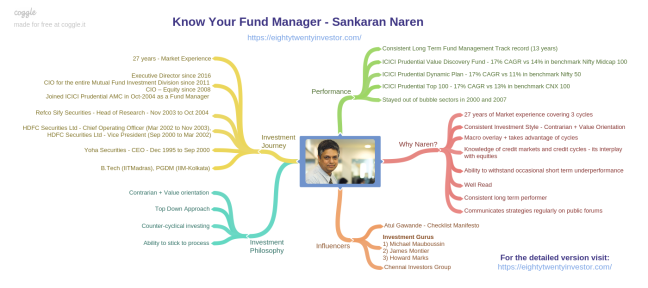

As we discussed in our earlier post here, we need to understand the thought process and investment philosophy of a fund manager before we commit our money. So as a part of this endeavor, we shall learn about various fund managers in this “Know your Fund Manager” series.

As most of us in reality won’t have access to fund managers, I have used only public sources to collect all the information.

Sankaran Naren – CIO , ICICI Prudential Mutual Fund

The one minute summary

Click here for the pdf version

Background

- Designation: Executive Director & Chief Investment Officer (CIO), ICICI Prudential Asset Management Company Limited

- Qualification: B.Tech (IITMadras), PGDM (IIM-Kolkata)

- Experience:

- Joined ICICI Prudential AMC in Oct-2004 as a fund manager

- Executive Director since 2016, CIO for the entire Mutual Fund Investment Division since 2011, CIO – Equity since 2008

- Major Equity Funds Managed:

- ICICI Prudential Top 100

- ICICI Prudential Dynamic Plan

- ICICI Prudential Indo Asia Equity Fund

Yawn.. this looks like the resume stuff and is outrageously boring. I get it 😦

But the key take away for us is that, here is someone with

- 27 years of investment experience! (That’s almost my age 🙂 )

- Diverse Expertise spread across the

Now you are thinking, “Ok. All this is fine. But get me to the most important thing that matters to me – Returns. What’s been the long term returns? “

A robust long term track record..

“The longer you have delivered performance, the clearer the differentiation between skill and luck. In the short run it could be luck but in the long run it is only skill.”- Naren (Link)

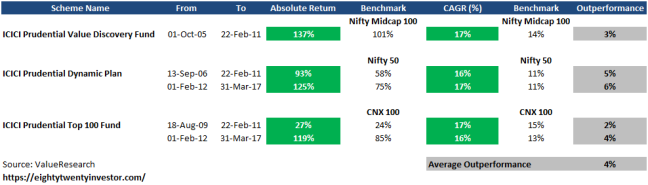

Naren has had two distinct fund management periods (2005-2011) and (2012-till date). He wasn’t actively managing funds for one year in between.

So let us check out his performance for these periods..

- In his last 12 years of fund management experience, his major funds have returned around 16-17% compounded annualized returns for the period that he managed these funds.

- Further on average, they have also outperformed their benchmarks by ~4%.

Now that we know that he has a strong long term track record, here comes the next question..

How does he do this? What is his secret sauce?

Investment Philosophy = Value investing + Contrarian + Evaluating Cycles + Top Down (using the big picture to arrive at stocks to invest in) + Bottom Up

1.Contrarian and Value investing..

“I look for the dogs of the markets which is my strength. A lot of my colleagues look for stars” – Source

Naren is a seasoned practitioner of contrarian and value investing. As a contrarian over the years, he has developed a knack for spotting neglected sectors and stocks before they become popular.

“Once a sector goes above the price/earnings multiple of 25, I become very uncomfortable. Because of this I have missed many opportunities, but that is fine. I still believe in buying stocks that are ignored by the market, rather than those that still have a lot of steam in them” – Source

“We believe, by and large, in reversion to mean. We believe, over a period of time, a sector doing very badly will do better and a sector doing very well will do very badly. ” – Source

Secret 1: Identify a neglected sector or a stock before anyone else does and hold it till it comes into limelight

2.Overlay of top down approach (macro)..

