In my last post I had indicated that at the current juncture investors are underestimating risks and overestimating returns, and hence we need to focus on risk over returns at this juncture.

While this looks like an eloquent statement, I could hear you go “WTF..What exactly does that mean ?”

Unfortunately, risk is an extremely fuzzy concept and it’s hard to precisely measure it. But as Einstein says..

So let us try and understand more on how to evaluate risk and its nuances.

Predicting a crash in hindsight..

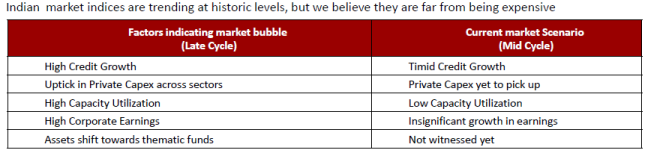

Nowadays a lot of the mutual fund presentations have a default slide in all their presentations as to why today’s market is not anywhere close to the 2007 peak levels.

Source: Kotak Mahindra AMC and Birla Sun Life AMC

Somehow hindsight makes it crystal clear that 2007 markets had all signs of a bubble.

Just for the sake of being curious, why don’t we actually travel back to 2007 and check out what the fund managers had to say during those times.

Prashant Jain – HDFC Mutual Fund (26-Nov-2007)

Do you see a market crash in the near future?

In my opinion, a “crash” is probably too strong a word for the Indian market. But a correction can never be ruled out. It is true that the Indian market is somewhat expensive, but it offers a unique combination of size and growth. Global investors are increasingly looking at India as a mainline asset class and are therefore, investing with a long term view. If you look at Indian P/E’s of nearly 20, 15-20 per cent earnings growth, interest rates of 4-6 per cent prevailing outside India and an appreciating currency, then Indian P/E’s still look reasonable. India is somewhat expensive compared to the past and to the prevailing interest rates locally. But when viewed in the global context and in view of improved size, fundamentals and visibility of the Indian economy, the market does not appear to be unreasonably valued.

Source: Link

Mahesh Patil – BSL MF (28-Nov-2007)

Do you see a market crash in the near future?

I don’t see a major market crash in the near future. The long term trend is still up. However, after the smart rally we have seen in the last few weeks, one can expect a short correction of about 5-7 per cent in the near future.

Source: Link

A Balasubramaniam – Birla Sun Life AMC (24-Dec-2007)

Do you see a market crash in the near future?

During the recent run up of the market, post the US Fed cutting the Fed rate, we have seen the CNX MidCap under perform the larger indices. This has resulted in an increase in the valuations gap between large- and mid-caps. We analysed the results of all manufacturing companies in the BSE 500. We saw sales rise by 24 per cent while PAT grew by 70 per cent on year-on-year basis. Given the lower the inflation and a softer interest rate regime, we expect the coming quarters to go quite robust. This would widen the valuations gap between large- and mid-caps further. Hence we believe mid-caps would be very attractively valued.

Source: Link

Birla Sun Life AMC Factsheet (31-Dec-2007)

Investors have now started worrying about a possible US recession and the consequent impact on the emerging markets including India. We believe that a near recessionary US economy is unlikely to have as significant an impact on emerging markets as in the past. Indian economy, is resilient to the impact of any potential US slowdown (domestic consumption driven and low export-to-GDP ratio at about 15%). India has diversified its exports base – commodity and country wise – share of US exports now stands at 15% of India’s total exports from 22.8% in FY2000. Research indicates that for every 1% fall in GDP growth in the US, India’s growth will only be affected by 0.25%.

Srividhya Rajesh – Sundaram AMC (6-Dec-2007)

Do you see a market crash in the near future?

While we are of the opinion that there may be a bubble (in terms of valuations) being formed in the market, we do not forsee it being pricked in the near future. Given the global liquidity conditions, we expect the bubble to last longer.

Source: Link

Anand Shah – ICICI Prudential AMC currently the CIO of BNP Paribas Mutual Fund (20-Dec-2007)

Do you see a market crash in the near future?

