The fat loss challenge..

I earlier used to workout with a fitness community in Chennai. Every year in January, they had an interesting challenge called “Fat Loss Challenge”.

Basically, everyone who registers for it, is given a 9 point checklist which you will have to answer and adhere to everyday. The checklist takes care of your diet (are you having enough starch, vegetables, proteins, avoid sugar, avoid wheat, avoid junk etc), exercise (45 minutes everyday), and sleep (more than 7 hours). Based on your answers, you are given a score. This goes on for around 2 months post which your results are measured.

While the program was the same for everyone, the results were not. Few had phenomenal results and lost weight like crazy, most had decent weight loss and some saw hardly any change as they couldn’t adhere to the plan.

Now the interesting part is this – none of us were surprised by the results!

The expectations were realistic right from the beginning, as all of us knew that adhering 100% to the plan each and every day is going to be difficult.

Different people found different things challenging. For some it was adhering to 7 hours sleep. For some it was avoiding sugar and so on.

So most of us, ended up having different levels of adherence and scores, based on our own personal constraints and preferences. All of us intuitively understood that, while the plan was great, to stick to the plan was where the actual challenge would be.

The not-so-easy part of making great returns..

Let us now come back to our world of investing. Returns whenever they come, receive insane marketing and media coverage. We go “wow” on seeing the mind blowing historical performance and immediately buy the fund. We expect the same returns to continue.

Yet, strangely once we buy a fund, we don’t seem to get similar results.

If a fitness program promises fat loss, we understand it’s not going to be easy. But when it comes to higher returns somehow we think once we buy the fund, the returns are a given.

Now here is where the challenge really lies.

When it comes to investing, the “not so easy” part of getting good returns is unfortunately also “not so obvious”.

We use a sophisticated jargon to represent the “not so easy” part – RISK.

You clearly see and understand RETURNS. You easily get it.

But this RISK..

It’s too vague. What and where the heck is it?

Me and my industry need to take the blame as we were talking a language which you obviously didn’t relate to.

So, how do we make sure all of us truly understand the “not so easy” part (read as risk) so that the return expectations are realistic?

Thankfully for us, a US firm called Riskalyze has developed an awesome yet simple solution. I will use their concept as an inspiration and explain my Indian customized version.

Great expectations…

Everything starts with this – a huge expectation mismatch between the investor and the nature of product returns.

Whenever someone asks the most logical question –

“What will be my expected returns in equity”

Around 14-15% goes the immediate answer.

But here is the shocker.

