In the last few weeks, I had discussed about a simple yet intuitive way to pick equity mutual funds. In case you are new to this blog you can check the entire series here:

- Selecting an equity mutual fund is a pain in the neck. Find out why?

- What if Steve Jobs was an Indian Equity Investor

- How do we experience good performance?

- How to select equity mutual funds the eighty twenty investor way – Part 1

- How to select equity mutual funds the eighty twenty investor way – Part 2

- How to select equity mutual funds the eighty twenty investor way – Part 3

Now obviously all this is just theory if I don’t walk the talk.

So I have decided to invest my own money in two of the funds chosen, each and every month for the next 10 years.

Yes, you heard it right next 10 long years (Phew! It sounds equally intimidating and scary to me as well). Hopefully we can pull it off together 🙂

While all six fund managers are good, I wanted to keep my portfolio simple and so will stick to just two funds (good enough for providing adequate diversification).

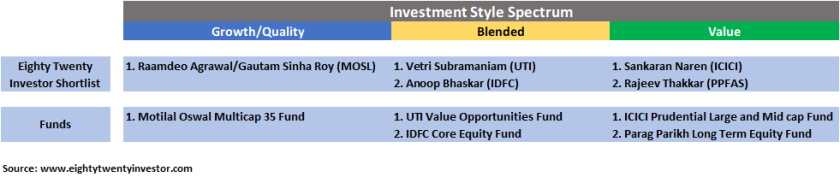

I have chosen both the fund managers from the value basket (personal bias)

- Sankaren Naren – ICICI Prudential Large and Mid Cap Fund

- Rajeev Thakkar – Parag Parikh Long Term Equity Fund

You are free to pick any two and don’t bother too much on my choice.

The game plan is simple.

I will be investing Rs 30,000 every month in these two funds (15K each) for the next 10 years. Hopefully every year as my salary increases I will also be increasing my SIP amount by approximately 5-10%.

I will be reviewing my portfolio once every 6 months and the link to the review will be updated in this page.

Live Portfolio Updates

1.Discipline and Behavior check

I personally believe this will be the biggest determinant for the success of this plan.

Current Plan of action – 15,000 in ICICI Prudential Large & Mid Cap + 15,000 in Parag Parikh Long Term Equity Fund on the 5th of each and every month

- Aug-18 Done – Rs 30K invested

- Sep-18 Done – Rs 30K invested

- Oct-18 Done – Rs 30K invested

- Nov-18 Done – Rs 30K invested

- Dec-18 Done – Rs 30K invested

- Jan-19 Done – Rs 30K invested

- Feb-19 Done – Rs 30K invested

- Mar-19 Done – Rs 30K invested

- Apr-19 Done – Rs 30K invested

- May-19 Done – Rs 30K invested

- June-19 Done – Rs 30K invested

- Jul-19 Done – Rs 30K invested

1 year done! Increasing investment amount to Rs 40,000 every month 🙂

13. Aug-19 Done – Rs 40K invested

14. Sep-19 Done – Rs 40K invested

15. Oct-19 Done – Rs 40K invested

16. Nov-19 Done – Rs 40K invested

17. Dec-19 Done- Rs 40K invested

18. Jan-20 Done – Rs 40K invested

19. Feb-20 Done – Rs 40K invested

20. Mar-20 Done – Rs 40K invested

21. Apr-20 Done – Rs 40K invested

22. May-20 Done – Rs 40K invested

23. June-20 Done – Rs 40K invested

24. July-20 Done – Rs 40K invested

2 years done! Increasing investment amount to Rs 50,000 every month 🙂

25 Aug-20 Done – Rs 50K invested

26. Sep-20 Done – Rs 50K invested

27. Oct-20 Done – Rs 50K invested

28. Nov-20 Done – Rs 50K invested

29. Dec-20 Done – Rs 50K invested

30. Jan-21 Done – Rs 50K invested

31. Feb-21 Done – Rs 50K invested

32. Mar-21 Done – Rs 50K invested

2.Decision Journal

All decisions will be documented here every 6 months (so that we can evolve our process based on feedback)