The rise is the reflection of very strong GDP growth rates in the last three years and expectation of the same being sustained in the foreseeable future. We believe that strong earnings growth of India Inc will sustain going forward and thus market valuations are reasonable on a one-year forward earnings basis. Also, the balance sheet of India Inc is stronger then ever. We are of the opinion that the market might remain volatile in times to come, however a market crash is unlikely.

Source: Link

ICICI Prudential AMC Factsheet (31-Dec-2007)

- Economy, which is likely to grow above global average based on domestic factors

- Valuations which are at premium over other EMs but at discount to China H share market

- Domestic investors now stepping up to take lead over FIIs

Source: Link

Sadly the other AMCs dont publish their historical factsheets 😦

But the story is pretty similar across most of the interviews which you can find in value research here

Most of them are amongst the top respected names of the industry and have a solid performance track record spanning decades. There is no doubting their integrity or intellectual capabilities and these are people who have been-there-and-done-that.

Yet, none of them got it!

While everything looks easy to predict in the hindsight why weren’t even the best able to predict the crash.

Before we naively start to blame the fund managers, there is an important lesson for us..

Welcome to the world of alternate histories..

Our first instinct is that all factors such as high valuations, high credit growth, high capacity utilization, high corporate earnings, asset shift towards thematic funds, high retail participation etc were clearly indicating a crash and why hadn’t the fund managers spotted them as they mention in their current presentations.

Here is where the concept of alternate histories come –

- What if the same crisis stuck after 2 years – say in 2010 instead of 2008?

- And what if instead of 2 years it took 5 years for the crisis to manifest?

All the fund managers would have been right in this alternate history (and you may also argue that this version of history might have been the most probable one)..

The fact that something happened doesn’t mean it was likely, and the fact that something didn’t happen doesn’t mean it was improbable. Improbable things happen all the time, just as likely things often fail to occur– Howard Marks

The key here is to note that the actual trigger for the event was the sub prime issue.

And ironically, the manifestation of sub prime had nothing to do with the parameters which we were evaluating such as high valuations, high credit growth, high capacity utilization, high corporate earnings, asset shift towards thematic funds, high retail participation etc

And the reality is that the sub-prime could have hit at any point in time. Who knows!

Unfortunately most of the negative triggers in the past that led to large corrections also had nothing to do with the domestic markets. In 2016 it was the Chinese slowdown, in 2013 it was the Fed taper, in 2011 it was the euro debt crisis, in 2008 it was the subprime, in 2000 it was the dotcom bubble, in 1997 it was the Asian currency crisis etc.

There are 195 countries in the world and something will always go wrong somewhere. Further there are thousands of variables which can impact markets and the unpredictable complex interplay between them makes it next to impossible to exactly predict and time a market correction.

Thus a negative trigger which is the catalyst for a market decline is impossible to predict and time with consistency

Takeaway 1: It is impossible to consistently predict and time the next crisis

But is everything lost, now that we know that we cannot predict these negative triggers and to our solace even the best guys weren’t able to predict.

Hang on, we have some valuable clues to solve this issue from another mundane activity that most of us do everyday – driving!

Your own driving has the answer to the puzzle

When I first started riding my bike, I never had a concept called accident in my mind. An accident was always something that happens to someone else. For years together, I was an extremely rash biker (the jackass who goes between two trucks, overtakes on the left etc) with an ability to over speed at the drop of a hat. And yet, while there were several close calls there was not a single scratch on me and my bike.

And then came 2004, my first accident where I nearly scraped my right eye off and broke my hand. I still have the scar below my right eye reminding me of the accident.

For the first time in my life I realized – things could go wrong.

And then came the killer. After a few weeks I started riding again but at much lower, controlled speeds and was going to meet my doctor to check on my hand. As fate would have it, a small kid suddenly ran across the road excited on seeing her mother. I fervently swerved, missed the kid by a whisker and met with my second accident, all in a span of 1 month.

This incident taught me all that I needed to know about investing.