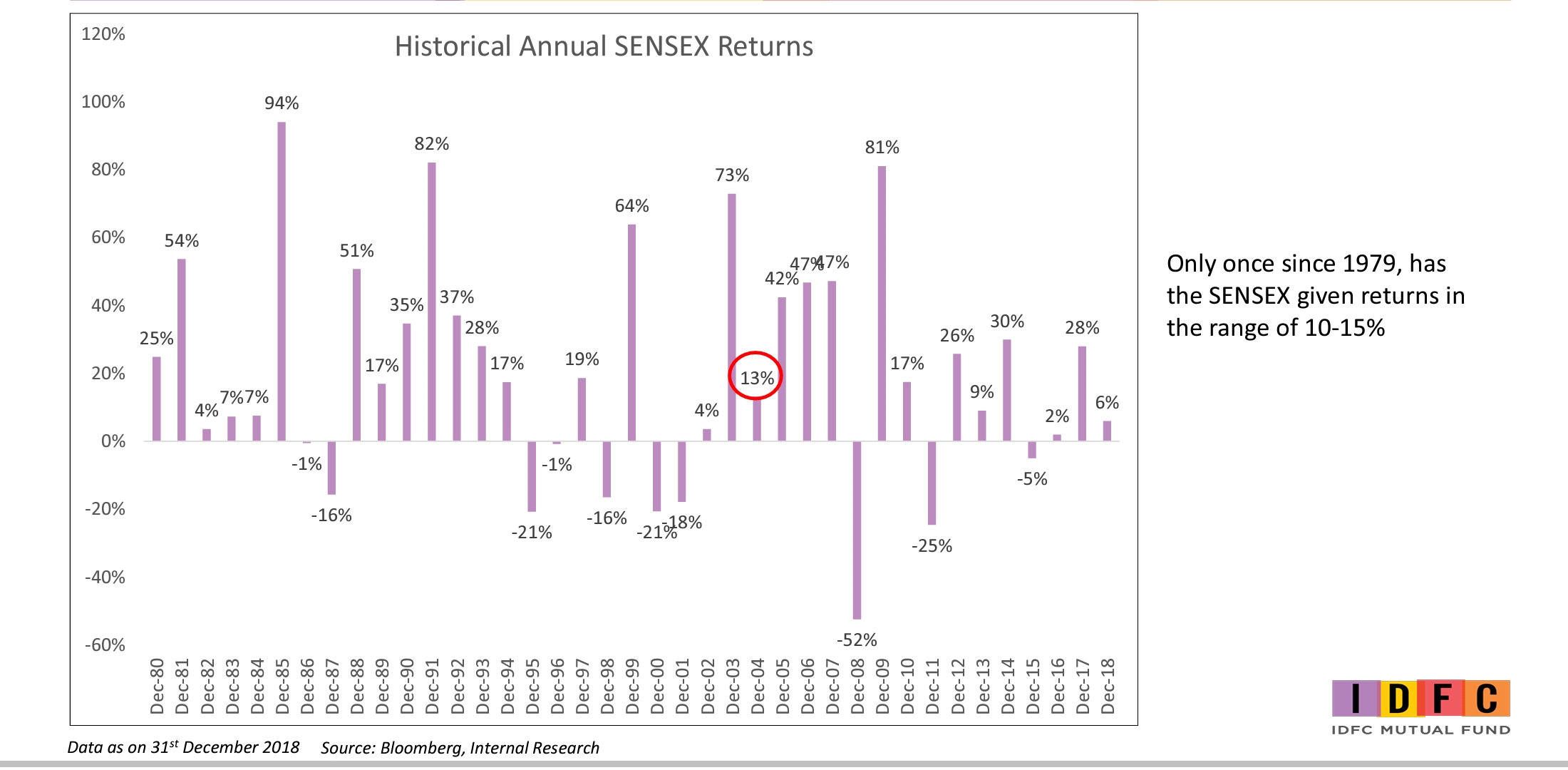

Sensex in the last 38 years, has not ended a single year between 14-15%!

The correct answer is “I don’t know”.

But a more empathetic and helpful answer would be “I don’t know. In the short run it is impossible to predict returns and no one has ever been able to do it till date. That said, if we’re thinking long term, equities will work out and going by history can give you decent returns in the range of 13-15%”

That’s great. You jump into equities. It’s six months and the portfolio is down 10%. You are furious. Where is your 15%+ returns?

While everyone asks you to focus on the long run, if your portfolio is down 10% in 6 months, you are obviously mighty pissed.

Why in the world would you hang on for the next 10 years?

So the harsh reality is that,

the long run is inevitably made of several short runs.

While long term is where we want to focus on, psychologically, we are investing for a large number of much shorter time periods.

If you are not able to manage the short run then the long run is a useless target.

And the short term decisions we make along the way will have a profound long term impact.

Takeaway: All long-term investors are made, one short term decision at a time.

This means, we have to make ourselves comfortable with short term first!

How do we do this?

Solving for long term via short term..

1.What would be the ideal short term period in which investors usually evaluate their portfolios.

My sense was it should be 1 year. But Riskalyze from its research has figured out that one year is just too long for a normal investor to “hang in there” if they are in the middle of a falling markets and worried about further losses. At the same time, a 3 month period is too short.

6 months was the sweet spot!

Now that we have decided to handle long term via a series of 6 months,

A 10 year long time horizon, suddenly becomes 20 short term – 6 month periods instead!

2.How much fall are we willing to put up with in a 6 month time frame beyond which we might find it extremely difficult to stay with

the plan?