- Aug-18 – Rationale for picking the two funds – Link

- 6 month review: Link

- 1 year review: Link

- 1 Year 6 months: Link

- 2 Years: Link

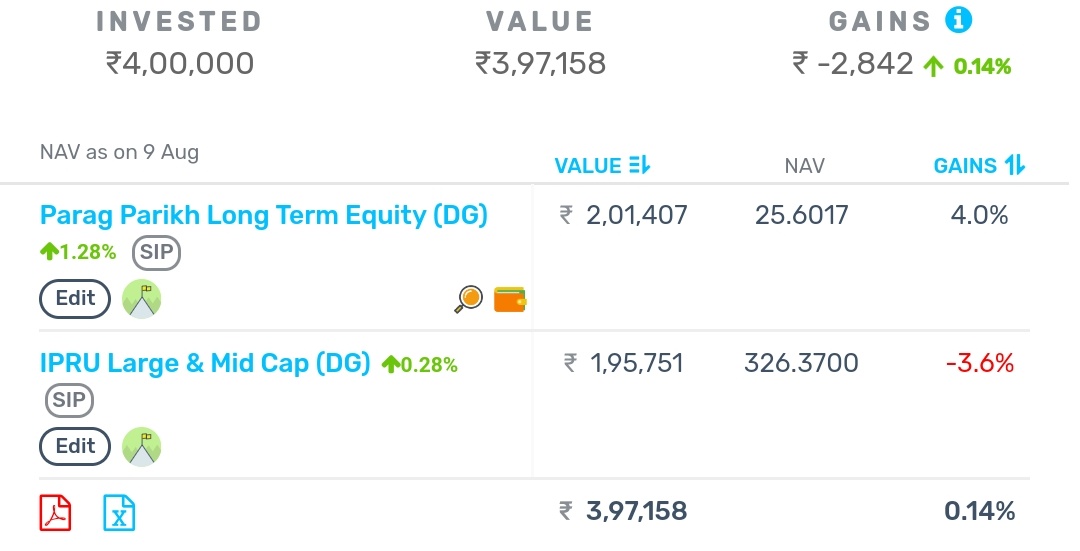

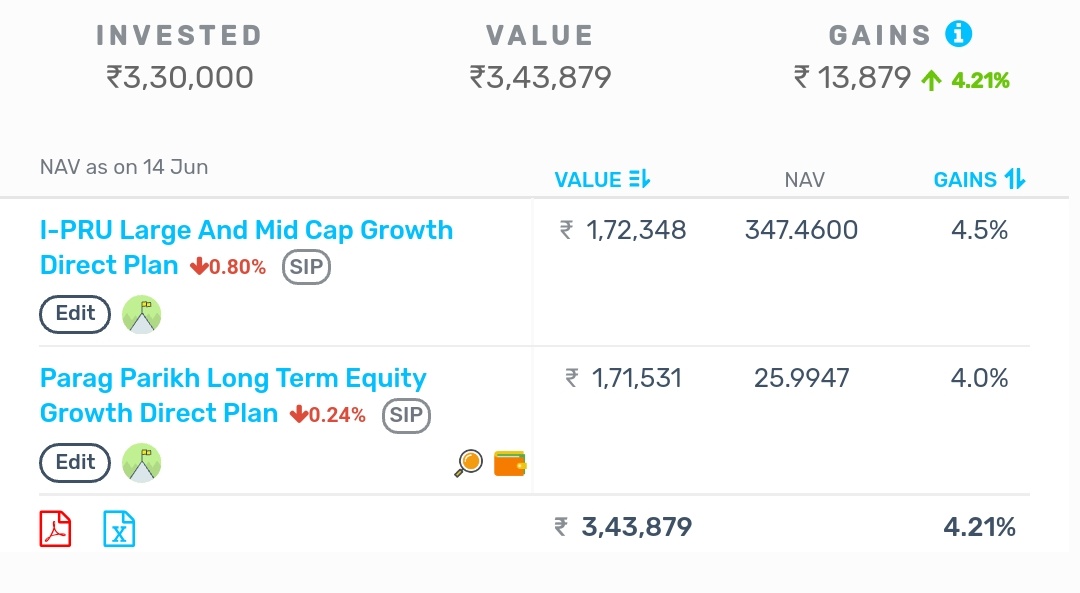

