In my last post here, I had discussed on how to choose your asset allocation.

Equity markets usually trade around their fair value range majority of the times. But there are also those phases where equity markets become insanely overvalued or unbelievably cheap.

There are two schools of thought on how to approach these extreme phases:

- 1st School of Thought:

- While it is true that markets may get insanely expensive or cheap, these phases are extremely difficult to identify except in hindsight.

- Market movement cannot be predicted – stick to original asset allocation

- 2nd School of Thought:

- Based on certain parameters the extremes of the market can be identified and asset allocation should be adjusted accordingly

- This school of thought, while definitely is more appealing, is also super difficult to pull off consistently

My approach is a blend of both.

First school of thought, will mean I won’t be taking any extreme positions. All-In or All-Out allocations from Equities will be avoided.

Second School of thought will imply I will try to do some adjustments (but nothing drastic).

Let us see how this translates into my actual framework.

There are 3 parts to it

- Regular Rebalancing

- Bear Market Plan

- Bubble Market Plan

1.Regular Rebalancing

This is a simple form of rebalancing, where each and every year when you review your portfolio, if any asset class allocation exceeds or falls short by 5% of the original intended allocation, then you bring it back to the original levels.

Let me explain with an example. Assume you have decided on 50% Equity and 50% Debt Allocation.

Now after a year, during the review, you find out that due to a market rally the equity allocation has increased to 58% and correspondingly debt allocation is now at 42%.

Since Equity allocation exceeds the original allocation by 8% (which is more than our threshold of 5%), we will shift some portion of equity to debt and bring the overall asset allocation back to 50%:50%.

This is a super simple yet very effective way to manage your risk and improve your returns over the long run. Backtests indicate roughly around 1-1.5% improvement in returns by doing this simple activity.

Research (link) also shows that returns are not meaningfully different whether a portfolio is rebalanced monthly, quarterly, or annually.

So in terms of rebalancing frequency you can either choose to do it once a year or once every 6 months (but be mindful of tax & exit load implications).

For most of us, we will also keep getting new money to be deployed at regular intervals. In that case every time you are adding new money, you can try to align it back to the original allocation and this can address taxation and exit load issues to a large extent.

2.Bear Market Plan

I will address the Bear Market Plan i.e how to adjust equity allocation during a market crash separately in the next post.

3.Bubble Market Plan

Let us start with the basics. A bubble essentially means that the equity markets have become insanely expensive. So any negative event whenever it hits can cause the markets to crash.

This line of thought argues for much lower allocation to equities than your original allocation.

That being said there are two major concerns with this approach

- A bubble market can go on for a long time (sometimes several years) and become extremely frustrating if you are completely out of the markets.