Accidents can happen anytime. You have freaking no clue when they happen.

The first time I met with accident, I had taken more risks since I drove rash and at high speeds.

The second time despite a lower speed and lower risk, I still met with an accident but ended up with lesser injuries and saving the kid as I could maneuver better.

Outcomes are the same – an accident. But which driving style should I follow going forward?

Welcome to the world of understanding “risks” and evaluating outcomes.

When we say a higher speed is risky, what we really mean is that if there is some unexpected external event not under your control (say a broken road, an unexpected swerve from the car in front of you, a dog suddenly crossing in front of our bike, a drunkard crossing the road etc) your ability to maneuver the bike is a lot lower at higher speeds and hence the possibility of an accident and the expected impact from it is also very high.

But the real cause for the accident is actually the unexpected event and not the speed. So while the unexpected occurrence might not happen everyday, if you keep over speeding everyday, then your chances of an accident are very high in the long run.

Even at lower speeds, this unexpected event might lead to an accident. However at lower speeds your ability to maneuver is much better and hence the chance of minimizing the impact of the accident is also very high.

In reality the only way you can predict an accident is to exactly foresee the unexpected event. Now the irony is that it is called an unexpected event precisely for the reason that it is unexpected!

So all we do while driving is to focus on what is under our control – the speed at which we drive our vehicles. We try to manage risk by increasing and decreasing the speeds based on the road conditions.

This is precisely what we should try and do in investing too – control investment risks

Controlling investment risks

Just like in driving, we have no clue where and when the next trigger for an investment accident (read as crisis) is going to originate.

However similar to driving, in investing while we cannot predict the time and magnitude of a crisis, we can always prepare for them.

Just like how we control our speeds based on the road conditions, we need to control risks in our portfolio based on the investment environment.

This risk control can take the form of adjusting equity allocation, staying out of overvalued segments, exposure to reasonably valued and contrarian segments, diversification, asset allocation, hedging strategies, extending time frames etc

Unfortunately, the process of evaluating risk cannot be put into a mathematical formula. Accessing risks in the equity market still requires skilled and subjective judgement .

Takeaway 2: While we cannot predict, we can still prepare

Checklist for assessing risks

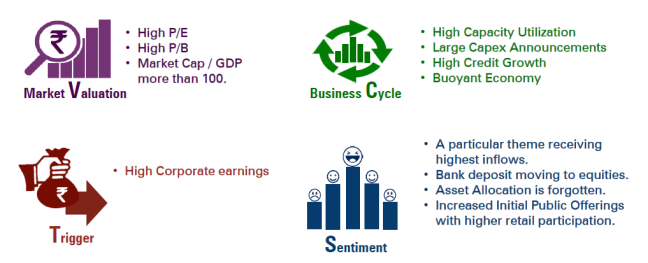

Here is a good starting point – a checklist for identifying bubble risks from ICICI Prudential AMC

The key thing to remember is that even if all these factors turn negative at some point in time, it still does not mean equity market will crash immediately.

All it means is that, if and when a negative trigger hits, the impact to your equity portfolio will be substantial.

So technically, now all these factors are not negative, but if there is a negative trigger which occurs the next week, the markets can still crash. The magnitude of the impact will depend on the risks taken in the portfolio.

I personally use valuations in the context of earnings cycle, corporate balance sheets and investor sentiments as an indicator of equity risks. (will explain them in detail in future posts)

The whole idea of controlling risks is to reduce the impact of declines (by reducing risks when likelihood of reasonable returns are low) while ensuring sufficient participation in the upside (by taking intelligent risks when likelihood of reasonable returns are high).

So what does this mean for us?

A negative trigger is the necessary catalyst for a crash which none of us can time and predict. A high risk in the portfolio only magnifies the impact if and when it hits.

Takeaway 3: When you evaluate that risks are high, all that you mean to say is that if some negative trigger hits, the magnitude of the fall can be substantial! If and when it happens is anyone’s guess.