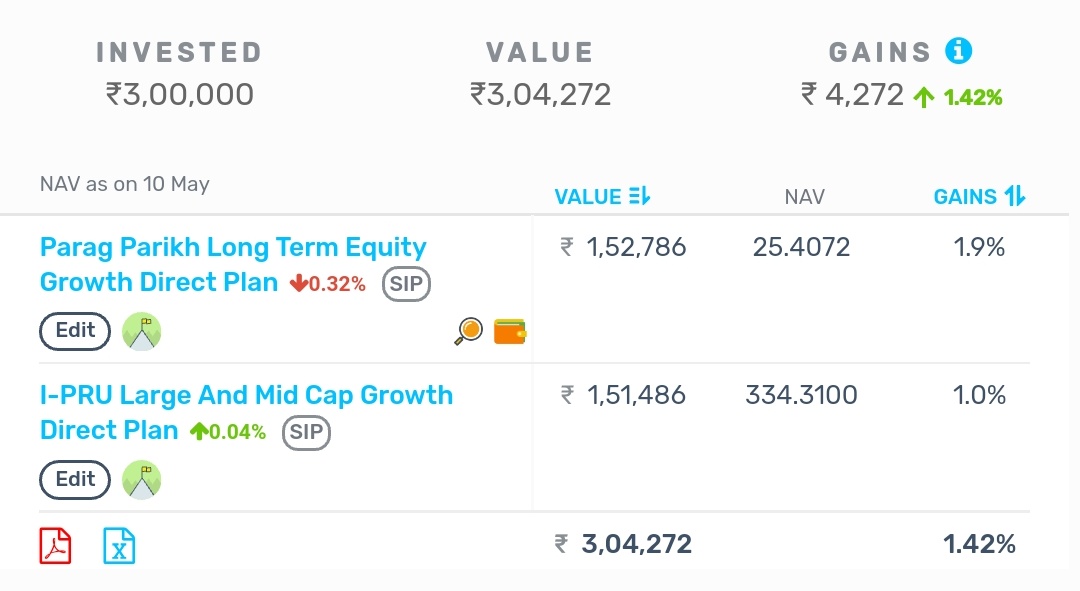

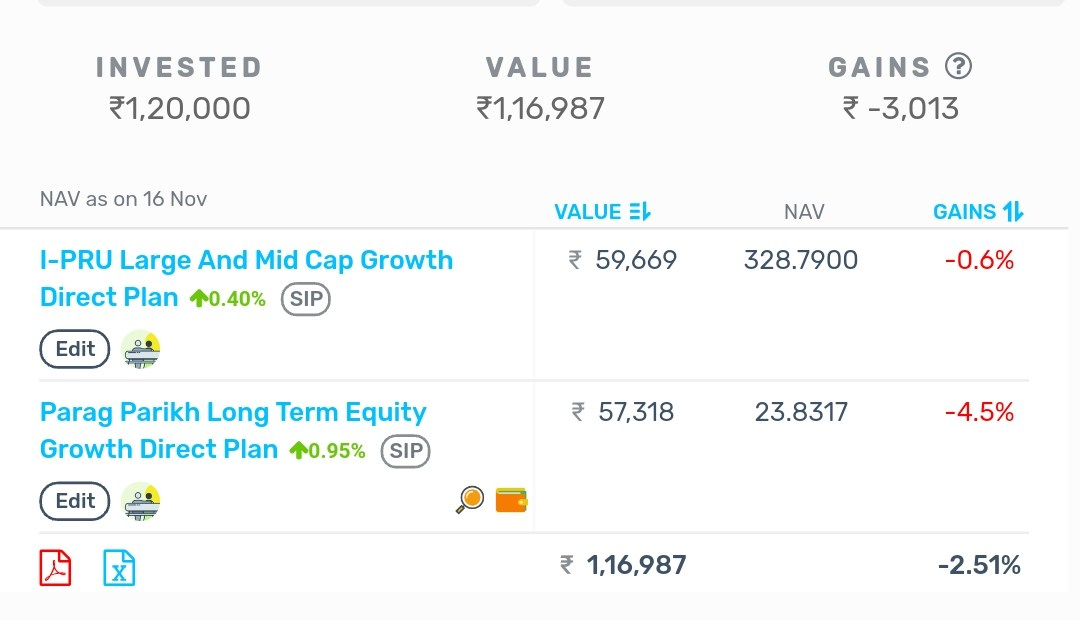

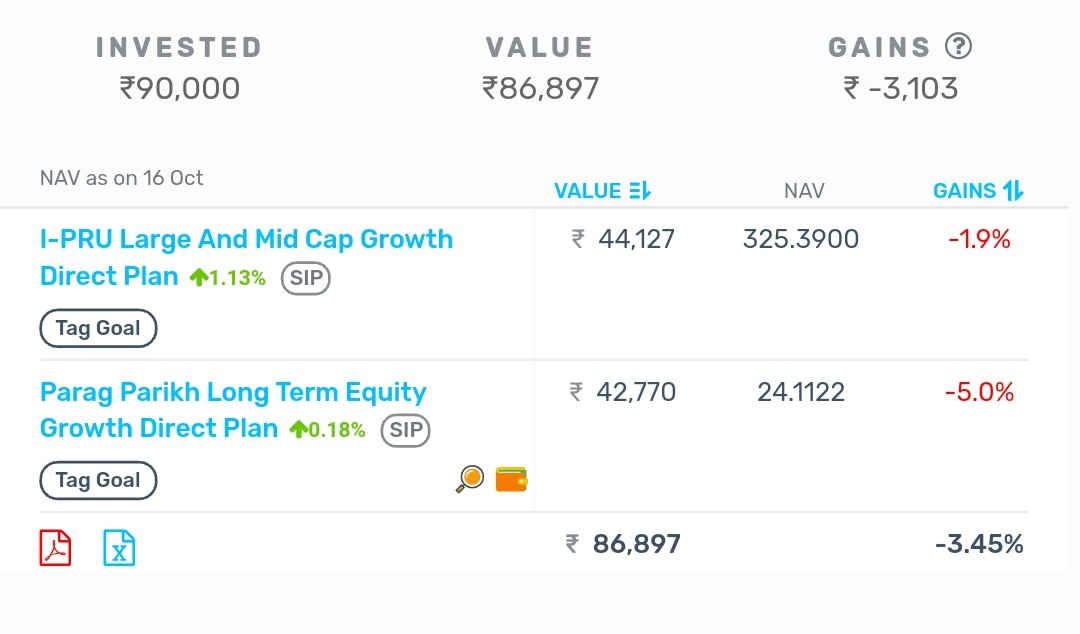

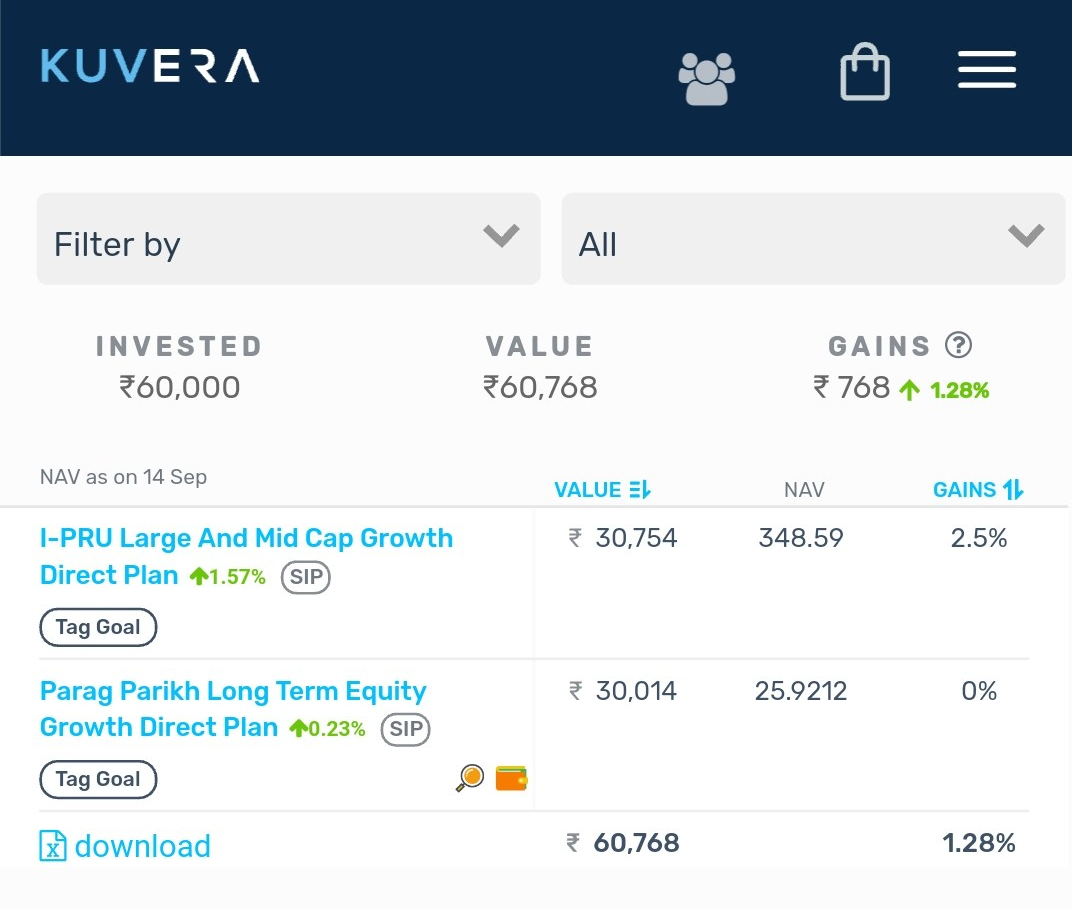

3.Current Portfolio (started from 05-Aug-2018)