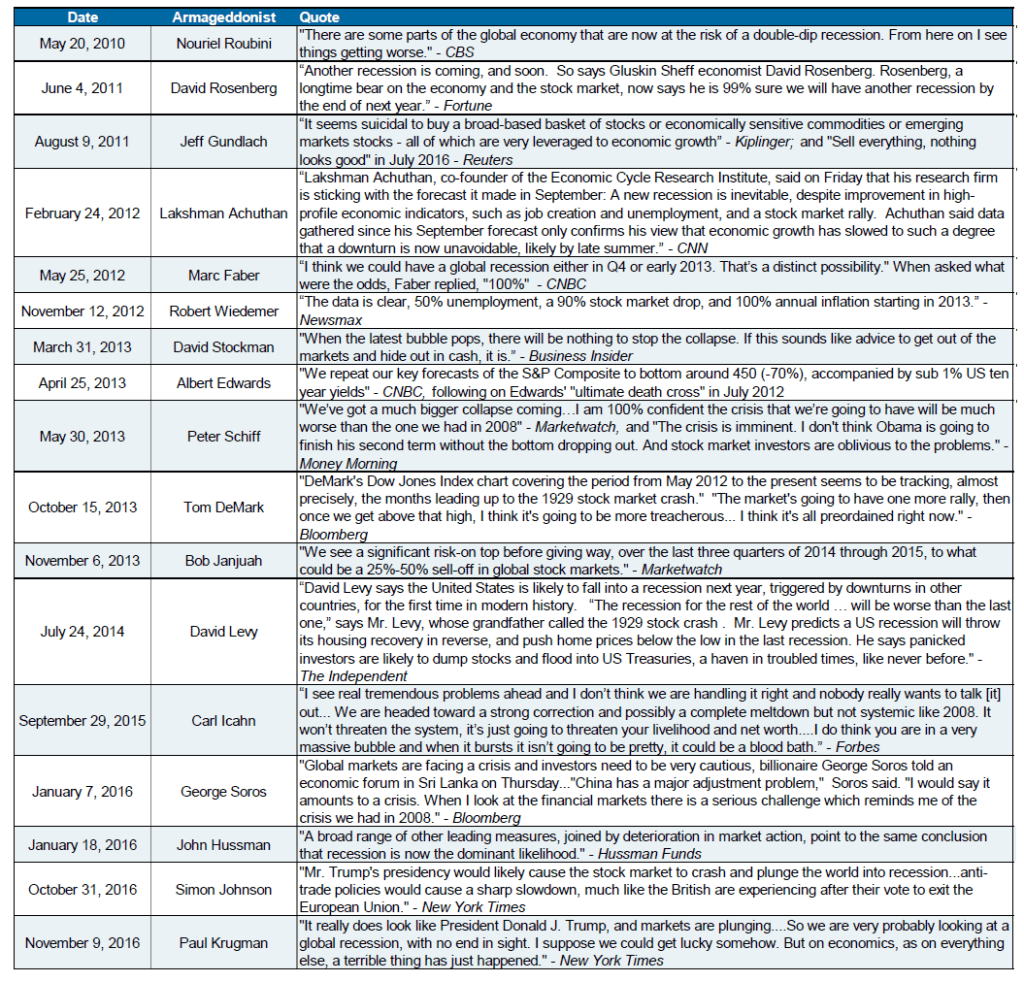

- Calling a bubble market top is super difficult – even the best have got it wrong!

Sample this…

Source: Link

and here we go again in the recent crash…

To balance both the above factors, I would suggest not reducing the equity allocation below half of your original equity allocation.

For eg if your original intended asset allocation was 50%, in case of a bubble market you can reduce it up to 25%. Say your original intended asset allocation was 70%, in case of a bubble market you can reduce it up to 35% and so on. You get the drift.

Worst case you get your call on the bubble market wrong, you have still built a humility net which is the remaining 50% of the original equity allocation.

I would suggest going underweight in two tranches:

- Trigger 1: Reduce to 75% or 3/4th of original equity allocation

- Trigger 2: Reduce to 50% or 1/2th of original equity allocation

Cool. Now comes the most important question

How do I decide on the Trigger 1 and Trigger 2?

Now before I go further, I have a honest confession. I have a fairly good and practical framework for increasing equity allocation in a bear market and have also seen it work really well both for me and my clients during the Covid crash.

But when it comes to evaluating a bubble zone, it is still work in progress and has not been tested real time (as I am yet to experience a bubble firsthand). This is mostly built from studying past market crashes both in India and other countries. So take my approach with a pinch of salt.

Now with the warnings out of the way, let us dive into the approach

Starting with the Basics

How to decide when to go underweight on equities?

If future returns from equities are going to be low – go underweight!

But how do we approximate the equity returns of the future?

For this, let us deconstruct equity returns into its components

Next 5Y Equity Returns = Change in Earnings + Change in Valuation (Price to Earnings multiple) + Dividend Yield

Dividend Yield for the Nifty 50 is usually roughly around 1-1.5%. So in essence if we get a rough sense of earnings growth and valuation change we can roughly estimate the future returns.

Approach for Valuations:

History shows us that, valuations don’t stay extremely expensive or cheap for a long time. They eventually come back close to their long term averages. So the extent of valuation deviation from long term averages, can be used as a rough proxy to identify valuation extremes.

