Two days back, I had the shock of my life. My younger brother who has just started to work, has been mis-sold on a useless insurance plan in the guise of investments.

Arghhhh.

While I am stuck in my own world trying to solve for behavioral issues, asset allocation blah blah, I just realised there are far more basic problems to be solved first.

Ok. Enough of my rant.

Here is a quick question for you

If a scheme offered you this:

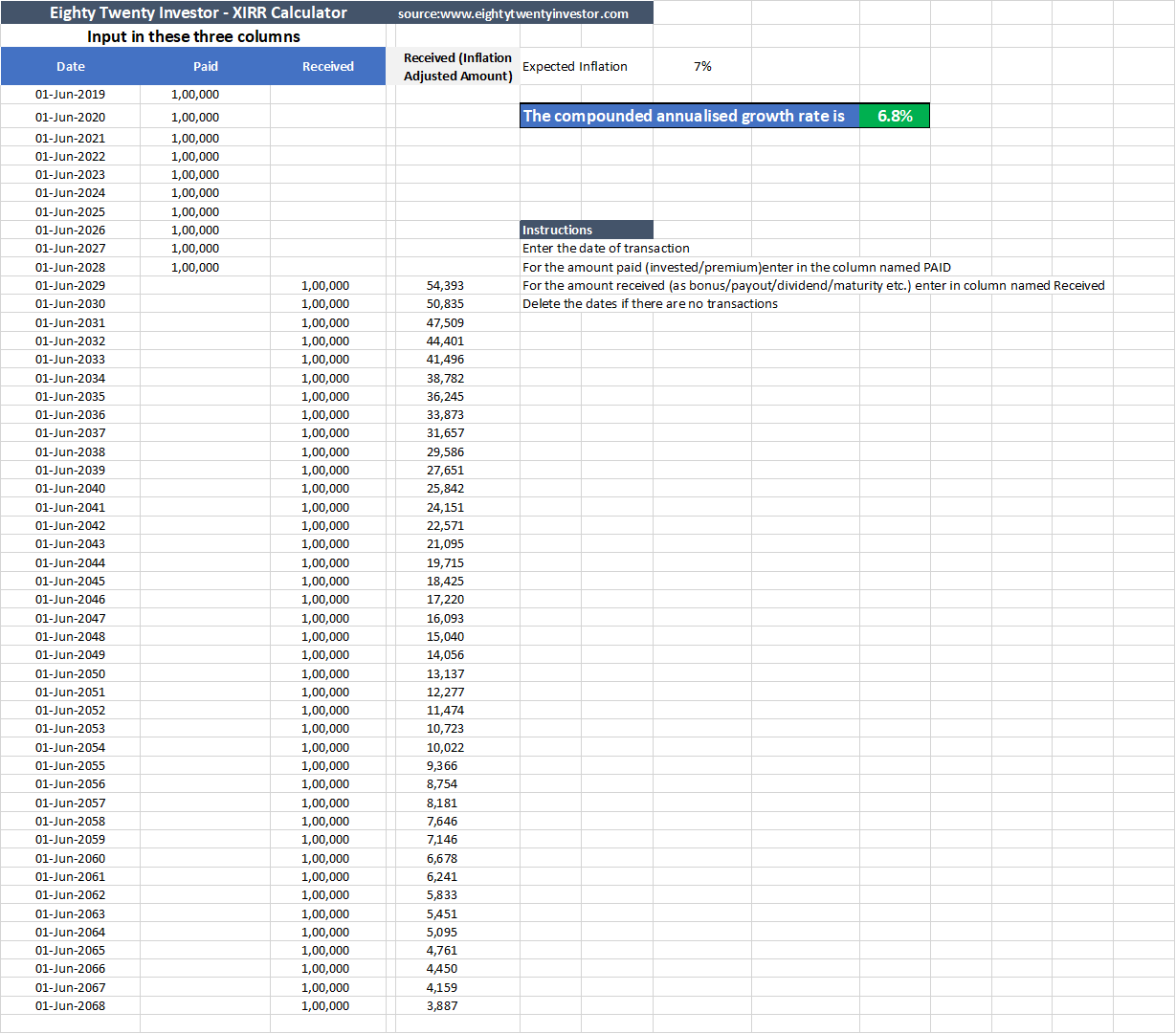

Pay any amount (say Rs 5 lakhs) once every year for the next 10 years.

From the 11th year, you will receive life long income of the same amount Rs 5 lakhs each and every year for the next 40 years!

Assume the scheme is from a very trustable and reputed company. There is no credit risk.

Will you take it?

What do you think is the return for this product?

I tested this with a lot of my friends and most of them called it a scam as no one can offer such super normal returns.

But once when I showed them the returns their enthusiasm died.

The return works out to a normal 6.8%

Now obviously this is a product that I made up (but you can find pretty close ones in the market). But it shows the difficulty of our brains in perceiving the long term impact of compounding.

Now to be honest, there was no way I could have calculated this in my mind and I would have obviously expected the returns to be higher.

This inability to comprehend the amazing effects of compounding over the long term, remains the key on which most insurance products are sold.

Most insurance products follow the same pattern

- They don’t explicitly mention the underlying returns but only the money you will get after “x” years.

- You compare the amount that is promised after “x” years to what it would mean today. Our brain conveniently forgets the impact of inflation.

- It includes a small life insurance component giving the perception of an all-in-one product. The fact that standalone term insurance is extremely cheap is forgotten.

Now it is not a problem if you understand the actual return rates. Then it is your call on how you expect the future to pan out and whether you are ok with the returns.

The issue is when you are tricked into the perception of higher returns only to end up disappointed after several years.

So we need to do two things

- Find out the underlying returns

- Find out the inflation adjusted amount so that you will have a better sense of what it can really buy after several years

For calculating both, use the excel sheet that I have provided.

Download the calculator here

Sample Screenshot:

Next time whenever you are shown any insurance related investment product, just take 2 minutes to plug in the numbers before you decide.

If you need any help, do mail me at rarun86@gmail.com

Happy Investing as always:)

If you loved this post, share it with your friends and don’t forget to subscribe to the blog via email (1 article per week) or Twitter along with the 6000+ awesome people. Look out for some fresh, super interesting investment insights delivered straight to your inbox.

Subscribe here:

You can also check out my other articles here

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

btw, inflation is not an insurance company’s problem, so let’s leave that point aside.

The moot and fundamental question is : Do insurance products offer you a reasonable rate of return. They offer you return only when you die before the end of your term. Otherwise, in all the cases, the returns are between 5.5 to 6.5% CAGR. You take any company, any product, etc.

And that’s why, it is advisable to take simple term insurance plan because you take insurance for ‘insurance’ and not for ‘investment’.

LikeLike

Very well written Arun. In fact, I had a new born in the family and my bank RM tried hard to sell me a ULIP (disguised as as Children Benefit Plan).

Needless to say, the plan benefited the bank and the RM more than it would have benefited me and my child. It’s a sad state that we are not being responsible with our money and such people take us for a ride.

Here’s a detailed account I had with the RM (https://jaintushar.com/why-not-to-buy-ulip/)

LikeLike

In the age of IL&FS and DHFL, i think 6% fares well 🙂

LikeLike

Hi Arun what about the taxation part? if this return is tax free, can some one consider it part of their debt portion?

LikeLike