The best part about having frameworks is that it allows you to go back and check if it really worked and based on the feedback you can evolve and improve it.

A few years back I had shared my debt fund evaluation framework here:

- Credit funds – Don’t count your returns before they hatch (Link)

- Here’s why I don’t invest in credit funds (Link)

The gist was that

- I will avoid credit risk

- I will avoid duration risk

- I will stick to liquid/Ultra Short Term/Short Term funds with low duration risk and highest credit quality

- Attempt at higher returns would be taken via equities while debt will remain primarily for safety

While it has been turbulent times for several debt funds in the recent months, the framework has avoided us a lot headache.

Why did I avoid credit risk?

Now if you think I am a genius and had foreseen all this credit downgrade/default fiasco a long time back, sorry to disappoint you. I honestly had no clue that the scenario would get this bad.

All I knew was at some point in time, credit risk will and should play out. Otherwise credit funds with higher returns will become the equivalent of a free lunch.

My simple logical rationale at that point in time was :

1.The excess returns from credit funds were mostly eaten away by the higher expense ratios

This still holds true. Let us take the example of ICICI Credit Risk Fund vs ICICI Prudential Short Term

For Apr-19,

ICICI Prudential Short Term Net YTM (Direct Plan) = 8.58 – 0.40 = 8.18

ICICI Credit Risk Fund Net YTM (Direct Plan) = 10.51-0.92= 9.59

Excess return potential in credit fund (direct option) = 1.41%

ICICI Prudential Short Term Net YTM (Regular Plan) = 8.58 – 1.15 = 7.43

ICICI Credit Risk Fund Net YTM (Regular Plan) = 10.51-1.64= 8.97

Excess return potential in credit fund (regular option) = 1.54%

So the way to interpret this is, if there are no credit downgrades or defaults, I will get ~1.5% excess returns. Once you factor in, one or two credit defaults/downgrades, the upside is not great.

2. More than the credit risk it is actually the liquidity risk (no buyers to sell it off) that is the problem

The debt market for lower rated securities is normally pretty illiquid (i.e there are no buyers readily available for large quantities). When credit events hit, it becomes even more difficult to find a buyer.

So the key problem is, when there is a credit downgrade/default, usually investors start to withdraw money from the funds. As the fund manager cannot sell his low rated papers, he sells off the more liquid higher rated papers.