“Prior to the 2008 crisis, we didn’t know of the impact of macro or top-down movements on stock prices. The year 2007 showed us the importance of top-down investing (using the big picture to arrive at stocks to invest in). We had built up big stakes in IT, FMCG and pharma stocks. They lagged the market because of currency appreciation. We realised that we needed to do a lot of work on macro factors. So we moved to a model which looked at both top-down and bottom-up.

We don’t try to forecast; but we try to determine the direction.” – Source

“It was based on top-down analysis that we cut exposure to banks in 2009. After the elections, we saw the rise of the current account deficit and a falling savings rate; both are negative for banks. That has really helped us outperform.”

“Once we combined top-down research with careful stock selection, we saw a steady improvement in fund performance.” – Source

Secret 2: Don’t ignore the macro – combine both top-down and bottom-up

3.The Counter Cyclical Approach..

“Whenever we raise a toast to outperformers, we tend to forget the role of [business] cycles. Companies become outperformers because of the sector becoming an outperformer. That part is forgotten by people very often. In the 1990s, we were in an export cycle. After that, there was a very strong boom in technology. Between 2001 and 2003, there was a lull phase and then from 2003 to 2006, there was a mid-cap cycle, followed by an infrastructure cycle that went on till 2008. Post that we had a consumption rally. The problem is that when you’re in an upcycle, investors get swayed into believing that cycles last forever. That is never the case.” – Source

“I’m of the view that if you look at cycles, you’re in a much better shape. There are periods of time when moats work; periods of time when growth works; and periods of time when only fixed income works. So, if you’re able to identify what cycle you are in and what cycle got overextended, you bet against that cycle which has got overextended and focus on what you think is likely to work. This works when you’re managing other people’s money.” – Source

“We first look at the cycle. There are periods when people have a very negative view on a certain cycle. So, we believe that cycles tend to mean revert. I am very comfortable with a stock that has done very badly, but where we have a strong conviction. If a stock does badly there is normally a reason. We try to see if that reason is mean-reverting.” – Source

“We also began to look at business cycles more closely. In the last three-four years, we’ve seen many business cycles in materials, from extreme bearishness and to optimism. Timing the cycles well can get you very good returns; but it is an art.” – Source

Secret 3: Understand Cycles – they tend to mean revert

But will value investing work in a growth economy like India?

In his own words,

“It is always possible to find pockets of value across market scenarios. Also, we believe in a concept of relative value. For example, in 2007, we found significant value in the consumer, pharmaceutical and technology sectors.

Therefore, at any point of time, we will be able to find value in something at least relative to the rest. In our opinion, given the way the markets have got integrated, there is a lot of scope to find value at all points of time.” – Source

“Value investing is not dependent on whether it is a growth market or not, but it is dependent on a steady application of the contrarian value philosophy in a systematic manner through market cycles.”

“This is very important because value oriented contrarian approach is not capable of delivering in all parts of the cycle but once you systematically run such an approach you are likely to generate alpha over different market cycles.” – Source

“Our experience with value investing over the last decade has been good. We believe that value investing requires an investment horizon of three-five years to bear fruit” – Source

A glimpse of his investment philosophy in action..

He has applied his investment philosophy across stocks, sectors, countries and asset classes.

Given below are few of his major calls that went right..

- 2007 – Exited the infrastructure sector and bought into consumers, technology and pharmaceuticals (rationale – contrarian + reasonable valuation)

- 2008-09 – Stuck to small and mid-cap positioning in ICICI Prudential Value Discovery (though large caps were outperforming)

- 2012 – Took exposure to IT and launched US fund (rationale – high current account deficit)

- 2013 end – Played the Small & Mid Caps theme via closed ended funds (rationale – contrarian + cheap valuation)

- 2014 – Gilts, Long Duration and PSU Equities (rationale – contrarian + cheap valuation)

- 2014 – Invested in utilities + metals + oil and gas sectors (rationale – contrarian + cheap valuation)

- 2016 – Advised investing in equities during the Jan-Feb correction

Just curious. How did he develop this thinking and investment framework. Who are the investors who influenced him?

The Three Gurus ..