As on 08-Aug-2019

As on 11-Jul-2019

As on 14-Jun-2019

As on 10-May-2019

As on 15-Apr-2019

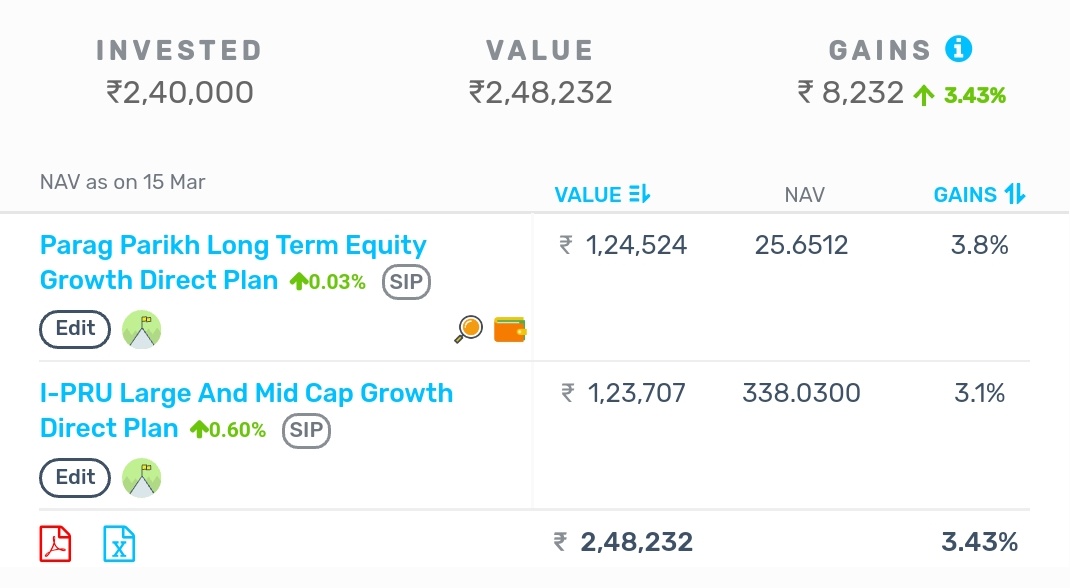

As on 15-Mar-2019

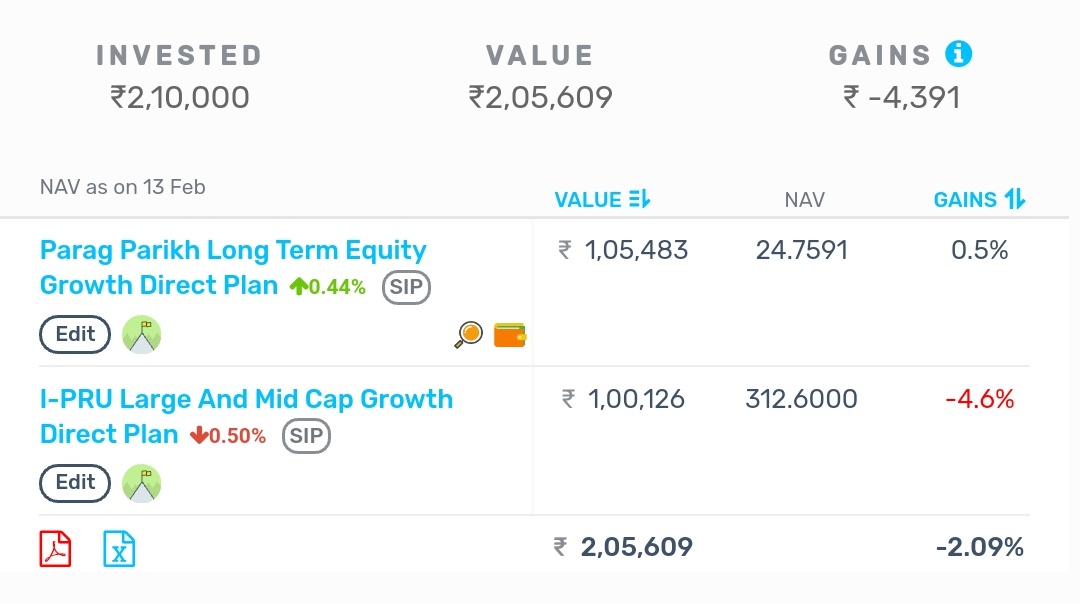

As on 13-Feb-19

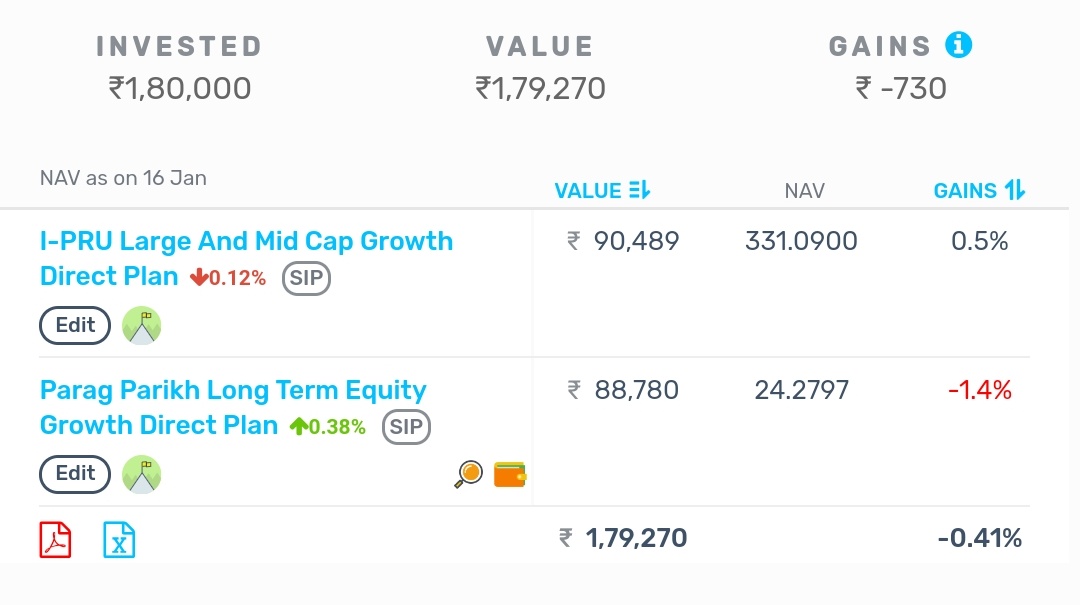

As on 16-Jan-19

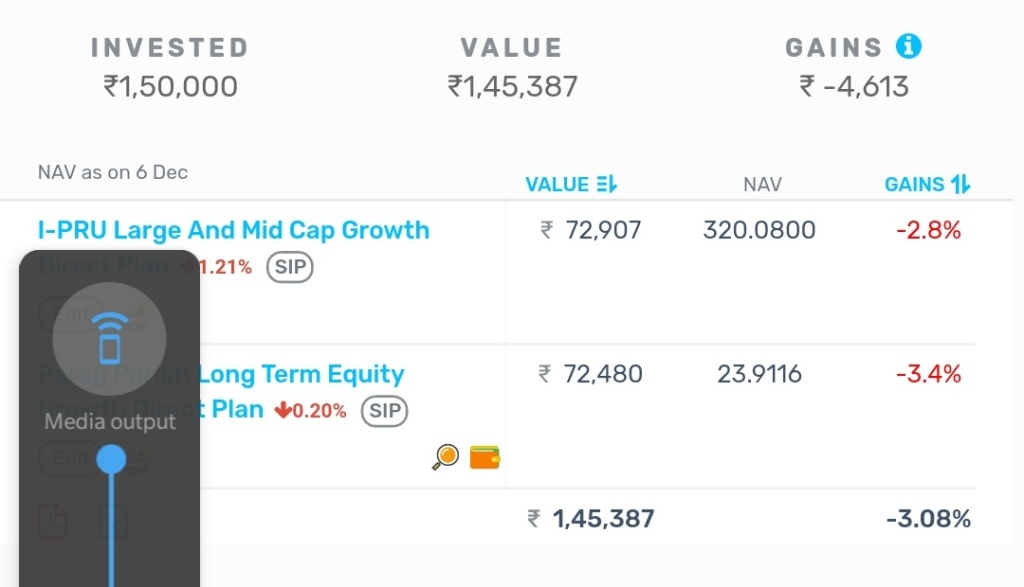

As on 06-Dec-18

As on 17-Nov-2018

As on 16-Oct-2018

As on 17-Sep-2018

FAQs

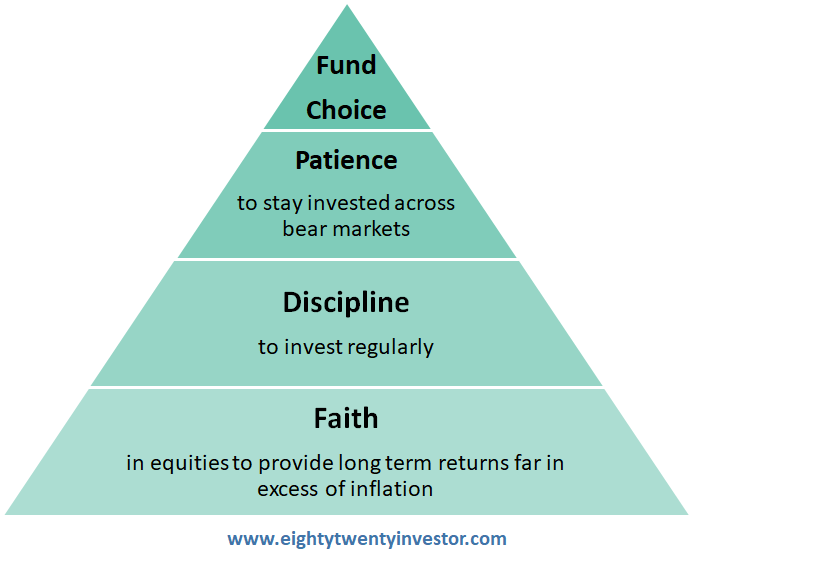

1.What will determine the success of this whole plan?

Now while this question is better answered ten years down the line, this is what I believe will be the most important contributors to the success of my investment plan.

- Faith in Equities:

- Investing in Equities for the long run is basically a bet on human progress

- You are simply betting that entrepreneurs (who take higher risks) on an aggregate will get compensated with higher returns

- Discipline to invest regularly:

- Ability to save and invest regularly through good and bad times holds the key

- Patience to hang on through tough times:

- Market corrections are not a bug but a feature – and it is next to impossible to predict when the next one is coming, how steep the decline would be and how long it will last

- It is prudent to assume that our equity portfolios will go through a 30-50% decline at-least once in every decade

- 10-20% corrections should be expected to be a regular affair

- It is ok to realise that you wont be able to predict the fall and in fact you don’t need to predict the fall to create long term returns

- The way you behaviorally respond to a fall (which is completely under your control) is all that matters for your long term returns

- Choice of funds

- The idea is to pick funds managed by experienced fund managers with a

- Consistent and well communicated investment process/style

- Long term track record across market cycles (i.e periods covering up and down markets)

- Well diversified across large, mid and small companies

- The idea is to pick funds managed by experienced fund managers with a

The real deal breaker in this whole endeavor is not the choice of funds..

