The Seat Belt mystery

In early 1970s, when the use of seat belts were made mandatory in the US to improve driver safety, something strange happened.

Instead of road accident deaths coming down they actually went up!

While the regulators were perplexed by this phenomenon, an economist by the name Sam Peltzman came up with a controversial answer.

He argued that though the drivers had lower risks due the additional safety that a seat belt provides, many drivers actually compensated for the additional safety by driving more recklessly (driving faster, not paying as much attention, etc.) under the comfort of the added safety.

“The safer they make the cars, the more risks the driver is willing to take”

This meant that bystanders – pedestrians, bicyclists etc – would receive no safety benefit from the seat belts but would rather suffer as a result of increased recklessness.

He termed this effect “risk-compensation” but it is popularly known as the Peltzman effect.

Although the study has had its fair share of criticism, the Peltzman effect has been observed in a number of different settings.

Condoms and HIV prevention

In the late 1980s, Thailand and the Philippines had roughly the same number of HIV/ AIDS cases at 112 and 135 cases, respectively.

In the early 1990s, the Government of Thailand enforced the “100% Condom Use” program in its booming commercial sex industry while the Philippines was characterized by its very low rate of condom use and the firm opposition of church and government to condoms.

In 2003, almost fifteen years later, the number of HIV/ AIDS cases in Thailand had risen to 750,000 while the number in the Philippines remained low at 1,935 cases despite Philippines population growing to more than 30 per cent that of Thailand. Thailand ranks as the country with the highest HIV prevalence in Asia.

Source: Link

Mike Roland, editor of Rubber Chemistry and Technology states that wearing a condom reduces the risk of AIDS by a factor of 3 but simply choosing your partners wisely reduces the risk factor by 5,000.

While it is obvious that wearing condoms during promiscuous sexual activity reduces the risk of HIV, counter intuitively the lower risk of HIV can actually have the effect of tricking people into blindly engaging in more risky promiscuous sexual activity.

Its our peltzman effect at play 🙂

Titanic – The ship even god cannot sink

All of us know what happened to the Titanic. I would rather let the below picture do the talking.

Yep, its peltzman effect, yet again!

Olympic Boxing – Good bye Head Guards

Did you know this – the Olympics ditched boxing headgear in 2016 for the first time since 1984!

The decision, according to the International Boxing Association, or AIBA came down to safety.

Several studies, including one commissioned by the association, found that the number of acute brain injuries declined when head guards were not used.

The studies pointed out that

Headgear creates a false sense of safety and boxers take more risks.

By now, you know what is happening 🙂

Our behavior adapts to perception of risk

Now while all this goes against our intuition – the underlying point is that

When our perception of risk reduces, we usually adapt our behavior by taking higher risks

Indian Investor and the Peltzman effect

What does this have to do with the Indian investor?

Based on the Peltzman effect, if investor perception of risks in the equity market reduces, then it means that investors will respond by taking additional risks.

Let us evaluate the current investor perception of risk.

From a purist point of view – risk is the probability of permanent loss of capital.

However, when there is a market decline, most of us at that juncture do not know if it is permanent or temporary. (and unfortunately a lot of us give up and jump out at the bottom).

So for the purpose of this post, I will assume that investor perception of risk will depend on the intermittent declines in equity market that he/she has witnessed in recent times.

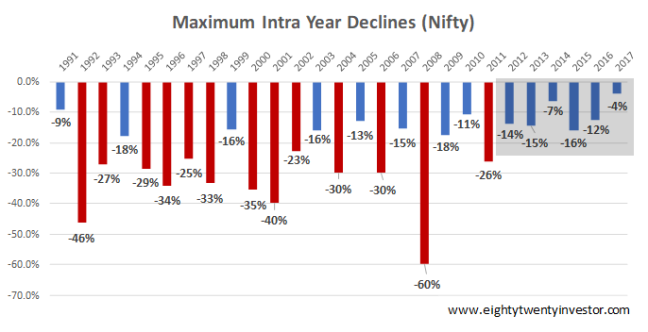

Here is an interesting chart which shows the intra-year declines which an investor in Indian equity markets would have witnessed in the last 27 years.

An interesting thing to notice is that, the 20 year period from 1991 to 2011 has witnessed significant declines each year and 20% declines or more (indicated by the red bars) were a common occurrence.

So any investor who invested in equities during that period, eventually had to go through these significant but temporary declines year after year.