“The current style has been over a period of time, fine-tuned based on the experiences of eminent fund managers in the western world and the readings that they have managed to communicate to people like us through internet as a medium.” – Source

The three investment gurus closely followed by Naren are –

1) James Montier – a member of GMO’s Asset Allocation team

James Montier wrote a book on value investing; he was one of the few people who had written about the tenets of investing. I would say that it was one of the best articles I have read. This article should be read every six months so one doesn’t forget the lesson. It teaches us to look from the ‘top down-bottom up’ approach. For example, we were underweight on the banking sector based up our top-down approach, but subsequently, our ‘top down- bottom up’ approach suggested that we should invest in banks. Similarly, we asked people to invest in public sector undertakings (PSUs) because from a classic ‘top down- bottom up’ approach, we found value in those stocks. – Source

You can read his writings from

- https://www.gmo.com/

- http://www.valuewalk.com/james-montier-resource-page/

- http://eurosharelab.com/james-montier-resource-page/

2) Howard Marks – Cofounder of Oaktree Capital Management

From Howard Marks, I learnt to recognise that in every market condition, there are some cycles. For example, one could clearly see the IT cycle during 1998-2000 and the infrastructure cycle during 2004-07. To go outside asset classes, you could see there was a pro-real estate cycle and pro-gold cycle post 2008. Howard Marks’ theory helps you to understand that there are cycles of certain sectors and one should always be aware of those cycles.- Source

You can read his writings from

3) Michael Mauboussin – Managing Director and Head of Global Financial Strategies at Credit Suisse

You can read his writings from

- http://www.michaelmauboussin.com/writing.html

- https://hurricanecapital.wordpress.com/tag/michael-j-mauboussin/

- http://www.valuewalk.com/2015/12/michael-mauboussin-research-papers-from-credit-suisse-full-collection/