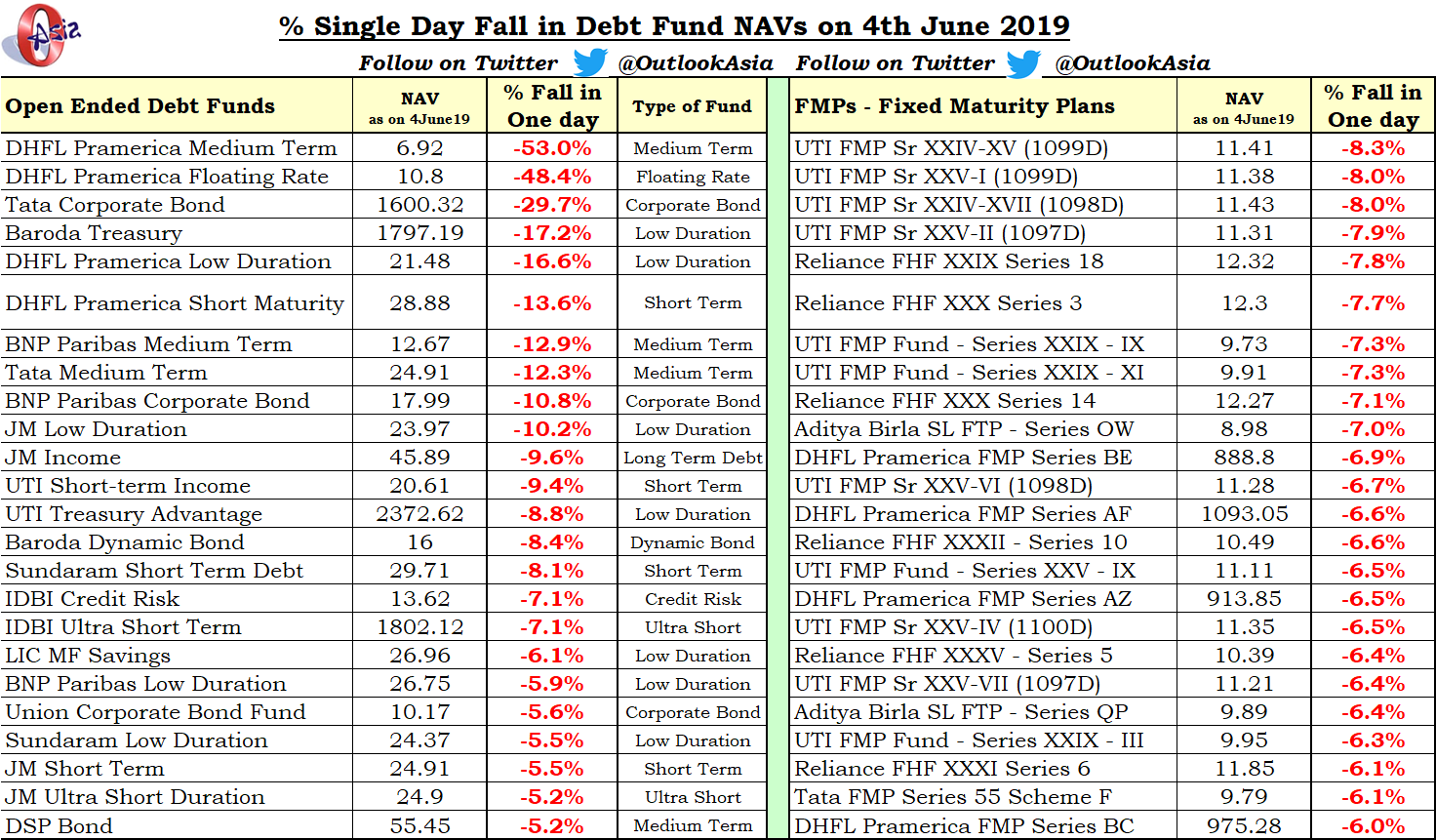

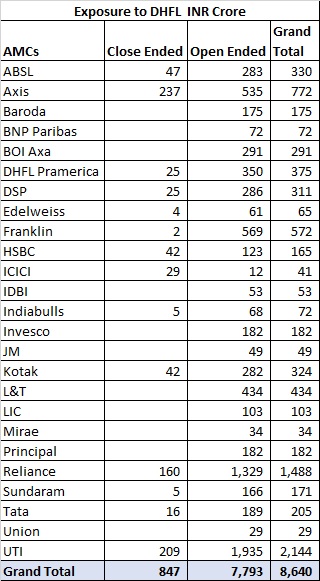

This suddenly leads to very high concentration of low rated papers. The recent sharp fall in a lot of funds when DHFL defaulted, was because of this.

Let us take the case of the debt fund – DHFL Pramerica Medium Term Fund:

DHFL security was 9% in Aug-18. Cut back to Apr-19, the holdings constituted a whopping 37%!

Why?

Due to significant withdrawal from investors, the AUM dropped from Rs 437 cr in Aug-18 to Rs 34 cr in Apr-19. Since the fund manager was not able to sell DHFL security he was forced to sell other decent securities to provide for the redemptions. And suddenly he was left with a huge portion of DHFL.

And then you know the rest of the story..

3. Concentrated portfolio increases impact of credit event

In the previous case, the concentration was a forced one due to significant withdrawal from investors. But there are also cases, where the concentration is high by design. This again is pretty risky. If there is a credit downgrade/default in one of the papers with high concentration, then the downside can wipe off few years of returns.