It is better to use actual values instead of percentages. Think about it – the same 50% fall on a Rs 10 lakh portfolio feels a lot more different in a Rs 1 cr portfolio.

So for a 1 cr portfolio, you may think you can withstand upto Rs 20 lakhs decline or up to 20% in the short run.

Any fall more than this, you might find it extremely difficult to hang on and might be emotionally driven to sell off .

In technical terms this is called your “risk tolerance” (the level of decline which you are willing to tolerate for a chance at higher returns)

Now that we have defined your ability to handle declines (or risk tolerance) in plain English, we have to check if your portfolios are aligned to your risk expectation.

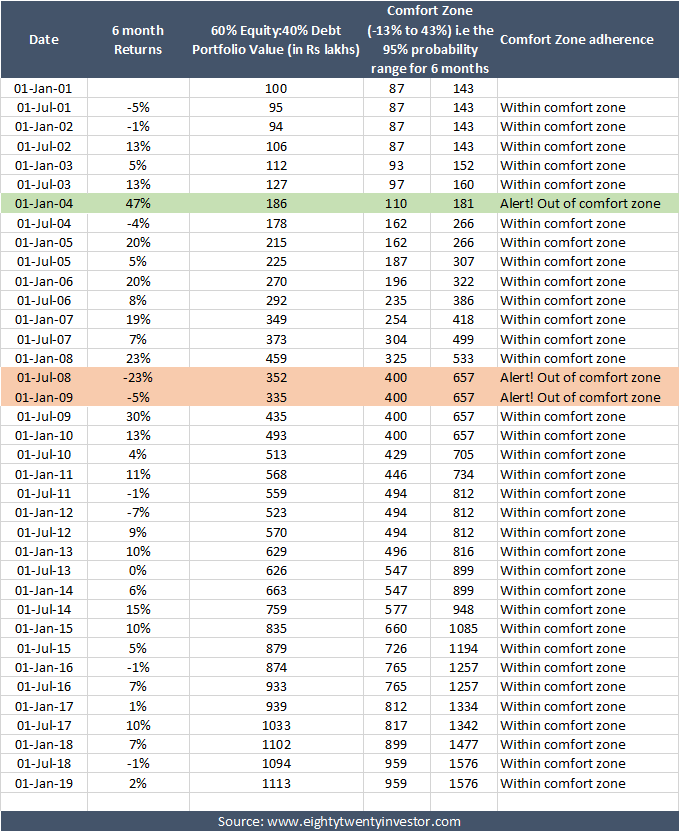

To do this, I have provided the representative 6 month outcome range (with 95% probability) for different asset allocation between equity and debt.

The workings have been calculated for the last 18 years with a large cap fund (Franklin India Bluechip Fund) representing equity allocation and a short term fund (IDFC Bond Fund – Short Term Plan) representing debt allocation.

The table above captures the 6 month range of returns which occurred 95% of the times. So you can read the table as, over the next 6 months, there is a 95% probability that the returns from a 70% Equity + 30% Debt portfolio will be between -17% to 30%. This range describes the “comfort zone” for the particular asset allocation.

In other words, if the investor chooses this asset allocation, he should be ok with the portfolio returns being anywhere between -17% to 30% over the next six months. This volatility is not a bug but a feature!

So based on the above comfort zones, you can align your asset allocation to your risk tolerance.

Conversations on risk..

Now armed with this new frame of viewing risk vs returns, let us see how our investing approach changes via an imaginary conversation.

Raj: Hi Arun, I have Rs 1 crore to invest and I guess I wouldn’t be needing it, at least for another 10 years. I am looking for high returns and want to go with a 100% equity portfolio. What kind of a performance can I expect?

(with great difficulty I resist the temptation to anchor to the sacred 15% returns 🙂 )

Me: Great! As you know, higher returns always come with the caveat that we need to pay the corresponding cost via higher short term ups and downs. Just to make sure your portfolio is aligned to your risk expectations, what is the maximum amount of fall that you would be willing to tolerate in 6 months ?

