Did you know that your portfolio has a fund which is not visible to the naked eye. Once you factor this fund, your entire asset allocation might be a lot different than what you thought.

Curious to discover the mystery behind the invisible fund. Read on..

The Elevator Problem

In the mid-20th century, in a multi-storied office building in New York, the tenants began complaining about the long waiting time inside the elevator. Several of the tenants threatened to break their leases and move out of the building if this issue was not sorted.

The building manager immediately brought in engineering consultants to determine the best solution. But there was a bigger problem

Because of the age of the building, no engineering solution could be justified economically!

And to make matters worse, the engineers said that the management would just have to live with the problem permanently.

The desperate manager called for a meeting with his staff which included a young recently hired psychology graduate and asked them for a solution. Everyone started giving their ideas. Unfortunately all the ideas given were focused on the engineering side, and had several issues either on the engineering front or cost.

Finally, the room went silent. The only person who had not participated in the brainstorming session was the young psychologist.

The young man had a different solution.

Unlike the engineers who saw the escalator service as too slow, he saw the problem as one deriving from the boredom of those waiting for an elevator. Rather than actually improving the speed of the elevator, he pondered on how he could change the perception of the people with regards to the speed.

So he decided that people should be distracted and given something to do while inside the lift. He suggested putting mirrors in the elevator lobbies to occupy those waiting by enabling them to look at themselves and others without appearing to do so.

The mirrors were put up and complaints stopped. In fact, some of the previously complaining tenants congratulated management on improvement of the elevator service.

Mirrors in elevator lobbies and even on elevators in tall buildings ever since have become commonplace.

Now here is the question for you..

Can we use the same line of thinking to solve for the problem of investor behavior?

Equity market declines are painful..What if we have a Psycho-Logical solution?

The fact that equity markets will see regular declines is a given. Unfortunately no one knows in advance – when these declines happen, how deep the fall is and how long it will continue. The declines are emotionally painful and most of us panic out of the markets only to be too late to enter back.

So how do we solve for this?

How do we make it easy for investors to handle the declines?

Now one way to approach this is via the products. This is the engineering approach.

Higher Debt Allocation, Tactical Equity Allocation, Diversification, Higher exposure to relatively lower volatile styles such as large caps, high quality, Closed ended funds etc

But hey, what if there was a “Psycho-Logical” solution vs the “Logical” solution. Here are two of my earlier attempts at a “Psycho-Logical” solution.

- Pre-decide on your “what if things go wrong plan” and automate the execution. You can read more about this here

- Forget your account password

I was joking. This simply means you monitor your portfolio less frequently. You can read more about this here

I have a third interesting psycho-logical solution.

The Mystery of the Invisible Fund in your Portfolio

One of the earliest mistakes that I did when I started investing, was to over complicate things.

I wanted to time the markets based on the news and events. Every time there was bad news (which meant almost everyday), I used to read each and every report on the event and listen to experts with the intent of gauging the possible impact on the market and tried to adjust my portfolio based on that.

I was hyper-focused on this intellectually stimulating exercise of predicting the markets. My portfolio was 100% in equities and I kept going in and out.

After a few years, I realized that this market timing thing is extremely difficult to do.

But the real epiphany was something else…

Since it was the beginning of my career, I didn’t realize that the amount of savings that I had at that point in time, would eventually become a minuscule portion of my existing portfolio. My savings over the next few years simply dwarfed my earlier portfolio.

That is when this unbelievably simple yet ignored reality actually hit me:

I have another 27 years of savings left. In other words I will be investing each and every month for the next 324 months. And this amount will keep increasing each and every year as my salary increases (hopefully).

So instead of viewing my current portfolio in isolation, I should rather view it holistically in the context of my future savings.

Most of you, unless and until you are near your retirement age, will have this hidden future earnings component as a large part of your portfolio.

So to get the true perspective on your portfolio, you will need to factor in your future earnings as well.

How do we do this?

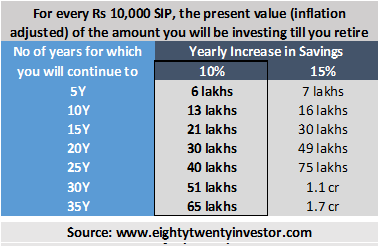

Now before you switch off, let me explain this table. It is much simpler than it looks.

Assume you are currently saving Rs 10,000 every month and plan to increase it by 10% every year (as your salary increases). Your current portfolio size is 10 lakhs.

Now if your age is 30 years and assuming you plan to work till 60 years, you have another 30 more years of savings to be invested.

This means based on the table, you will be investing roughly around Rs 2 cr over the span of the next 30 years.

Think of this as a hidden Systematic Transfer Plan from “You” to “Your Portfolio”

Now if you are investing more, say Rs 20,000 every month you can calculate the same by multiplying with 2. So instead of Rs 2 cr, you will be investing Rs 4 cr over the span of the next 30 years.

Now, if you are an investment geek, I can see the obvious question coming.

What about inflation?

Fair point. So let us adjust for inflation and rework the table. I have worked with a 7% inflation assumption.