4. Primary intent of debt is to help in asset allocation re-balancing decisions and fund near term goals

My primary usage of debt fund is for near term needs and as a part of my asset allocation strategy (i.e changing the mix of equity and debt based on valuations).

So typically I will be needing this debt money desperately to buy equities when there is a crisis and equity markets have crashed (now whether I am able to pull it off in reality is a different issue).

The last thing I want is for my debt fund to say that “Sorry boss, we have stopped redemptions due to a liquidity crisis”. Credit funds given their inherent structure have a high probability of getting scr****d up in these scenarios.

So my simple laymanistic reasoning being – why take so much tension for debt returns. As it is equities give me enough of it, but at least the long term payoff is worth the pain

5. From an overall portfolio perspective, the incremental returns mostly go unnoticed

Also if you really think about it, most of us have credit funds as a small portion of overall portfolio. Say Debt is 50% and Equity is 50%. You may have 30% of debt portfolio as credit funds. Now this means it is 15% of overall portfolio.

So assuming you get 1.5% excess returns over short term funds, for the overall portfolio it works to 0.23% excess returns. The effort to reward for this category from an overall portfolio level is too less.

Instead you can focus on reducing the expense ratio of the overall portfolio, which is intellectually boring but easier and more effective.

So make sure you think about the credit fund contribution from an overall portfolio perspective before you make the decision.

So broadly my thesis remains and I will continue to avoid credit funds.

Still want to evaluate Credit funds?

If in case, you really want to play this category then here is how you can go about with it:

- The expense ratio is a killer – go for direct option and opt for less than 0.5% expense ratio (if available) – the lower the better

- Check the Net YTM (i.e YTM – Expense Ratio) of a credit fund versus a high quality short term fund. The excess returns should atleast be >2%. The higher the better.

- Check for concentration risk – Top 5 group exposure and Top 10 company exposure

- Prefer large AMCs which have a better track record in managing credit risks

- Avoid funds where the fund size is small and is reducing

- Closed ended structures are better structures to play credit risk, as there is no concern of immediate investor exits leading to liquidity issues and existing investors getting caught with higher concentration of bad assets

- Be a little more worried if a large % of portfolio is rated by Brickworks (anecdotal, not evidence based – you can skip this if you like)

Ok, so we are done with credit funds.

Even Short term/Ultra Short Term/Liquid funds require due diligence..

The real issue is not that credit downgrades and credit defaults happened in credit risk funds. These funds were supposed to take credit risk and the risk played out. There is nothing shocking about this.

My disappointment is that short term/Ultra Short Term funds which were supposed be really safe and simple plain vanilla FD substitute products, also had some of these credit downgrade/default incidents.

To be fair, I was earlier of the opinion that if you stuck to these categories in major fund houses you couldn’t go wrong. But the last few days, have proved me wrong and careful analysis is required even for this simple category.

So in addition to the 8 factor model that I discussed earlier here, I will be adding a few more checks.

1. Dog that didn’t bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

Sherlock Holmes solved the mystery by focussing on what was missing rather than what was present. In this case, Holmes recognised that none of the people he interviewed mentioned that the watchdog had barked on the night of the incident.

Holmes concluded if the dog did not bark, then the dog must have known the perpetrator and this led him to track down the guilty party.

Takeaway: What doesn’t happen matters as much as what does

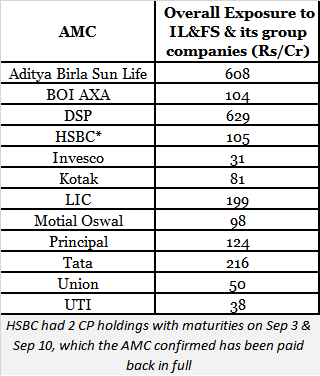

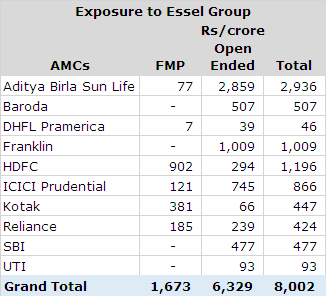

All the focus is now on the fund houses where credit downgrades and defaults have happened. But what is equally important, is the fund houses where credit downgrades and defaults have not happened.

