In our last post here, we had explored a new intuitive framework to help us understand our risk tolerance and how to adjust our asset allocation based on the risk which we can take. The overall idea was to get a realistic sense of what is the downside which we are willing to tolerate in the short term to get decent long term returns.

With expectations being more realistic, there is a better chance that we stick to our portfolios during both ups and downs and hence enjoy better outcomes over the long run.

For almost a month, I have been a little obsessed with this framework and it’s immense scope to improve our investing behavior. A lot of readers have mailed me on how useful it is and also some amazing questions and suggestions on how to improve it further. I will be writing about the new revamped framework in the coming weeks. Thanks to all you wonderful folks.

However once we cling on to an idea, there is always the risk of confirmation bias. I suddenly keep looking out for views which confirm to this idea. So to break this bias of mine and check if this framework will really help us handle declines better, let me try and argue from the other side.

Why this new framework of quantifying risk using a 6 month returns range (with 95% probability) still has some unaddressed issues?

For finding this out, let me take myself as an example.

Given the relatively small size of my current portfolio compared to my future earnings potential (read as human capital) and also my age, I have a very high risk tolerance and hence a 100% equity portfolio.

For the purpose of illustration, let us assume I have a portfolio of Rs 50 lakhs. I am ok to see a loss of up to 30% or Rs 15 lakhs in my portfolio for the next six months. Not that I would like it, but given the attempt at maximizing long term returns, this is an emotional cost I am willing to pay.

With this as the backdrop, let us check out my thought process if a real decline were to happen.

Eavesdropping my brain in an imaginary market decline..

Post the recent attacks across the India-Pakistan border, there is significant uncertainty over the relationship between two countries.

Hypothetically let us assume, both countries decide to go for war (honestly if this happens, we have far more things to worry than our portfolio and I really wish nothing like this happens).

How would we handle our portfolios?

While I have told you that I would be comfortable with a downside of up to 30% or Rs 15 lakhs in the next 6 months, suddenly when an event such as this happens, my narrative starts to change.

“Hey these are not normal events. This is a serious problem. The equity markets will definitely get hit. Why should I wait till a 30% fall. Rather I will take out the money from equities now and enter later”

Oops! This is our Framework-meets-reality moment!

Let us assume, my advisor puts sense into me and says “Hey, it is impossible to predict markets in the short run. I know it is tough to be calm during these periods. But you had agreed that you were ok with upto 30% or Rs 15 lakh decline in a 6 month period. These are precisely those sort of periods which test you. Kindly hang on.”

I listen to him.

But unfortunately as I had predicted the market has started to fall. It is already down -4%.

A week has passed. The markets are further down to -9%.

Me: “WTF! If only I had listened to myself. I would have saved Rs 4.5 lakhs. That’s like almost the cost of a car.”

My Advisor: “While things are definitely not easy and I completely get it. We are still within your chosen comfort zone. This level of risk was agreed upon as the normal behavior to expect from the portfolio. Our plan is on track and if we stay with our plan, we should be fine in the long run”

Me: “Your advice has already cost me Rs 4.5 lakhs in just 2 weeks! I still think we need to pull out money as this war is going to have a significant impact on the economy and the markets”

My Advisor: “It is impossible to predict the short run. This uncertainty of not knowing what will happen, is precisely the emotional cost that we have to pay this equity asset class for long term returns. I think we should continue to stick to our plan”

Me: “Ok..Whatever”.

I feel like he is a broken tape with the same in the long run it will all be fine bu** sh**.

So I finally decide to do nothing and stick to the plan.

As my bad luck would have it, I am down again to -15% in the next two weeks. That is like a whopping Rs 7.5 lakhs in 4 weeks.

Enough is Enough. I am pulling out my money.

It proved to be a great foresight. The portfolio was down to -20% in the next week. Phew, I have saved atleast Rs 2.5 lakhs.

But wait. The market has suddenly gained 10% in the next week. Should I get back in or wait?

It has again gone up and now its just 5% below the levels at which it started to decline. There is unconfirmed news that due to international intervention both the countries have agreed to stop the war.

Oops! Let me get back in immediately.

But early morning, Pakistan troops have again raided one more village near the border. The war is not yet over. The markets start to crash again.

Now what do I do?

This is exactly how even a good portfolio invested after clearly knowing our risk tolerance can still go for a toss.

It all boils down to this single question.

Do you believe you can predict the market movement over the short run?

Each and every decline has a new reason. Sometimes its oil, sometimes its sub prime crisis in US, sometimes its the currency, sometime its the dotcom bubble, sometimes it’s a war etc.

To predict the markets, you will need to be an expert in almost everything which can go wrong in the world. You need to have a view on how exactly things will pan out.

Add to it, if you move out of equities you also need to get back.

When do you get back?

This means you will not only need to be an expert in almost everything which can go wrong in the world, but also an expert on how and when these problems will get solved.

And if you thought that’s about it, hang on. You have to go one step further and also predict how millions of investors will perceive and react to these!