Now here is an interesting way to frame this.

Think of your potential future savings as a liquid fund – Future Savings Liquid Fund. There is an Invisible Systematic Transfer Plan set up, which transfers money from the Future Savings Liquid Fund to your actual portfolio every month till you retire.

(For those wondering what a STP or Systematic Tranfer Plan, don’t worry. It is simply an automated process to transfer money in designated intervals (weekly, monthly etc) from one mutual fund plan to another one.)

Making the Invisible Visible – an illustration

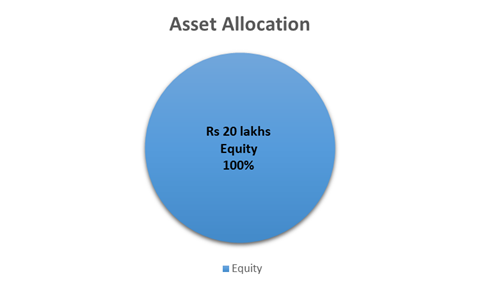

Assume you are 30 years old. Your current portfolio has Rs 20 lakhs entirely invested in equity funds. So your asset allocation is 100% Equity Allocation.

Since it is a 100% equity portfolio, it is obviously risky and will be extremely volatile.

Every time the market falls 10% or more, this also means there is some bad news. Inevitably some confident experts will be of the view that this fall will continue.

Now you are already 100% exposed to equities. This represents all your savings. But having read Warren Buffet, you decide to wait some more time. Unfortunately, the markets as the experts predicted falls further.

Oops! If only you listened to the experts. You press the panic button. You decide to move out now and get back in later. And we all know how this story ends.

So let us take the pscho-logical approach and use “framing” to help us make better decisions.

In the above case, you have 30 more years to earn and save (assuming you retire at 60 years). You currently save Rs 30,000 every month.

Now based on the table, this means the present value of your future savings is approximately equal to 1.5 cr. (51 lakhs for Rs 10,000 SIP. And hence ~1.5 cr for Rs 30,000 SIP).

Let us put this Rs 1.5 cr under an imaginary fund called “Future Savings Liquid Fund”. This will get classified as debt. Now let us see how your asset allocation pans out.

Suddenly you see that while your current asset allocation seemed risky at 100% equities, if you factor in your future savings, then suddenly your entire asset allocation becomes extremely conservative.

Now you are able to see the bigger picture!

Should you worry about timing the markets?

Your equity allocation from a holistic perspective, is still too low for you to worry too much about it. It is more lucrative to spend time increasing the size of the “Future Savings Liquid Fund”.

This means focusing on improving your skills leading to better pay hikes and increasing your savings percentage. Boring advice. I get it. But that is all there is to it!

Putting all this into action

I hope all this hasn’t gone above your head. If yes, no worries. Just follow the 7 step plan below and you will be sorted.

Step 1: What is the total value of your current portfolio?

Step 2: What is your current asset allocation?

Step 3: How many more years will you continue to earn?

Step 4: What is your current monthly investment amount?

Step 5: Based on the results of Step 3 and 4, refer to the table and calculate the value of Future Savings Liquid Fund

Step 6: Add the value of Future Savings Liquid Fund to your current portfolio

Step 7: Recalculate your true asset allocation, considering Future Savings Liquid Fund as a part of your debt allocation

If your current portfolio size < Future Savings Liquid Fund

Focus on earnings more and increasing savings. When it comes to your portfolio, keep it simple. Stick to investing regularly every month, maintain high equity allocation, choose few good fund managers and adjust equity allocation only if markets enter bubble territory (if you think this is tough, skip it).

If your current portfolio size > Future Savings Liquid Fund

Focus on managing the current portfolio via asset allocation, tactical equity allocation, category choice, fund selection, risk management etc.

If you loved this post, share it with your friends and don’t forget to subscribe to the blog (1 article per week) or Twitter along with the 6000+ awesome people. Look out for some fresh, super interesting investment insights delivered straight to your inbox.

P.S

One small request. I have been trying to do away with the ads in my blog and hence planning to move to a direct reader pay-if-you-like-the-post model. If you found this post useful you can convey your love and support by sending Rs 30 bucks or more to my

UPI account: rarun86@okhdfcbank

You can also follow me on twitter

Check out my other articles here

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

Source for the elevator problem story:

Turning Learning Right Side Up: Putting Education Back on Track by Ackoff and Greenberg

I had a discussion with a client where he was lamenting the recent battering his portfolio had taken. I reminded him that he would not even have that amount of savings if it wasn’t for the SIP we started. He acknowledged the point and increased his SIP amount 🙂

LikeLiked by 1 person

I have observed you tend to write bok in a blog. Try reducing the length.I like ur story telling style.

LikeLike

Sure. Feedback noted!

LikeLike

Also one more thing as a reader i see all content only in left side better do the formatting properly and let sentences occupy Right side of the screen too.

What I mean is that your sentences are Vertically not Horizontally. Like eg out of 20cm page your content is heavily put into 10cm of left side rest 10cm on right side is empty. So the reader has to scroll more & he also feels the Length of Article is long.

LikeLike