Instead its actually our ability to stay disciplined (invest every month) and stay patient through bad times (which is inevitable at some point in time).

And here is the best part..

Both these are completely in our control!

2.Is an SIP completely risk free?

How I wish!

Unfortunately SIP while it has a tremendous behavioral advantage, there are also certain risks that you must be aware of. You can read about it in detail here

3. Why do I not follow an asset allocation plan?

This is one of the common mistakes which most of us do. When you are in your 20s or 30s you forget the fact that you have a long investment time horizon & large human capital (i.e the amount of money you are yet to earn using skills, knowledge and experience, over the course of your career). This essentially means your current savings is a paltry amount compared to the expected corpus 15-20 years down the line.

I am in my early 30s and the amount that I am saving right now is a minuscule component if I take my entire future savings over the next 10-20 years in context. So to take advantage of this long investment time frame and human capital, I am going for a equity heavy portfolio as I have my short term requirements sorted through safer avenues such as fixed income funds etc

You can read more about this here

But if you have a large portfolio, then you will have to follow an asset allocation plan as wealth preservation takes a higher priority over wealth creation.

Just remember, if you are young – your ability to save is more important than picking the best fund!

3.Why do I do this?

Most of you must be going through the same problems as I am – difficulty to save, extremely complicated investment world and the problem of getting scared out of equities during a market fall.

The hope – is that you and me together will be able to solve this.

This journey which will be available in the public domain, will attempt to give you an idea of how living through an actual SIP portfolio looks like. Together, if we are able to stay invested without panicking through a bear market (which will inevitably happen sometime in the future) and invest regularly, then the long term results would be awesome and we could have our investment journey sorted!