You can also listen to Naren’s thoughts on these three investors here

Further, you can read more about his learning from these 3 gurus here

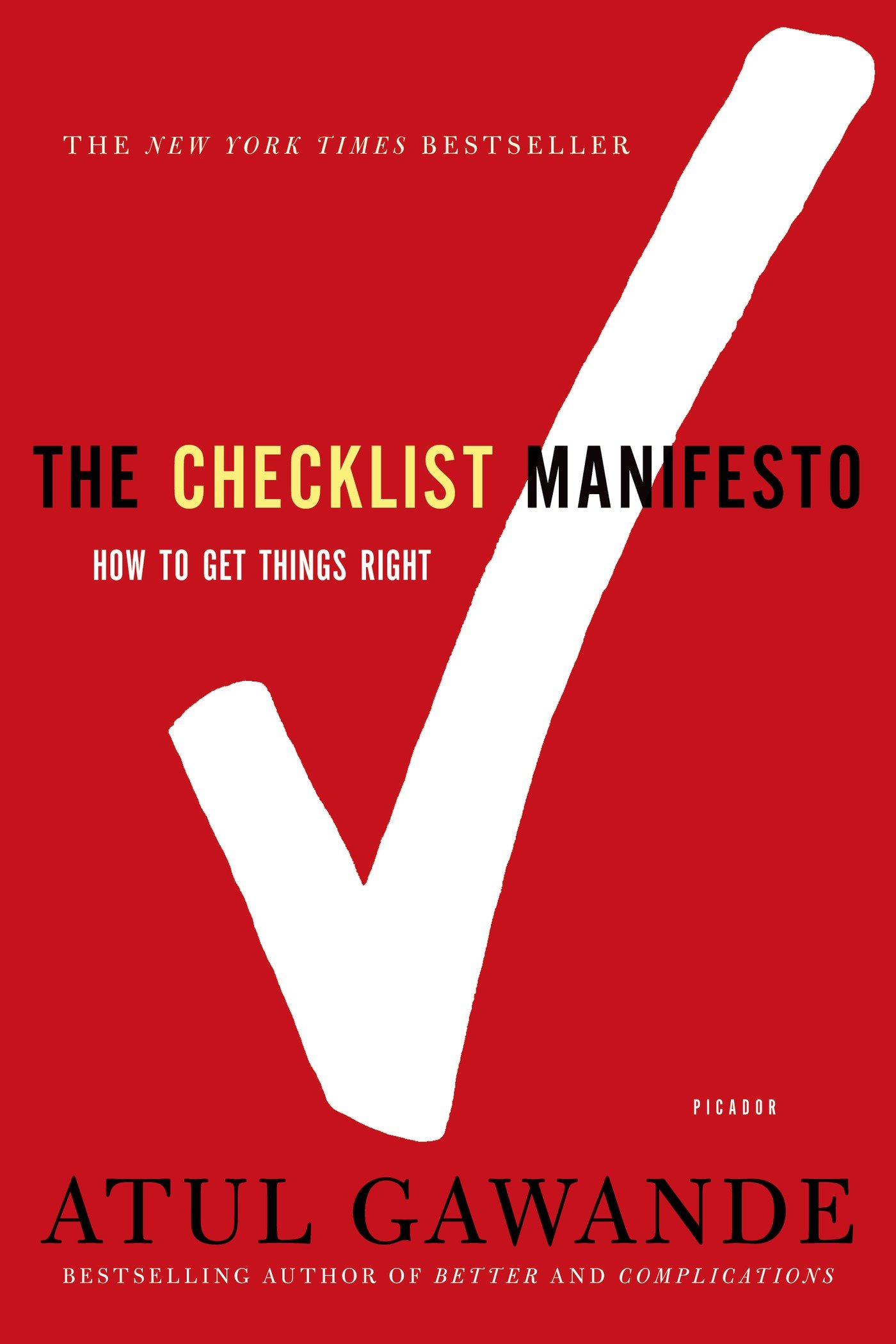

Inspiration from Atul Gawande’s Checklist Manifesto..

When Naren was researching on markets and on the techniques many gurus employed, he learnt that certain investors were using checklists with a remarkable degree of success to reduce errors and validate investment ideas.

And coincidentally, he happened to read “The Checklist Manifesto” by Atul Gawande in 2009. The book has changed the way he functions. Post this, both Naren and his team have been using checklists for some time now. The habit has helped him in cutting down elementary oversights that can creep into the investment process.

Let us hear the benefits of checklists in his own words..

“One of the reasons why there are errors in a process is because either there is too much information or too little time to run through many ideas or there is some element of overconfidence in one’s processes. Checklists help break down complex market situations, ideas and processes into simple manageable ones that can be easily implemented and handled.”

“What makes a checklist so compelling is that it can be easily implemented by everyone. Whether for personal investments or any other area such as career growth or business expansion. I am certain that anybody who uses a checklist will derive a better quality experience.”- Source

His checklist is a one-pager containing rules that can be followed by anyone. It helps younger employees learn from the past experiences of seasoned fund managers. The slimness of the checklist also ensures that it spares the reader the tedium of flipping through hundreds of pages.

“Having been through two extremes—of 2007 and 2008—we could easily put together a checklist on what to do in a bullish market and what do in a bearish one. When we put these two into place, we followed many of those rules in 2010, when the market went up substantially. Think about it, in 2013, the market was not as bearish as in 2008. Some of the lessons we learnt in 2008 helped us in 2013, in peaking the bottom and telling people that these are the times to invest.”

“We do use it for standard operating procedures that already have a researched process. But in abnormal market conditions, when the markets are very high and very low, we had to prevent big mistakes as we were managing other people’s money. For us, it was in the extremes that the checklist worked very well. In normal market conditions, I believe that some of the old, simple processes that we had, which are mandated by the regulator, worked well.” – Source

You can read more at

Why a checklist for investment matters: Atul Gawande in conversation with S Naren

What is the secret behind his “nerves of steel”

To stay on course of being a contrarian requires a fair amount of conviction and significant emotional strength, as it defines your ability to go against the crowd. And developing such a trait is not easy.

He remembers that the 1995-2000 phase was so frustrating for some of his colleagues that they left finance jobs to work in IT firms. ‘Many of my classmates actually told me to become an IT guy. One of my friends even found a job for me in an IT company in 2000,’ he recalls. – Source

So how does he do this??

Firstly, in Naren’s own experience, one cannot do this alone.