Raj: Fair enough, I understand that my portfolio will go up and down often. But I guess a maximum of Rs 15 lakhs loss (i.e 15% of portfolio) is what I will be ok with in the next 6 months. Anything more than that, I am not sure if I am upto it..

Me: Sure. I completely get it. But I guess there is a slight mismatch in your risk expectation vs the risk present in a 100% equity portfolio.

If we go for a 100% equity portfolio, your portfolio’s short term returns i.e 6 month returns for 95% of the times has ranged anywhere between a Rs 26 lakhs loss to Rs 52 lakhs profit.

Now to be brutally honest, I nor anyone has a clue on where exactly in this range your next 6 month return would be.

But if your portfolio is down say 25% or up 40% in the next 6 months, this is something which I would consider as the normal behavior to be expected from this portfolio. As long as it is within the range, you should be ok with it. This is the risk that we are signing up for, knowing well in advance.

Here is the best part – it is completely under your control whether you want to take this level of risk or not.

You had indicated that you are not comfortable having a short term decline of anything more than Rs 15 lakhs in the near term which unfortunately is a part of the normal behavior of the 100% equity portfolio.

A 60% Equity + 40% Debt is more in line with your risk expectations where the 6 month – 95% probability range of outcomes is between -13% to +33%.

This also means, we need to lower our longer term returns expectation from the earlier 13-14% for a 100% equity portfolio, to around 10-11% for a 60 Equity:40 Debt portfolio. (conservative assumption of 13-14% in equity and 7% in debt)

As you can see, there is an obvious trade off between the amount of risk and return we can expect. While there is nothing wrong with both the portfolios, as with everything else in life, we need to choose our tradeoff. If you need higher returns then you must take higher risks (read as short term pain) and vice versa.

Raj: Oh! I never thought about it this way. I thought a 15% return was easy to get in equities. So you are saying I must be ok with the possibility of a Rs Rs 26 lakh decline to a Rs 52 lakh gain in any 6 month period.

Phew! I really think Rs 26 lakhs is a significant amount for me. I don’t really think I am up for it. Let us go with your suggested 60% Equity:40% Debt portfolio. I shall compromise on my return expectations.

(How I wish this was a real life conversation. I would have fainted right away in happiness)

Me: So just to make sure we are in the same page, in the 60% Equity:40% Debt portfolio your near term 6 month outcome range is anywhere between loss of Rs 13 lakhs to gain of Rs 33 lakhs.

We shall be reviewing your portfolio in 6 month blocks and most of the times we would expect your portfolio returns to fall in this range. This is the expected normal behavior and exactly what we have signed up for. As long as your returns are in this range, we will show a thumbs up to each other and agree that the portfolio is on track.

Assuming ten years is your holding period, we have 20 six month blocks to be reviewed.

But, let me also honestly tell you that this outcome range covers only for 95% of the scenarios which I can quantify for you. As you know, there is about 5% of the risk that I can’t quantify for you, the outlier ‘black swan’ type events we saw in 2008 are a good example.

These are not events, which may or may not happen. These black swan events will definitely happen sometime in the future but are very rare.

To give you a sense of what to expect during those crisis scenarios let us check how the portfolio would have done during 2008.

In 2008, the 60% Equity:40% Debt portfolio was down by around 24% or Rs 24 lakhs which is a lot higher than your comfort zone of 15 lakhs or 15%. But a 100% equity portfolio was much worse. It was down by almost 48%!

Since these are rare events, I don’t want to build your portfolio for outlier scenarios as they make it a lot more conservative than required. That being said we shall try to address such crisis scenarios to a certain extent by adjusting your asset allocation.

Raj: Fair enough. I think this is a sensible plan which I understand. So every 6 months we shall check the portfolio, and as long as I am within the +33% to -13% range I would be fine. In the long run, as I get to have 20 shots at these 6 month returns, eventually my returns should get closer to the long range returns.

And yes, as you told, there would be those rare crisis times when the declines might be even more than our expected range. Fair enough.