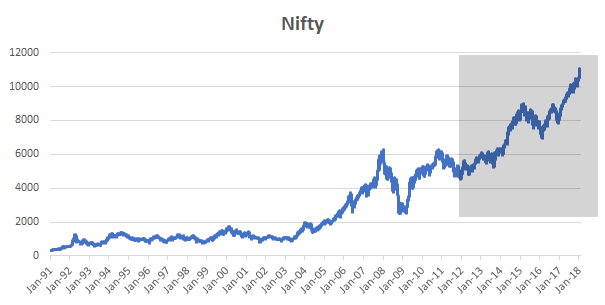

However, if you notice the recent 5-6 years, the declines have been significantly lower.

In fact the intra-year decline for 2017 is the lowest ever!

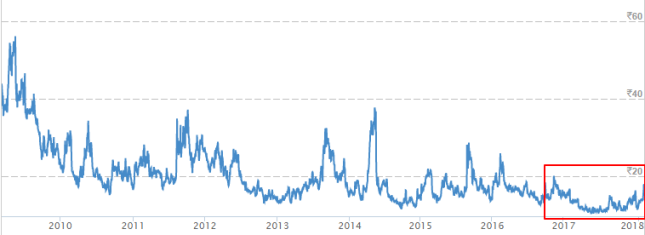

The other way to confirm this thesis is to look at the index which indicates volatility – Nifty VIX index (It measures the degree of volatility or fluctuation that active traders expect in the Nifty50 over the next 30 days).

The Nifty VIX index is also close to its all time lows!

Thus the first takeaway is:

Takeaway 1: Indian Equity Market fluctuation is extremely low in recent times (leading to a perception of lower risks in equity markets)

Further the markets have also rallied since 2013.

Takeaway 2: Indian Equity Market Returns have been awesome in recent times

Further real estate returns have been poor in recent times and are showing initial signs of a decline (see here)

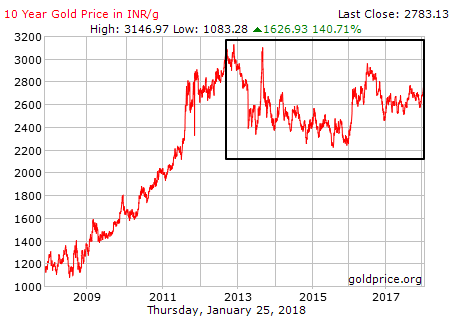

Gold returns have also been very dismal over the last few years.

Bank FD rates and debt fund returns have also significantly dropped due to lower interest rates.

Takeaway 3: Real Estate, Gold, Bank FD – all fall down!!

Now if we combine the above three takeaways, it’s a deadly combination where equity returns are high, equity volatility is low (read as – perception that risk is also low) and none of the alternatives are performing.

Now if we apply the Peltzman effect, this means Indian investors will adjust their behavior to take on more risk!

Is this true? Let us see if Indian investors have increased their risk..

Equity Mutual Fund Industry – Unprecedented Flows!

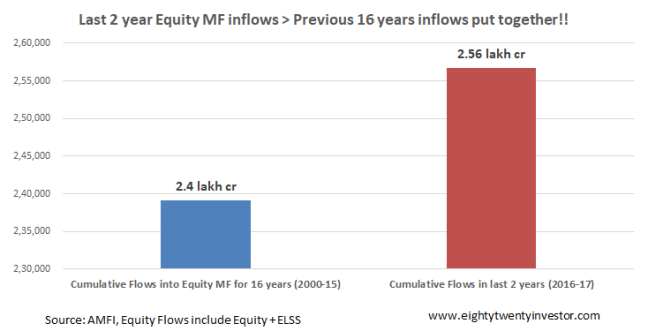

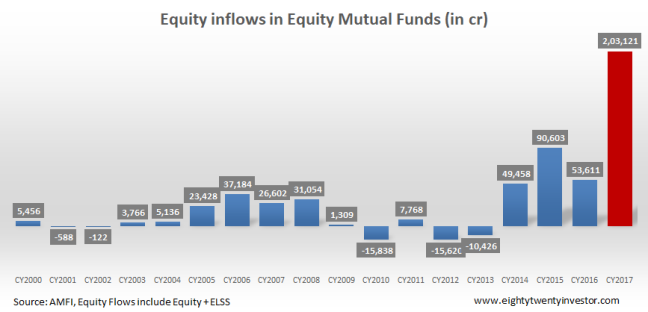

You read that right – In the last 2 years, the money that we Indians invested in Equity Mutual funds is more than the earlier 16 years put together!