This implies that any strategy which aims to reduce risk is not a market timing strategy (something which will exactly predict the top and bottom of the market). Most often than not, these type of strategies will be early in their decisions and will focus on reducing the overall declines while providing sufficient participation in the upside. It will work well only over longer periods and can under perform in the short run.

Takeaway 4: Any strategy that pursues to control risk, is not a market timing strategy and will inevitably undergo periods of short term under performance in pursuit of long term out-performance

In a nutshell

- Any crisis is easy to predict in hindsight

- Even the best of the fund managers, weren’t able to predict the 2008 crisis

- The future is always a set of possibilities while the same future in hindsight is always a precise outcome

- Always evaluate alternate histories to understand the quality of a investment decision

- A negative trigger which is the catalyst for a market decline is impossible to predict and time with consistency

- Takeaway 1: It is impossible to consistently predict and time the next crisis

- In driving, you can never predict an accident but you try to manage that risk by controlling your driving speed

- Similarly in investing, while we have no clue about the negative triggers which keep hitting the markets from time to time, we can manage and navigate them by focusing on controlling risks

- Takeaway 2: While we cannot predict, we can still prepare

- Controlling risks while cannot be put into a mathematical formula, involves a qualitative judgement on valuations in the context of earnings growth cycle, corporate balance sheets and investor sentiment (captured by flows).

- High risk does not equal to immediate market crash and vice versa!

- Takeaway 3: When you evaluate that risks are high, all that you mean to say is that if some negative trigger hits, the magnitude of the fall can be substantial. If and when it happens is anyone’s guess!

- Any investment strategy that focuses on risk – more often than not, will be early in its decisions and will focus on reducing the overall declines while providing sufficient participation in the upside

- Takeaway 4: Any strategy that intends to control risk, is not a market timing strategy and will inevitably undergo periods of short term under performance in pursuit of long term out-performance

Now that we understand the importance of evaluating risk, in the coming weeks we shall actually go about evaluating various risks at the current juncture and see how we can manage the risks in our equity portfolios.

And in case you haven’t guessed till now, the award for the world’s best risk manager goes to the driver in us for navigating the Indian roads each and every day 🙂

As always, happy investing 🙂

If you loved what you just read, share it with your friends and don’t forget to subscribe to the blog along with the 3000+ awesome people. Look out for some free super interesting investment insights delivered straight to your inbox. Cheers 🙂

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments

I have not seen a better explanation of risk – the word most experts throw around..

LikeLiked by 1 person

Thanks a ton Jay Cobb 🙂

LikeLike

Great post Arun. It helps that you use the accident example to communicate the idea of risk. Cheers

LikeLiked by 1 person

Thanks Vipin. Glad you liked it 🙂

LikeLike

Hi Arun,

I never miss reading your blogs, You are doing a great Job. Pls keep posting.

I am unable to download the attachment which you have give the below blog. (See how easily you can create your own financial plan in 15 minutes) Could you pls send me the excel of Financial Planner which you have created.

Thanks

Regards/Mervin.

On Sun, Feb 25, 2018 at 7:50 PM, The Eighty Twenty Investor wrote:

> Arun posted: “In my last post I had indicated that at the current juncture > investors are underestimating risks and overestimating returns, and hence > we need to focus on risk over returns at this juncture. While this looks > like an eloquent statement, I could hear you g” >

LikeLiked by 1 person

You are good writer, but examples are not appropriate. Due to incentive in fund management, fund managers are bullish most of time and can also spin out any new story. Their main job is to collect large AUM. If they can not think about crash, then they also do not know when bull run will start. You are assuming that they are “God of market” and genius, but they are not.

LikeLiked by 1 person

Very nice explanation with examples

LikeLiked by 1 person

Your all articles are more valueable for learning perspective. This continuous learning is surely a ladder to reach where millionaires are stand now.

LikeLiked by 1 person

First time to your blog, great articles you have written. Good writing skill. ..

Do you have viewpoints on “trend following” system? In rule based trend following system risk is in focus…

LikeLiked by 1 person