Me: Also let me show you how, your portfolio would have stuck to our bands in the last 18 year period.

As you see, except for the 2008 crash, it has never declined more than our comfort zone of -13%.

Raj: Wow! This makes it pretty clear for me.

Me: There will obviously be several distractions say market events like budget, elections, some global event, oil price moving up or down blah blah. The key for us is to ignore the news and focus if our returns are still within our agreed comfort zone. As long as it is behaving as expected, we are good to go.

Raj: Sure. I am good to go!

Me: Once we have this part figured out, the other normal nuances of

asset allocation adjustment, comparing performance with peer group, benchmark, evaluating fund choice, what-if-things-go-wrong plan etc will be taken care by me.

Raj: Thanks a ton! This makes it clear for me.

Summing it up..

While this is obviously a hypothetical conversation, I believe this is a great way in which we can start to have conversations on the risk vs return trade off.

Here is the next step:

Figure out your 6 month comfort zone and check if your current portfolio is aligned to this.

Do take the help of your advisor or write to me at rarun86@gmail.com if you are finding any difficulty.

Let us together, nail the long term investing challenge, one short term decision at a time!

This approach is relatively new to me and I am still exploring the various angles to this. Hence it would be great if you could share your thoughts on this. Do you think this approach makes sense?

I hope to write more on this as I believe understanding risk and aligning portfolios to our risk tolerance is a crucial step to becoming a successful long term investor.

Happy investing as always!

If you loved this post, do share it with your friends and don’t forget to subscribe to the blog via Email (1 article per week) or Twitter along with the 6000+ awesome people. Look out for some fresh, super interesting investment insights delivered straight to your inbox.

You can also check out my other articles here

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

Arun, this method is applicable for investments made in bulk. What is the time period I should look at for a review in case of SIPs.

LikeLike

Great question. Actually we need to look at the ongoing SIP in two parts. 1) Your accumulated amount 2) next 6 month SIP. You can apply the above table to the accumulated amount and calculate the 6 month range. For the SIP over six months we will have to calculate based on a different range. I will do a seperate post on it. But for now, the rough range is for a 10k SIP expect the range to be 50k to 75k at the end of 6 months. You need to add this to the previous accumulated amount range to get your next 6 month range. Not sure if I have explained it well. It’s not as complicated as it sounds.

LikeLiked by 1 person

A loss is a loss, is a loss, period. And conversely a profit is a profit, a profit, period.

However, understanding the basic dynamics of market behaviour and tuning and preparing our temperament and psychological frame of mind is definitely a better way to “handle” the situation and avoid any panic behaviour and decision. Comfort zone could be different for different persons and therefore it is very important to find our comfort zone and then take a decision.

LikeLike

Fantastic article. Pretty sensible and useful. It would be great if following doubts are answered.

1. For 6 month time frame what is the rolling frequency ? I.e. returns are rolled on the daily bases? Or Monthly? Looking at the table it seems Monthly.

2. In case I have pretty long investment horizon e.g. 10 to 15 years. In this case I would be definitely buying midcaps or small cap. So how to consider it’s effect on the equity portfolio returns? As here we considered large Cap returns.

3. How to understand our own risk tolerance. As most of the time when markets are moving down the behaviour changes. Our risk tolerance reduces.

4. Suppose I review my portfolio after 6 months and my 1 cr portfolio becomes 1.3 cr then now for the next review My allowable risk tolerance becomes 1.13cr i.e. loss of 17 Lakhs. So again I need to increase my risk tolerance by say 2 lakhs (from 15 and agreed 13). Is it right interpretation?

5. You have highlighted some green and red zones. What we should do in these zones?

I am really thankful to you for giving this wonderful insights.

LikeLike

Thanks Parth!

1) I have used a daily rolling return

2) I will publish the risk probabilities for mid and small caps seperately in the future.

3) Great question. Please wait for the next week’s post 🙂

4)This is correct

5) Ideal points where you can might want to get a check on valuations and correspondingly either go underweight or overweight on equities. This week’s post will address this too.