If you noticed IDFC MF is absent in all three incidents.

Infact, IDFC MF was amongst the rare ones to actually warn on the possibility of credit problems. You can check the video below

For liquid funds, PPFAS and Quantum are the most conservative with the focus entirely on government securities and government owned companies.

We need to give higher weightages to Liquid/ULS/Short Term funds from these fund houses.

This does not mean that other fund house funds should not be considered. It simply means that if someone has stayed out of all three issues till date, it indicates a far more conservative process.

For someone like me who is not inclined to make higher returns from debt, these fund houses get higher weightage purely from this context.

If your intent is to maximize returns from debt, please ignore this entire post.

2. Concentration risk

Usually concentration makes sense, if a particular security is expected to provide a large upside. But in case of debt funds, where the interest received from different securities is in a very tight range, there is no big upside to concentrate (unlike in equities).

So we need to check for the no of securities above 5% allocation and the group level exposures exceeding 5%. I would personally prefer most of the securities to be in the <3% range.

3.Sharp fall in AUM

If the fund is seeing sudden sharp fall in AUM, usually it means investors are withdrawing their money from the fund. This warrants further investigation.

We need to get a sense of why this is happening and also immediately keep a check on the % allocation of various securities in the fund.

4.Rating Agencies

Theoretically, it shouldn’t matter from which rating agency you get your ratings. But my interactions with friends from the rating industry, indicate that ratings from Brickworks is slightly viewed with a suspicious eye.

While this is purely anecdotal, no harm in keeping a check.

Based on all the above learnings and recent events, I have evolved and improved my checklist for debt funds

New 10 factor framework to evaluate debt funds

- Net YTM = Yield to Maturity – Expense Ratio

- Credit Quality: % of government, AAA and AA rated bonds

- Modified Duration

- Average Maturity

- Size – Higher the better + check for sharp fall

- Exit Load

- Historical NAV movement graph

- Past Returns

- Concentration Risk – check for no of securities above 5% allocation and group exposure above 5%

- AMC Reputation and Track Record

Next week we shall apply this framework to a few funds and understand it better.

If you don’t want to miss out on the latest articles, do subscribe to the blog here (takes less than a minute)

You can also follow me on twitter or mail me at rarun86@gmail.com if you need some help.

Happy investing 🙂

You can also check out my other articles here

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

Your comment on “Brickwork” came as a surprise because nobody so far has so openly commented on ‘Brickwork” like this. No judgement from my side only on your courage and possible conviction against ‘Brickwork’ which is good for all of us.

Also, surprisingly HDFC MF was absent in case of IL&FS and DHFL also. In case of ZEEL, they are present of course. Btw, ZEEL is still quoting at price of more than Rs. 350.00 and therefore not that bad as of now. ZEEL has been pioneer for much of their businesses including for Essel Propack and of course the great Indian TV and media journey of the Essel Group. They have sold Essel Propack.

LikeLike

Hi Arun…as usual a very nice read…just one clarification required..the fund house which was absent from all the credit events has high concentration of issuers & groups even though names are mostly high rated…would you be comfortable with such a portfolio as you talked about not more than 5% per issuer ?

LikeLike

Which fund Ankit?

LikeLike

IDFC schemes – short term debt, banking & psu, corporate bond fund

LikeLike

Well written article. Very timely. Thanks Arun. Waiting for your next article ( shall we say the sequel to this one) on applying your new framework to evaluate some of the existing debt funds.

LikeLike