I have always believed that investing needs to be simple and if we just got our behavior in place, all of us can have amazing results. This is my humble attempt to prove it.

Someday I hope of making you financially free and take pride in playing a small role in helping you live your dreams.

I know its a tall ask. But nevertheless..

Overall, if things work, then this page will be a inspiration for many people to start investing and appreciate the journey of what it really takes to be a long term investor.

If in case the whole concept is a failure, you can rip my case off via the comments explaining what a stupid jackass I was. For me while that would mean I would go down as a dumb guy, the best part is since every decision is documented you and I can always go back and analyze as to what actually went wrong. Then based on the actual evidence, you can avoid all my blunders.

Either way, its a win-win for you!

4.Any hidden agenda?

I am a nice guy and want to genuinely help you out. Err..Partly true.

But let me be brutally honest. I have a selfish motive as well.

Here goes my story..

Most of our parents were phenomenal savers (mine were for sure!). If you really look at why this happened, most of them took a huge loan and invested in a home early in their life. And this meant each and every month for the major part of their working years, they had to forcefully save and pay for the EMI. All their expenses were post their EMI.

Unfortunately I am not too keen on buying a home despite my mom trying day in and out to convince me.

The result – I am a terrible saver and a super spend thrift!

Since I have no loans, I end up spending a lot (especially impulse purchases). Adding to the pain, the Facebooks, Instagrams, Amazons, Flipkarts, Swiggys, Zomatos, Netflixes, Ubers etc of the world are making my savings habit almost next to impossible.

So unless and until I force myself to save I won’t be able to do it. The moment I have given a public commitment (to save 30k every month), then I suddenly become accountable to all of you and most importantly myself!