He had his informal chennai investor group supporting him and reassuring him about his conviction.

Let us hear from him on what he says about his group in various interviews..

“Yes, actually that group you know were all people who needed, in those days I would call psychiatric help, because all of us had lost money in the 1994-1997 period. So we all needed support to know what mistake we made and looking for answers. So we got into this group. When we entered this group and then went about the process, we realized that you cannot be a momentum investor in the long run to make money. You need to know when to buy and you need to know when to sell and most of the time when you want to sell, the others should be interested in buying and you should be interested in not buying. So, that is how the whole concept of I would say contrarian thinking came and for which our first experience was in 1999-2000, the tech bubble when we saw stocks like Global Telesystems, DSQ software etc

And we had to avoid them and most people around us said, these people have more than 10 years of experience in equities and they are saying these companies are useless, we are making money. But contrarian investing that we have to look at the stock and come to a conclusion, we were negative on many of them. So contrarian investing helped us to stay solvent. First, we were considered irrational in 1999-2000, we did not get it and then we realized that we were solvent when the others became insolvent in 2001-2002.” – Source

“It helped, as investing is a psychological kind of subject. So, if different people have gone through the same experience of making money and losing money you tend to get into a situation where you need psychological support.”

“Group helps you to actually share your thoughts and that led to a situation where finally to make money in investing you need an investment process. If you have a group and you are able to sit with different people’s strengths and different people’s weaknesses you actually get that process.” – Source

Secondly, one needs to have the ability to bear temporary pain.

“Of course, first you have to succeed. Once you have a few successes in contrarian investing, it becomes that much easier”

While going against the crowd is fine, does one develop overconfidence?

“Not really as going against the crowd is difficult. Only a growth investor could become overconfident. In our case, we see a series of bandages. Where is the question of over confidence?” – Source

Tracing the roots

The interview below gives us a rare glimpse on his entire investment journey.

Summing it up

- 27 years of Market experience covering 3 cycles

- 13 years of fund management experience

- Robust long term performance track record

- Consistent Investment Style = Value investing + Contrarian + Evaluating Cycles + Top Down (using the big picture to arrive at stocks to invest in) + Bottom Up

- Macro overlay + takes advantage of cycles

- Knowledge of credit markets and credit cycles – its interplay with equities

- Ability to withstand and stick to investment process during occasional periods of short term under performance

- Widely read

- Investment Gurus – James Montier, Howard Marks, Michael Mauboussin

- Deploys checklists for investing – inspired from Atul Gawande’s Checklist Manifesto

- Communicates strategies and thought process regularly on public forums (making our lives a lot more easier)

Phew. So with that we come to the end of our first qualitative fund manager analysis.

Now comes the million dollar question..

Do we actually need to spend so much time and effort to understand the fund manager?

Is it a case of an idiot like me getting too over enthusiastic and going overboard.

Perfectly valid questions.

Hang on for a week. You will have your answers 🙂

And if this whole thing makes sense to you, then please do follow/subscribe to the blog so that you don’t miss out on the next week’s post. The post will be directly delivered to your mail. Also drop in your comments if you would like a similar analysis done for the other fund managers.

The post for all normal people reading this officially ends here!

P.S: Now, assuming you are of the rare human breed who has survived me till here and if you are up for it, you can go through all his past interviews via the links given below. (honestly I don’t expect you to go that far today. But you can always get back some other day)

Latest Outlook

Collection of his interview videos

Other Videos

- Invest With 2018 In Mind

- ICICI Value Investing Summit – Curtain raiser

- ICICI Value Summit – Episode 1

- Investing in Dynamic allocation products

- Dynamic Asset Allocation is the key to good investing

- Market Makers – Apr 2015

- Market Makers – Aug 2016

- Market Makers – Mar 2017

Collection of his interview links

Generic Interviews

- Suffering is a part of value investing

- Apr-2017: Sankaran Naren on the importance of volatility

- Dec-2016: Evolution of a fund industry Sankaran Naren has seen first hand – India’s Investing Transformation

- Dec-2016: He’s India’s ace CIO; but how is he as a fund manager?