Also instead of one indicator, I prefer using a mix of valuation indicators and see if all valuation signals point towards the same direction. If the indicators are showing, different signals, then it means we need to check for the context involved.

I will be evaluating valuations via three factors

- Price to Earnings Ratio

- Price to Book Ratio

- Market Cap to GDP Ratio

Based on the evaluation of the above 3 with respect to historical averages, you can take a stance on where the valuations are – High or Moderate or Low

Approach for Earnings Growth:

While it is impossible to exactly predict earnings growth, the idea is to find out where we are in the earnings cycle. If you look at history, the equity markets go through periods of strong earnings growth followed by weak earnings growth and again the cycle continues.

So if we can evaluate where we are in the cycle, then we can build a rough expectation around the likely earnings growth environment over the next 5 years.

For this we will be looking at several factors such as:

- Past Earnings Growth

- ROE Cycle

- Corporate Profits to GDP

- Interest Rates

- Credit Growth

- Capacity Utilization

- Other Factors – Oil Price, Government reforms etc

Based on the evaluation of the above factors with respect to history, you can take a stance on where we are in the earnings growth cycle – Bottom of Earnings Growth Cycle or Middle of Earnings Cycle or Top of Earnings Cycle

Putting them together

Once you evaluate both, here is how this translates into the decision making.

For Trigger 1 (Underweight to 75% of original equity allocation) to happen, these are the scenarios

- Scenario 1: Top of Earnings Cycle + Moderate Valuations

- Scenario 2: High Valuations + Moderate Earnings Cycle

- Scenario 3: Extremely High Valuations + Bottom of Earnings Cycle

For Trigger 2 (BIG Underweight i.e reducing to 50% of original equity allocation) to happen, 2 conditions should be satisfied

- Condition 1: Top of Earnings Cycle

- Condition 2: High Valuations

How to build a framework?

What I explained above is the underlying thought process. As a part of my firm, I track around 25 factors to take a view on the above.

Now to be honest, because I am a part of a large firm and do this as my dayjob, I have the luxury and time to build fairly elaborate frameworks.

But this can become a little overwhelming for a normal investor.

So how about doing a little jugaad and building something equally efficient?

Here is my suggestion:

For Trigger 1 (reduce to 75% of original equity allocation): Use VALUATIONS as an indicator

Consider it as High Valuations (or Trigger 1) when any 2 out of 3 conditions are satisfied

- Equity Allocation of ICICI Balanced Advantage Fund <45%

- Equity Allocation of Kotak Balanced Advantage Fund <40%

- MCAP/GDP>100%

So if any of the above two conditions are satisfied reduce equity allocation to 3/4th or 75% of the original equity allocation levels.

ICICI Balanced Advantage Fund runs an asset allocation model based on Price to Book and has worked reasonably well over the last 10 years. Check here to find out the equity allocation.

Kotak Balanced Advantage Fund’s asset allocation model is based on Price to Earnings and the good part is they also adjust it to account for depressed earnings during market crash periods. Check here to find out the equity allocation.

For MCAP/GDP you can check here

For Trigger 2 (reduce to 50% of original equity allocation): Trigger 1 + Top of Earnings Growth Cycle

Apply if two conditions are satisfied:

- Condition 1: Trigger 1 has already been triggered

- Condition 2: Top of Earnings Growth Cycle

How do we check for top of earnings growth cycle?

You can use the below three factors

- Last 5 year earnings growth

- Corporate PAT/GDP

- Nifty ROE

If all the three are close to their highs (with respect to long term history), then it implies we are close to the top of the earnings cycle.

Right now we are at the bottom of the earnings cycle. So Trigger 2 is ruled out for the time being.

How to go underweight?

Given what happened to the US markets for the last 10 years where it continued to rally despite high valuations, I am usually extremely cautious when it comes to going underweight.

So instead of going out from equities into debt for underweighting, I would suggest going underweight using Dynamic Asset Allocation funds (also called Balanced Advantage Funds).

These are funds which automatically increase and decrease equity allocation based on valuations.