If you further drill down, the largest amount of money came in the last year (more than previous 3 years put together)

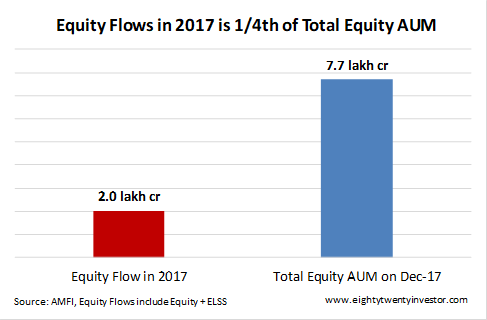

And here is the scary part – the flows for 2017 currently represent 1/4th of the entire equity AUM – and investors who have brought in this money have never witnessed true equity declines (20% and below which was the norm a few years back) as they have come at a point where the volatility is at its historical lows.

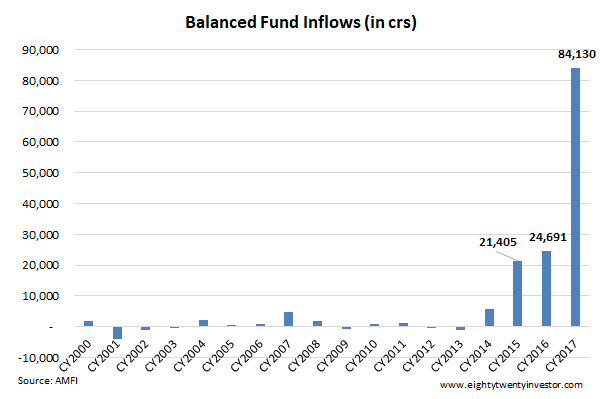

Balanced Funds are the new FD replacement – WTF?

In every bull market, there is always some product which is mis-sold.

This time it is the balanced funds – a category of funds where equity is around 70% of the portfolio and the remaining in debt instruments.

Unfortunately, this equity heavy product is being mis-sold as a 1% every month dividend product which will give you 12% tax-free returns every year and as a FD replacement.

This is clearly reflected in the staggering growth of inflows witnessed in 2017

Here is an interesting article which explores this further – Link

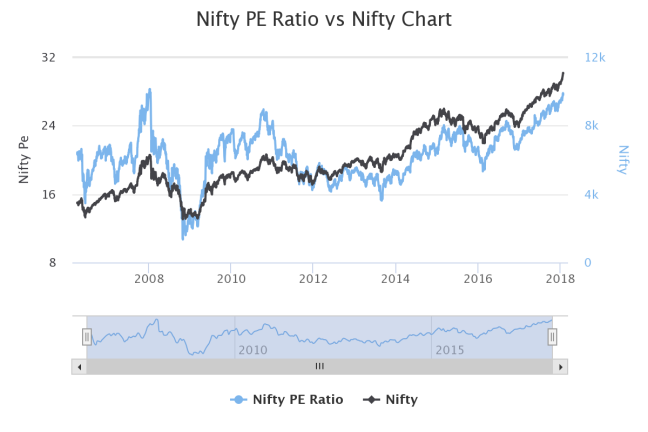

Equity Market Valuations have moved up significantly led by flows

Source: www.equityfriend.com

Source: www.equityfriend.com

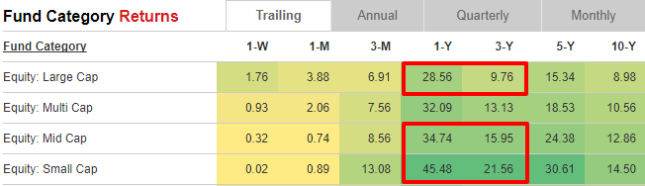

Small Cap funds & PMS signalling “Enough! We can’t take more”

Given the whopping out-performance of small and mid cap funds over large caps recent money has been chasing this segment leading to insane valuations for most of the companies in this segment.

Source: Value Research

To the extent that certain funds have shut down their funds and returned their money back to investors.

Source: ET, Read the entire article here

Some other funds which have restricted their funds for new money – DSP BlackRock Micro Cap Fund, Reliance Small Cap, Mirae Asset Emerging Bluechip and SBI Small and Midcap Fund.