If I don’t save up every month, I will end up looking like a failure – the man who only preached.

So this is my selfish motive – to help myself get the discipline to save each and every month straight for 10 years – come what may!

5.Should you follow this portfolio?

The whole idea is to view this as a reference point and you can evolve your own plan based on this. Always focus on the thought process and my logic behind the plan and don’t blindly go by my choice.

Personally, I believe in this plan and hence I am investing my own money in it. So to trust me or not, I leave it to your own judgement.

6.Will there be tough times?

Obviously. There will be several periods where you will feel you would have been much better off investing in an FD instead. In a bear market, the portfolio returns will be extremely disappointing and I have no magic wand to save you from the pain of seeing temporary losses in your portfolio.

And again, at all points in time there will always be some other fund doing better than the ones I chose. I profess no special ability to spot future winners.

Simply put, this is a plain vanilla investment portfolio which will test our patience and discipline at several points of time. If you are not ready for it, then you need to evaluate safer options with lower return expectations.

7.Will I change the funds?

Yes, I will change the funds if

- The fund manager changes (because that is the basic premise of our investment)

- The performance over a cycle under performs the index

- The size of the fund becomes too big

- The fund manager does not stick to his communicated mandate and investment style

- Corporate governance issues

- Does not communicate in plain English during tough times

8. Should you pick the same funds?

Not at all. You can actually pick any fund based on your conviction. There are several good funds out there. The key is that we need to invest regularly and have the conviction to stay put through bear markets. The big idea is, if we can do it together, the journey of ups and downs become a lot more palatable.

9.Which platform do I use to invest?

As of now I use Kuvera. I find it simple and good enough. The newly launched Paytm Money might also be a decent option.

10.What about asset allocation?

Once my portfolio size grows to lets say 5 times my yearly spending, then I will start implementing an asset allocation strategy.

11.What is my risk profile?

I have my entire savings till date invested in equities (primarily via stocks). All my tax savings is in ELSS. I work for a wealth management firm and hence my career is also equity market dependent. My better half is an amazing entrepreneur and she runs a chain of dessert joints in Chennai called The Brownie Studio (if you drop in sometimes to this part of the country, try us out and do let me know). So in effect both of us are basic believers in the Indian entrepreneurship story and all our investments reflect this.

I am a very high risk taker and hence this SIP portfolio again falls into the pattern. My reason for choosing an SIP is because I am trying to automate my savings behavior.

———————————————————————————————————————————–

If in case you have any other questions, do let me know. I shall try to answer this in the same post.

Until then, happy investing folks!

If you loved what you just read and think your friends might also find this us meful, share it with your friends and don’t forget to subscribe to the blog and join th 5000+ awesome people. Don’t miss out on the interesting investment insights delivered straight to your inbox every week. Cheers

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments

Why not in Raamdeo Agarwal managed Motilal Oswal 35 Multi cap fund. It is equally credible and having equally great past performance record as compared with at least ICICI Large & Mid Cap Fund.

LikeLike

This is just a personal choice. I have no expertise in predicting which will be the better fund over the coming years. You are free to pick based on your conviction.

LikeLike

Excellent Series

Truly Long Term (10 years waiting period)

LikeLike

Thank you for this great series on selection equity mutual funds. Really helps in understanding the factors that go into deciding which MFs to invest. With regards to selection of “Icici Large and midcap fund”, Motilal oswal is coming up with a Large Midcap 250 Index fund called “Motilal Oswal Nifty 250 Index Fund”, I’m guessing the icici fund too will be compared to this index benchmark for performance. Would you be replacing your icici to Motilal one since the overall TER is lesser?.

LikeLike

Too early to comment. As of now I think multicap active funds will be able to outperform passive indices over a cycle.

LikeLike

How did you arrive at 30K as the investment amount?

We keep on hearing about goal based investing and when you say long term of 10 years, does this mean, you only invest in equity and not in a debt w.r.t a goal

LikeLike

This is an amount I can save comfortably without having to touch it for the next 10-15 years. All my short term goals will have a portion of safer allocation such as debt .

LikeLike

What is the expectation from this portfolio? Any concrete numbers? or just beating the index is fine?

LikeLike

What is the expectation from this portfolio? any numbers or just beating index?

LikeLike

A 12-15% returns over a ten plus year period is what I would be looking for..

LikeLike

Great culmination to an amazing series of articles – this is truly skin in the game. Also, the first such public display I’ve personally seen on an investment blog so you’ve got me hooked to your journey as you demystify investment for the masses.

PS – look forward to trying brownie studio when am in Chennai!

LikeLike

Yes, skin in the game, very much evident.

LikeLike

Thanks a ton Kamal 🙂

LikeLike

Thank you so much Jatin. Hope we can make this journey work. And yeah, do try Brownie Studio when you are in Chennai 🙂

LikeLike

You had earlier commented in “Dude, Shall I cut my equity exposure?”

Only when my portfolio size crosses 5 times my yearly salary will I start attempting to be cute and implement an asset allocation strategy

while in this post you are saying

Once my portfolio size grows to lets say 5 times my yearly spending, then I will start implementing an asset allocation strategy.

The difference between the two statements is huge, especially if you are frugal and follow the FIRE philosophy.

LikeLike

The logic is going by history we should be prepared to experience equities fall by 50 percent or more at some point in time. So when I say 5 year salary or expenses, it means you will be ok to see 2-3 years of your hard work temporarily vanish in front of your eyes..Earlier I used salary as a benchmark but since my expenses as you rightly mention are much lower I have decided to use expenses instead. So there is nothing sancrosanct about the 5x or expenses/salary. Based on what you think is more suitable, you can modify the thumb rules.