This means, when markets start falling due to some event, it is impossible to know if the event and the fall is a regular one or the rare black swan types. For each and every event, there are several possibilities on how it could have played out. Unfortunately when we look at it in retrospect, it is just one version of history that we get to witness.

In hindsight, we are able to weave a nice narrative on the cause and effect for the market move and hence start to think that future market moves are predictable.

If you really think about it, this belief that we or someone can predict the markets is where the actual problem is.

My own prediction debacles..

I am no saint. To be honest, just like all of us I too started out with the notion that I will be able to interpret the events and predict the markets.

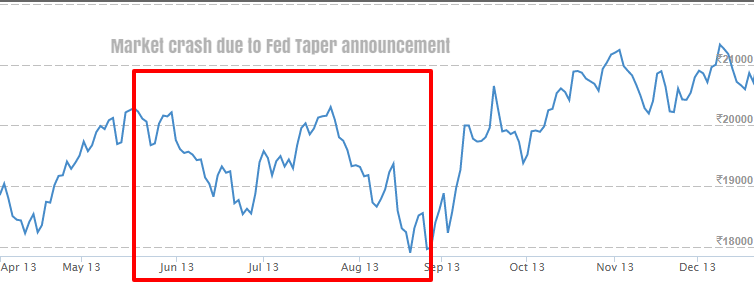

In 2013, around May the US Fed had announced that they were planning to gradually reverse their quantitative easing programme (read as no more money printing).

The Indian equity market was down by 10% and the Indian currency had moved from 53 to 66 levels! India was classified as one among the FRAGILE FIVE.

It was the “sh**-hit-the-ceiling moment” for me.

I poured over various brokerage reports and got a clear sense of the issue and how it will play out (or that’s exactly what the overconfident me thought)

I predicted that the markets will obviously fall more and exited a part of my equity allocation with the plan to get back. You know what happened next.

The markets recovered!

By the time I entered back all my stocks were above my selling price

I was almost about to make the mistake again during demonetization. Given my earlier 2013 experience I thankfully stuck on for sometime. But if you really think about it – the whole thing was unprecedented.

Most of the articles and reports really scared the daylights out of me. Every part of my brain was shouting, “Markets will go down! Sell first. We can think later”.

Now to be fair to the reports, what played out was possibly one among the many equally possible outcomes. The reports, most of them did have a logical case and could have easily turned out the way they predicted.

To predict or not?

The key learning was this – the world is extremely complex. To make sense of each and every possible crisis situation and predict how millions of investors will interpret that is beyond my level.

So, I personally belong to the camp that

“To predict what will happen to the markets in the short run consistently is almost impossible.”

Till date unfortunately, while there a few who got it right once or twice there has been no evidence of someone who has done it consistently.

If you don’t trust me check out how our Indian fund managers fared in their prediction of 2008. Link

Its not just the Indian fund managers, even the global investing giants too haven’t been too successful in this endeavor. Link

Now before the next fall occurs, you need to clearly decide on your stance as far as predicting market is concerned. This will be the key determinant to how we actually handle the next fall.

The worst time to figure this out is when the market fall actually happens. We need to do it now, when we can think clearly and without any pressure.

If you think you can predict the world and the markets, then this whole risk tolerance framework where you will have to put up with some decline is of no use to you. You can rather easily move out before the crash and get in before the rise.

But if you are convinced that predictions are too difficult, now suddenly our risk tolerance framework (i.e the 6 month range of returns) starts to make a lot of sense.

Since you have no way to know what the market will do or which event will hit us when, the only thing under our control is to decide the degree of fall we need to tolerate for getting higher returns. It may be 10% or 20% or 30% etc. By choosing a corresponding asset allocation we can control our risks to a great extent.

This being said, the degree of risk within the asset class is also impacted by valuations. Our existing framework can be improved further by adjusting asset allocations based on valuations. While valuations won’t let you time markets precisely, they can help in improving long term returns and reducing the 6 month volatility range.

In the next post, I will discuss, how we can create our what-if-things-go-wrong plan based on valuations.

This combined with our humility that we can’t predict and our new risk tolerance framework should keep us in a much better position to handle the next fall.

Till then, happy investing as always!

If you loved this post, do share it with your friends and don’t forget to subscribe to the blog via Email (1 article per week) or Twitter along with the 6000+ awesome people. Look out for some fresh, super interesting investment insights delivered straight to your inbox.

You can also check out my other articles here

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

Hi

You are right.

Its really easy to say I am comfortable with 25% or sth decline and very difficult to see and remain inactive when the fall actually happen. This article reinforces investors that keep in mind that markets will fall and stay cool.

Looking forward to your next article on “what-if-things-go-wrong plan based on valuations.”

LikeLike

NICELY WRITTEN

LikeLike

Great post. I was pretty sanguine about the recent fall, the demo and whatever has happened over the last few years and have only added positions but the very thought of a 2008 fall or a 1929 kind of fall really scares the living daylights out of me.

LikeLike

Thanks. Unfortunately we will never know which 10-20% decline will get converted into a 2008 kind of a fall. That’s where the need to have a pre built plan is critical.

LikeLike

Useful Article Arun.

LikeLike

Thanks!

LikeLike