Peltzman effect at play – Time to be cautious and focus on risk

At this point, it seems pretty clear that the perception of equity risk is currently very low amongst investors and this has clearly manifested in higher risk taking behavior across Indian investors.

Everything at this juncture is about returns as risk has taken a backseat.

Hence we as investors must remain cognizant of the exuberant expectations being built into the current market. While earnings growth cycle is yet to begin, lofty valuations imply the possibility of sharp intermittent declines if in case something goes wrong. (and usually something always does go wrong in the interim)

So, at the current juncture the key is to focus on risk. Also

- Pare down return expectations

- Stay away from mid and small caps

- Stick to your asset allocation plan

If you don’t have an advisor to help you out with asset allocation, then dynamic equity allocation products can be a good option for incremental money allocation.

In a nutshell

- Peltzman effect – Introduction of safety belts in cars increased accidents as drivers compensated for the additional safety by reckless driving

- Observed in several settings such as HIV prevention via condoms, Titanic, Olympic boxing etc

- Peltzman effect visible in current equity markets

- Deadly Trio: Indian Equity Volatility at all time lows + Great returns in equities + Alternative investments (Real Estate, Gold, FD) not doing well

- This lower perception of risk in equities leading to risky behavior in Indian investors

- Signs visible in 1) Unprecedented Equity MF inflows 2) Balanced Funds being sold as FD replacement 3) High Valuations 4) Small Cap funds restricting flows

- Time to be cautious and shift focus on risk (rather than returns)

- Things to do: Pare down return expectations, Avoid mid & small caps and stick to asset allocation

Happy investing 🙂

If you loved what you just read, share it with your friends and don’t forget to subscribe to the blog along with the 1800+ awesome people. Look out for some free super interesting investment insights delivered straight to your inbox. Cheers 🙂

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments

Very interesting , mate. First time I’m hearing of the Peltzmann effect. Although I have read something similar where when the quality of roads constructed went up , accidents also increased as speeding tended to be more.

This ICICI Pru PMS returning money reminds me of Buffet winding up his partnership in 1970 or 72 , and returning money to his investors as he was no longer able to spot good opportunities in the market. Then came the huge market crash of 1973-74 , which scarred investors so badly. Of course , 10 years after that , came the greatest bull market ever recorded in the history of America:)

LikeLike

Good one….bang on target

LikeLike

Excellent read

LikeLike

Thanks a ton 🙂

LikeLike

Thanks Nishanth. Only time has the answer to what will happen to markets going forward. Right now the only thing in our control, is to be cognizant of the risks and have a plan if in case things go wrong. As students of the market, its a phenomenal opportunity for us to learn, make errors and adapt 🙂

LikeLike

Wow,I wish my teachers were as lucid in their THOUGHT process as you are,than certainly my achievements would have been quite different and upscale as they are now.

Thanks Einstein of fact dissection,keep going & keep helping us.

God Bless U 😚

LikeLike

Very well said

LikeLike

Absolutely Brilliant …..

LikeLike

Superb analysis with very relevant graphs and charts. YOU MUST REGISTER FOR A PHD IN A UNIVERSITY . Thank you for all the effort to produce a highly analytical article.

LikeLike

Thanks a ton Ravindran 🙂

LikeLike

I tend to agree with the author. However, people will adjust and overcome this phenomena quickly. This can be observed from the facts of all similar cases over two to three years. Yes in the short term this will have a shocking effect.

LikeLike

True. In case of equity markets, while the long run will be determined by earnings growth, short run will be predominantly determined by investor behavior (which will reflect in valuations)

LikeLike

I completely agree with you on the balanced funds being mis sold and the focus on risk rather than returns. Being an equity coach and Author myself, I always ask people to keep risk under control all the time because returns are not in our hands. All fund managers and advisors are actually helping the investors control only one thing, that’s risk. If only we knew how much risk to take, 99% of our problems shall be solved. Thank you for sharing such an informative piece with your readers. You have earned another follower.

LikeLike

Thanks Moneyogi 🙂

LikeLike

Also would like to have your previous article

From when is your opinion cautious

I have reduced exposure fro m10000 nifty

LikeLike

This is not a market timing call. Its just that we need to be prepared for volatility. You can refer my post here on how to prepare – https://eightytwentyinvestor.com/2017/11/26/preparing-for-the-next-crisis/

LikeLike

Excellent, but much more importantly, you have shared information on investments in a very different and thought provoking manner by providing real life comparisons of the past in other playing fields. Kudos to your superlative analysis.