- Nov-2016: Sankaren naren on picking contra bets

- Sep-2016: Stock Investing is not only about buying the right stock

- Jul-2016: Soap and Toothpaste help ICICI Prudential bypass India’s growth math

- Sep-2015: The road less travelled

- Jun-2015: A contrarian approach

- May-2015: ‘If a company we have selected is doing badly today, do we worry? The answer is No’

- Apr-16: Essence of smart investing

- Sep-2014: Understanding when and why asset classes perform is a homework well done

- Sep 2013: The crucial role of cycles is missed out in outperformance

- Sep-12: Value investing works in India – just like it does the world over

Market View Related Interviews

- Apr-2017: We are a big believer in Infra theme; prefer power and roads

- Apr-2017: Infra is a pocket of value right now

- Mar-2017: Debt is the best asset class at this point in time

- Mar-2017: Why it is the right time to invest in debt instruments

- Dec-2016: Correction after fed hike wont be deep

- Nov-2016: Demonetisation: Near-term pain for long-term gains; like largecaps, says S Naren

- Nov-2016: Ace CIO gives contrarian call

- Nov-2016: Demonetisation is another step that will help boost financial markets

- Oct -2016: There is opportunity in hybrid funds and dynamic asset allocation funds

- Sep-2016: IT and telecom offer opportunity to make money

- Aug-2016: Big returns come from panic levels which are missing

- Aug-2016: Dont try to time the earnings cycle, invest for the medium term

- Aug-2016: India will gain big from GST in 5-7 years

- Jun-2016: Is it a good chance to buy for investors

- Mar-2016: Markets are likely to do well over the next 2 years

- Mar-2016: More FIIs sell stocks more you should buy stocks

- Feb-2016: 2016 is the year for investors not traders

- Jan-2016: Start nibbling stocks now go big before year end

- Jan-2016: Big Billion Sale in equity market

- Aug-2015: Best time to invest in indian equities is when FIIs sell

- Jul-2015: The best way to buy low and sell high

- Jun-2015: Global events not to impact domestic markets in the long term

- Jun-2015: Equities are safer today, but returns of 20-30% per annum not possible

- May-2015: Time to stay away from equity or plunge in?

- Mar-2015: When earnings don’t pick up, correction is logical

- May-2014: Epochal election verdict should deliver a big growth spurt

- Dec-2014: Use correction to invest in equity; like IT

- Nov-2014: Fixed income meets all 4 criteria of a classic value story

- Oct-2014: Smallcaps, midcaps to shine in 5 yrs

- Jul-2014: This NFO will tap 4 big priority areas of the new Government

- Jun-2014: Unlike last time, growth is starting with high interest rate

- Apr-2014: Market has discounted a reasonable government, not a very strong one

- Mar-2014: March is usually a good time to invest in mid and small caps

- Feb-2014: Mid caps will continue to outperform large caps

- Sep-2013: Market volatility will continue till general elections in 2014

- Jul-2013: Beaten down infra, midcap will outperform over 5 years

- Jun-2013: Expect export sectors like IT services to outperform

- Apr-2013: Market to remain buoyant if commodity price fall continues

- Mar-2013: If inflation declines, rates may fall by up to 2% in long term

- Nov-2012: 9 on 10 for this 10 year old !

Disclaimer: No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

Liked your post very much. Very well researched. Keep it up.

LikeLike

Glad you liked it Sharon. Thanks 🙂

LikeLike

Pure excellence! This article is a treasure trove for beginners like me! You mentioned a list of calls that he got correct. Can you please tell us about the ones he got incorrect?

LikeLike

Thanks a lot. Sure. I will try and cover that also

LikeLike

Now this is among the best fund manager reviews I have read! Keep them rolling Arun. Do read Peter Tanous on Investment Gurus.

LikeLike

Thanks Srikant for the kind words and the book suggestion. Just downloaded it and planning to read it in the coming days. Do visit again and happy investing 🙂

LikeLike

27 playing like pro

LikeLike

Thank you for another great article. Where else could anyone get that kind of information in such an ideal way of writing? I’ve a presentation next week, and I’m on the look for such info.

LikeLike