio’s to further trim dow. Wonder why you didnot get into using the greeks , sharpe and sortino ratio to determine the better amongst the lot ? I dont think retail investors will track news of the fund and the fundmanager on regular basis ..

LikeLike

True. But honestly I personally am not a big fan of these ratios. At the end of the day, all said and done, the fund manager is the primary determinant of future returns. I was trying to figure out a simpler way on how to track fund managers. So will soon put a post on a new method which I recently figured out.

LikeLike

Arunbhai…. today I once again read this article… as I was looking for a pathway of selecting good mf schemes…. you have a different flair to represent things… Thanks again for boosting confidence …

LikeLike