LikeLike

Are you planning something on ELSS ? That’ll be a great help.

LikeLike

Not planned for ELSS. But I personally use the one from Motilal Oswal.

LikeLike

Arun, just too good. Best publically available mutual funds analysis in a long time. I have also started 2 mutlicap funds for last 3+years and lets put the seatbelts & see how the journey goes for 10 years. All the best 🙂

LikeLike

Thanks Sriram..Fingers crossed 🙂

LikeLike

Hi Arun

Great Post …one question

Will you also update on other 4 Funds also or just 2 selected funds only for checking funds performance ?

Thanks.

LikeLike

Thanks for reading..As of now the plan was to update for the two funds on a regular basis..but as you suggested it makes sense to do it for the other 4 as well. So I will do it for other 4 too.

LikeLike

That would be great. Thanks Arun, for lazy plus not so market literate people like me this is a boon.

LikeLike

Thanks, I’m going to pick some of these funds.

Best, Vishal

LikeLike

Hi Arun, will you not put in small cap and mid cap funds at all?

LikeLike

Hi Nithin,

These funds invest in a mix of large, mid and small cap stocks. So anyways I get exposure of around 30-40% in mid and small caps.

If at all I am playing mid and small cap funds directly, I would like to be a little more opportunistic and invest when valuations are very attractive.

LikeLike

Since you’ve mentioned you might change a fund if it gets too big, do you have any ballpark figure?

LikeLike

I have to admit, your series of posts were highly enriching and knowledgable. I doubt if there is any other detailed explanation of selection process for Mutual funds available. Congrats for the wonderful post.

Taking your suggestions, i have decided to increase my Large & Mid Cap exposure and bought PPFAS and Axis Focused funds. Now, where i need your suggestion is how to trim down my Small Cap exposure. I am invested in three major fund houses and idealy would want to continue for only 1 fund. Here are the details and my thought process so far.

1. Reliance Small Cap – Has been a very good fund until Mr, singhania. Recent change in Mgmt makes me jittery, however have fair enough corpus lying there. Investing from last 3 years

2. DSP Small Cap – Vinit Sambre had a roll 2-4 years back and this is what attracted me to the fund, lately fund is doing really bad, though i like Vinit’s selection process, which i think is more blend investment. Investment from last 2 years

3. L&T Emerging Business – Again good management, have been investing from last 1 year.

Please let me know your suggestion and would be glad if you could share your thought process as well while making this selection. Thanks & Congrats again for wonderful share.

LikeLike

Did you invest in Oct? If yes, then my request would be to update this page regularly as people following you would like to know your commitment to the funds you advised.

LikeLike

Oops..Forgot to update..I have and will continue to invest every month 🙂

LikeLike

Hi Arun. Still awaiting the update on your November investment. Again requesting you to update your monthly investments regularly.

LikeLike

Apologies. Updated!

LikeLike

(1) How come your losses as on 17th October 2018 and 17th November 2018 (latest reporting period) stand exactly at Rs. 3013.00.

(2) In fact, the game has become interesting because you have turned from ‘profit’ in your first month of investment to ‘losses’ in your subsequent months. Now this is a real test of the model and your conviction in it.

Would wait and watch the model for the next decade to show the maturity and correctness of the model but also your conviction also in the model, which will actually be a good encouragement for all those who follow you, your theories and your practices.

LikeLike

It’s actually 3013 and 3103! Strange coincidence 🙂

4 months is too small a period to evaluate any strategy. Anyway time will tell as to how this simple, boring strategy will work out over the longer run.

Thanks for the feedback Kamal

LikeLike

ICICI Multicap fund is also managed by Mr naren don’t you think that Multicap fund will be better option for long term?

LikeLike

Naren has started to manage this fund only from this month. The only worry I am having now is that there are too many funds that he is managing. Multicap is definitely a better option as there are no constraints – but let us wait for a few months for him to align multicap fund as per his style and see how the portfolios differ between large & mid and Multicap

LikeLike

hi arun .. nice post .. will u also do a post on asset allocation strategies ? thanks

LikeLike

Thanks a ton! Sure. Will do Manish 🙂

LikeLike

Regarding Asset allocation, do u prefer Asset allocator fund OR prefer do your own asset allocation through equity and debt separately?

LikeLike

I prefer a combination of both!

LikeLike

As per great pundits, it is only the ‘boring strategy’ which generate great returns. Excitement filled strategy only burns hole in your pocket. Simple mantra of success in investment is make good and considered choice and then don’t tinker with the strategy frequently. Let boredom overcome your strong itch to play around and see what fabulous returns one gets.

LikeLike

Hi Arun,

I like your blog, the posts are very informative. Eagerly waiting for the 1.5 years review.

LikeLike

Hi,

Your return is updated only upto 08.08.2019 whereas investment is updated upto April 2020.

It is requested to please update the results also so that we can learn the lessons of this choice of funds and strategy of investment also.

LikeLike

Wow, nice !!!

These article can really help people to start investing. I’ve also started SIP on my Kotak Securities account.

Will use same strategy but my investment would be less for now.

LikeLike

Great. This is the most important decision – TO START!

Happy investing 🙂

LikeLike

Amazing, decent !!! This article can truly assist individuals with start investing. I’ve likewise begun SIP on my IIFL Securities account.

LikeLike

Great. Happy investing 🙂

LikeLike