LikeLike

Thanks Nair 🙂

LikeLike

Interesting way of describing human behaviour in case they perceive risk is covered. Great direction for risk assessment to equity investor in the present market scenario.

LikeLike

Arun, nice article with apt apt diagnosis and medication for investors

LikeLike

Thanks a ton Himanshu 🙂

LikeLike

The fact that so many people are bearish tell me that a bear market (there will be significant corrections all along but nobody can time them, atleast I can’t) is far away. I’ll keep putting in money until my maid starts asking me for stock advice. Happy investing 🙂

LikeLike

As always the idea is to be prepared with a plan. No one can predict the markets 🙂

LikeLike

Hi Arun,

Very nice article. It is very true that lesser our perception of risk greater our propensity to take our chances.

However, in the current context of inflows into equities by first timers ( like me ) there may have never been a confluence of so many events-demonetisation, sliding interest rates, real estate which is seemingly depressed ( in my view this was never treated as a financial asset but an emotional fulfilment )- and the perceived risk on account of these events and/or depressed returns in any of the asset classes including gold is higher than the risk in equities is actually driving this rally ( IMO).

However, there may exist pockets of opportunities even within the broad spectrum of mid and small caps which a discerning fund manager would be able to access and reap rewards for the subscribers.

LikeLike

There will always be pockets of opportunities. But as the size of the fund grows, the ability to take reasonable exposure also goes down. If looking at mid and small caps, also include size as one of your parameters. Happy investing 🙂

LikeLike

Excellent analysis. Good to know about the Peltzman effect.

BTW your final ‘nutshell’ really helped some scrolling time – as i was about to scroll up to see the points and there came your nutshell!

Very well written with good examples and a simple read. You are destined for greatness 🙂

LikeLike

Thanks a ton Jay 🙂

LikeLike

Very Well Written. Clear and Logical. Always Keep things simple. Asset Allocation . Unfortunately Retail Investors do not have benefit of Advisors. They are sucked in by desire for higher returns. In India Risk Management is only on Paper.

LikeLike

Thanks Abhay. The real role of advisors as behavioral coaches rather than investment product selectors will someday be hopefully realised 🙂

LikeLike

Good Analysis, let me say this its not only Indian Equity Markets making New highs Its Global phenomena, Pls understand ur analysis seems little bias ,but you are individual investors shudnt at all be investing in smallcap or midcaps on basis of social media advice’s,those who are doing so the risk is 100%. the world markets are rising cause is shift of policies by political leaders were ever you see, if you speak about china then you shud be knowing about it also ,

LikeLike

Arun, superb article, but when the market will come down is a mystery now.

LikeLike

Hi Arun, superb article. Loved your analysis.

1. Thanks for sharing the Pelzman effect. It makes me wiser.

2. The real worry is lack of financial knowledge of the investor, making investing a gamble, leading to pure speculation vs a game of skill.

LikeLike

Thanks Vivek 🙂

LikeLike

While technically you are right in saying that the “Maximum Decline” during calendar year 2015 was 16%, we must be wary of calculating the markets crest and troughs based on calendar years and financial years.

Bear phase that started at the peak of 2015 (NIFTY 8996, 3rd March 2015) lasted all the way till Feb 2016 when the NIFTY touch a low of 6980. Which make that correction 22%!

LikeLike

Absolutely. In fact a drawdown chart would have been a better representation. But most of us find it difficult to comprehend the chart and hence had consciously avoided it. The overall idea was to convey that volatility is extremely low in recent times giving a false sense of comfort

LikeLike

Very insightful and incisive …Kudos for such a lucid analysis

LikeLike

Thanks a ton 🙂

LikeLike

Well written and very insightful..

LikeLike

Thanks Abi 🙂

LikeLike

Brilliant piece.

Recently my mother in law was sold balanced funds as FD replacement and she has been happy as they have given her good returns so far. She increased her contribution even further, as of now she maintains that she is not worried about loss as she is looking at 5 year term minimum. But having seen the crash in 2008, I believe a crash like that can test patience of all such investors.

LikeLike

Thanks a ton. Very sad to hear about your MIL being mis-sold. This balanced fund mania is a perfect case of a disaster in the making.