So going underweight both in Trigger 1 and Trigger 2 will be via Dynamic Asset Allocation Funds.

If Trigger 1 happens, then reduce your equity allocation by 1/4 th of original allocation. This 1/4th of original allocation will be shifted to Dynamic Asset Allocation funds. Eg If your original equity allocation is 50%. Then for Trigger 1, shift 12.5% of your equity allocation into Dynamic Asset Allocation funds. The new asset allocation will look like 37.5% Equity + 12.5% Dynamic Asset Allocation Funds + 50% Debt.

Does this become too tempered?

We need to remember that our original asset allocation, has already built a layer of safety via debt funds based on our ability to tolerate declines. So this is only adding one more layer of safety and hence the need to be a lot more tempered.

Going underweight comes loaded with the second issue – how to bring back to original allocation?

Here is the rule:

2 conditions have to be satisfied to get back to the original equity allocation by shifting to pure equity funds.

- Condition 1: Kotak BAF equity allocation goes above 60%

- Condition 2: ICICI Prudential BAF goes above 65%

Since we have gone underweight using Dynamic Asset Allocation funds, worst case you panic and are not able to increase equity allocation back to original levels during a market fall, the Dynamic Asset Allocation funds will automatically increase the equity allocation. So this becomes a behavioral safety buffer that we have built.

Final Thoughts

Of course, there is nothing sacrosanct about these rules and you can evolve your own ones.

But the key idea is that we need to have clear, logical, evidence backed rules and a plan well ahead of the bubble market.

In an actual bubble market without these rules it will be extremely difficult to execute our plan as greed will set in. Most of us tend to overestimate our abilities to handle greed.

If all this seems to much to handle, absolutely no worries. Once you have decided on your original asset allocation a simple yearly rebalancing (with a 5% threshold) is a good enough solution.

So, this is how you can prepare your own plan to handle a bubble market.

If you have any feedback or thoughts you can also mail me at rarun86@gmail.com.

If you loved this post, share it with your friends and don’t forget to subscribe to the blog (1 article per week) or Twitter along with the 8000+ awesome people. Look out for some fresh, super interesting investment insights delivered straight to your inbox.

Till then, happy investing as always

You can also check out my other articles here

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

Hi Arun,

Very practical way for a common man to actually time the market in a simple yet effective manner.

Any direct way to check these things you pointed out:-

1. Last 5 year earnings growth

2. Corporate PAT/GDP

3. Nifty ROE

Thanks.

LikeLike

Thanks a lot. You can try the mutual fund monthly presentations from ICICI Prudential, Kotak, UTI etc published in their websites. They will have all the above details.

LikeLike

Thanks

LikeLike

Dear Arun,

Thanks wonderfull writing as always . I really follow most of your advises as it makes lots of sense and ligic

I have a question related to BAF link you mentioned for ICICI it says equity % as on 31st October.Is there a way to get it more updated , In extreme times in a month world and allocation changes alot .Same is the clase with Kotak BAF.

How to get the latest updates of equity level

Thanks and Regards

Rajeev Bahuguna

LikeLike

Thanks Rajeev. Kotak provides it everyday. For IPru BAF unless you have access to the fund house team, you will get it only once every month. But sometimes during drastic changes, they publish the nos in between the month also.

LikeLike

Thanks Arun

LikeLike

Dear Arun,

Thanks wonderfull writing as always . I really follow most of your advises as it makes lots of sense and ligic

I have a question related to BAF link you mentioned for ICICI it says equity % as on 31st October.Is there a way to get it more updated , In extreme times in a month world and allocation changes alot .Same is the clase with Kotak BAF.

How to get the latest updates of equity level

Thanks and Regards

Rajeev Bahuguna

LikeLike

Hi Arun,

Thanks for the detailed write-up. Indeed very sound & logical way to ‘time’ the market 🙂

Just a thought if triggers are based on equity allocation of BAFs, shouldn’t the layman investor simply invest in BAFs themselves? 🙂

LikeLike

BAF is probably one of the best products for a layman investor. This strategy is intended for experienced investors who dont want to outsource their asset allocation and want complete control over their risk exposure, asset allocation and fund choices.