Hope it helps!

LikeLike

Hi Arun,

Nice article. Just want one clarity. Basis our comfort zone, we can start with a Equity:Debt mix of 60:40 but this mix will keep on changing constantly. So, in the above table of 10 year returns, what is the mix of debt & equity at the end of every 6 months ? If its not the same, then we are exposed to more risk as our equity component grows. At the same time due to tax reasons, I cannot rebalance my portfolio frequently.

LikeLike

You can keep some tolerance band say +-5% or +-10%. So whenever your equity allocation deviates from intended allocation by say 10% (or whatever you have decided on) then you can rebalance.

LikeLike

True Gem of a post Arun, Congrats for this.

While reading your post, i was also thinking that may be the Equity-Debt Mix can be played based on the investor age. What i mean is that someone in his 30s could be okay with 80:20 Equity:Debt ration, but as he progress to retirement age lets say 55, he should than switch it it 20:80 (Equity:Debt), so he doesn’t loose his corpus at the time of his goal maturity.

Secondly, It would be phenomenal if you could put numbers in a jar for Midcap or SmallCap as well, it would be interesting to understand how this strategy fits in that case. Reason being, lot of your avid readers are in their 20’s and 30’s, so their risk taking capacity is more at this point of time, hence SmallCap/MidCap heavy.

LikeLike

Thanks for the kind words Puneet. As you reach the last 5-7 years before your goal or retirement it makes sense to reduce the equity allocation. Thanks for the suggestion, I shall include the table for small and midcaps as well 🙂

LikeLike

I liked this as well as previous post. The model gives an interesting way to incorporate risk in managing the portfolio. However, I have to fully comprehend to see how I can apply it to myself. It assumes large corpus to begin with, which may not always be the case. Many investors (including you) are on SIP (or STP from debt).

What would your strategy be for an individual who is in portfolio building phase – accumulating equity as compared to debt? Should there be some difference in strategy if the index has been in high PE range (like now, for long)?

Routing more money (surplus) in equity at this high PE, may not get 12% return (GDP + inflation) for investments (goals more than 10 years away). How should one approach this scenario?

LikeLike

When you are young and the corpus is getting built via monthly investments, the contribution of next year savings is much more than the contribution of returns from the portfolio. Also your future savings potential or human capital makes the current portfolio really small in comparison. So my usual advice is to not get into complications like tactical asset allocation based on valuations etc till your portfolio size reaches a certain size say 5 times your annual expense. If you still want to do it, then you need to have a framework based on either valuations or momentum. Or you can pick one of the dynamic asset allocation funds and move between pure equity and dynamic asset allocation based on your market call. There is unfortunately no one right answer and this plan has to be built based on your goals, preferences and constraints.

LikeLike

Hey, Arun. Great article as always. Can you write an article about your opinion on index funds, at least large cap index funds like N50 or NN50? I’m sorry if you wrote it earlier and I missed it. Thanks, again!

LikeLike

Large cap index funds will become tough competitors to large cap funds. Unless large cap funds reduce their expense ratio they will find it difficult to beat index funds.

LikeLike

Hi Arun, though I am writing for the first time, I eagerly look forward to your Posts. I am in deployment stage myself (got significant sum last year through sale of property) and have so far deployed 50% of the corpus. Deployment is one of those stages when you want markets to fall & fall significantly. Psychology at work 🙂 The single reason for slow allocation is my discomfort with valuations. I am happy you are going to address valuations soon.

Your Posts are eagerly awaited and almost always puts me in thinking mode. Thank you for the value addition!

LikeLike

Thank you so much for your kind words Sachin. Glad to be of some help!

LikeLike

Hi Arun,

Excellent thoughts cherish reading your articles. I would like to understand what happens to the risk tolerance when the asset class within equity changes also when there is lumpsum investment done at the middle of the 10 Yr cycle.

Also in the case of dividends in equity when the same is reinvested there is a need to rebalance by buying more debt to maintain the ratio.

Thanks

LikeLike

Thank yyou for sharing

LikeLike