LikeLike

one of the best article…which even a layman can understand

Thanks

LikeLike

Innovative and informative details relevant to present condition.

LikeLike

Interesting read and seems logical, too.

LikeLike

Hi Arun

I simply loved your writing style. Crisp, relevant and to the point.

Keep it up bro 👍

LikeLike

Good that you point out we need to be cautious because of so many reasons. I am just curious why can’t this irrational behavior continue for next coming years..i mean irrationality can stay in a market for really long time and if you pull out because of irrationality you would miss out on every bull market ( because every bull market has a big irrational part).

And also if you consider markets are discounting mechanism , and currently we are discounting big future impact of structural reforms which have taken place . Also the yield worldwide in non equity assets is so low that there is no place for money to come into apart from equity.

As an long term investor who is completely invested in equity, you have to accept the volatility and downturns which come with it. I mean the best in the world can’t predict when they happen, so its better to accept it and keep invested.

LikeLike

hi arun,

its a very eye opener article about Peltzmann effect which i hear 1st time,

pl guide for the mkt if u can

LikeLike

I appreciate. Your advice is highly valuable in the present situation. MF and equity market in general are business for business houses for making money and is not for them to loose. So loss to small investors is not their concern. The game is simple and easy since most investors except some big business men /houses are mostly novice in the field to get easily looted. For ordinary investors including retired senior citizens, avenues like FDs , RDs etc were good and safe avenues to get some decent returns for their hard earned money and for their livelihood. Even small investments in Land, other immovable properties, gold etc also helped them in making reasonable profits. Now that all those avenues are made unattractive by policies of the government on one pretext or other, people are forced to invest in risky stock market related investments. It is obvious that it is by design to benifit few at the cost of several innocent ordinary investors. Why the government is adopting such policies which can create disaster to a large section of the society. Is it that the government is unaware of the vulnerability of the small investors and that they don’t have the financial strength and knowledge to take such risk. After the shock of demonetisation ordinary citizens can’t just afford another Shock like this. Government is supposed to do justice to all and not part of the society as it suits. Policies shouldn’t just remain in slogans.

LikeLike

Truely great article in this financial jungle… Providing right way of thinking…..Safeguarding us… Open mind like a parasuit…..

LikeLike

Thanks a ton 🙂

LikeLike

You have perfectly cautioned the investors about the runaway rally going on, resultantly huge money flowing in mis-sold balanced funds. I got to know about Peltzman effect for the first time. Perfect description of present scenario! Keep up writing thought provoking articles. Thanks a lot.

LikeLike

Thanks a ton Madhusudan. Do visit again 🙂

LikeLike

Agreed, but as you know risk and reward go hand in hand this time also risk is on the rise and fall will also be greater. I follow a old saying, Girte hain shahsawar hi maidan-e-jung mein. Woh tifl kya gire jo ghutno ke bal chale. Game is on and crown will be on best bazigar.

LikeLike

Reblogged this on softwaremechanic.

LikeLike

Brilliant article. Even in our religious texts there are ample examples. I have three questions.

Could this be a regime change? Also could you please elaborate on “dynamic equity allocation product for incremental money”. Can this iminent risk be dealt with Rupee cost averaging?

LikeLike

Just wondering when is it a good time to start investing in small cap MF again?

LikeLike

Hi Arun, I follow your articles… I liked the set up of the perfect conditions lulling us into believing that Risk is low, but one point I need more clarity is from you on “stay away from Small & Mid caps”. Given the recent meltdown in those stocks, shouldn’t it be a great buying opportunity? In fact all the smallcap funds have recently opened up again for subscriptions (including DSP, SBI etc.). Buy when others are fearful maxim may mean that IF our expectation window is LONGTERM (which anyways should be for SmallCap), I think maximum alpha generation may happen if we buy when prices are down or lower.

Thoughts?

LikeLike

Do take into consideration the valuations before you take exposure to small cap segment

LikeLike

Hi Arun, thanks for all the thought provoking articles. I read through it all and it gives a good perspective about markets in relation to other facets of life and the Universe.

If the max AUM has come in 2017 and if that is 1/4th of the total mutual fund AUM, then this market is in big trouble. So at least a major investing has been done in 2017-18. The markets tanked off in 2018 and with so many pledged shares around and prices continuing to fall; we are sitting on a ”super volcano”. A tsunami is brewing.

LikeLike