LikeLike

Dear Arun,

Pls pardon me for basic doubt.

In the mentioned link for Kotak BAF in Sectoral Allocation it is showing – Equity 78.02 %, Debt 21.98 %. Where as in Asset allocation Bar it is showing Equity- 40.1 % Arbitrage 20.32 % Debt & cash 39.58 %.

So please help which one to look for our condition of equity level Equity Allocation of Kotak Balanced Advantage Fund <40%

Thanks in advance

Rajeev Bahuguna

LikeLike

40.1 is the correct no. The previous no includes arbitrage allocation.

LikeLike

Thanks for prompt response

LikeLike

I think a really very detailed analysis of handling different market phases and how to rebalance one’s asset allocation. Though a bit more complicated for a layman to assemble, analyse, track and then take a corrective action without any fear (during bear phase) and greed (during boom phase).

I think a more practical and peaceful approach would be to track the three things as given in the article :

1. PE ratio

2. PBV ratio

3. Market cap to GDP ratio.

Add to this analysis, the equity and debt allocation of any one of the two funds referred i.e. ICICI Balanced Advantage Fund or Kotak Balanced Advantage Fund (though I am not cleared by author has given the trigger at 45% in case of ICICI BAF and 40% in case of Kotak BAF ).

This should serve the purpose as many such studies conducted have also revealed that there is nothing great difference (say less than 1 or 2% – though, to be fair this difference is in CAGR) in the returns if one were to deploy a very detailed, complex and hard to maintain by a layman.

Very nice analysis indeed.

Thanks.

LikeLike

Apparently a nice way to adjust equity allocation per market timing but failed to understand why to bank on ICICI BAF when this fund (most of the time) has not given even debt return year on year in last 5 years e.g. 2.44 % return in year 2018.

LikeLike

ICICI BAF is just a proxy. You can build your own valuation model or bank on any other baf model you like. And ICICI BAF has done pretty well over long periods of time (>5 years)

LikeLike

Dear Arun,

Are you still continuing your SIP in ICICI India opportunities fund?

When can we expect next SIP review. I think it is due on December right

Value is a category which seems really contrarian category at the moment

Regards

Rajeev Bahuguna

LikeLike

Yes. Next review in Feb!

LikeLike

Its was a great article, very informative

But Don’t you think it would be wise to reduce your equity allocation as much as possible when you have predicted the negative event and you are sure the bubble is going burst and re invest it again after the market crash ?

LikeLike

Unfortunately while it would be awesome if we could predict this, it is extremely difficult to pull this off consistently. Evidence shows that even the most reputed and experienced investors have got this call wrong. So personally I am of the view that I can always be wrong in trying to identify bubbles. So I am building a humility net.

That being said if you are confident that you will be able to do both exit and entry, you can try it out. This framework has more to do with my own weakness and inability to predict markets.

LikeLike

Dear Arun,

Can you pls give a frame work to look in to selecting criteria for Balanced Advantage Fund . I feel one such Good fund is ICICI Balanced Advantage Fund.S Naren is very vocal abt this fund scheme & work style .So aleast i am aware abt the scheme.

but not able to distinguish or find any other substantial info about any other BAF/DAAF Fund. Most of the time all DAAF/BAF get painted with same brush , but as the equity portion of such funds also is quite Good . I feel it is important to have good Fund Manager etc

Kindly suggest

Thanks in advance

Rajeev Bahuguna

LikeLike

You can evaluate Kotak, Edelweiss, DSP etc

LikeLike

Thanks

As an starting point any article of yours or some one you wish me to check for

Regards

Rajeev Bahuguna

LikeLike

Deciding the suitable resource asset model for a monetary objective is a confounded undertaking. Fundamentally, you’re attempting to pick a blend of resources that has the most noteworthy likelihood of meeting your objective at a degree of hazard you can live with. As you draw nearer to meeting your objective, you’ll have the option to change the blend of resources.

LikeLike