Do you have a financial plan??

Don’t worry if you don’t have one. Be with me for the next 15 minutes and we will get a simple yet effective financial plan done for you.

The backdrop..

All of us have dreams which are extremely close to our hearts. A happy family, our kids in the best colleges, memorable vacations, a nice cozy home, starting your own company, a comfortable retirement and so on…While as unromantic as it may sound, the hard truth is that most of them also need enough money to get fulfilled.

A financial plan for normal people like us, is a simple reality check of putting a cost to our dreams and figuring out ways to make them feasible.

So when I went about trying to find a simple planner online, one of the issues I faced was that, most of them were too complicated. The ones which were simple enough calculated a monthly required investment amount which was constant and did not increase. This meant, I got a horrendously large monthly required investment amount given my goals which also meant I was staring at a “put-your-entire-salary-into-investments” kind of a future. But its impractical to assume that my salary would remain the same for the next 10-20 years and it’s reasonable to assume that my investments will keep increasing let’s say conservatively by at least 5-10% every year. Since I couldn’t get my hands on a simple planner which let me do this, I have created my own basic planner which you can download from the below link.

Download the financial planner here: Link

How does it work..

10 fairly simple steps:

- Enter your goal in column under the name “Goal”

- Enter the age of the person for whom the goal is planned

- Enter the age at which the money is required

- Enter the expected yearly increase in costs (i.e inflation) for the particular goal (In India Inflation historically is around 7-8%)

- Enter the goal’s current cost (i.e how much does it cost today)

- Enter the % by which you want to increase your yearly investments (approx should be equal to expected salary hike %)

- Enter existing overall investments value (if any)

- Enter the expected portfolio return from your investments

- Repeat the above steps for all your goals

- Press the “Calculate” button

Tips while filling the planner

- Don’t get too bogged on getting each and every assumption precisely right to the final decimal point. Honestly, no one knows what the future exactly looks like and so the basic idea is to get an approximate estimate of our future financial needs to help us plan

- Historically, inflation is around 7-8% in India.You can use that for most of the goals. Education and Housing might have higher inflation so I generally assume it to be around 10%.

- Play around with the portfolio returns – Get a sense of monthly investments required if you put your savings only in safe but lower return generating Fixed Deposits, volatile but higher return potential of equities etc. It lets you appreciate the importance of having a good investment process which can improve your returns.

- Retirement amount – Calculate it as 18-20x your annual requirement for getting inflation adjusted annual income for the next 30-40 years. I will do a separate post on the logic and mechanics behind creating an annual income flow.

Sample plan..

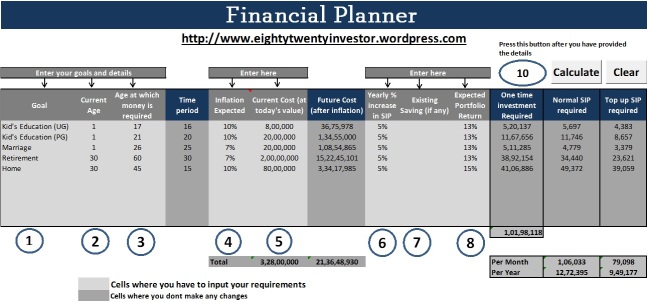

Lets take the case of someone who is around 30 years old, married and has a 1 year old kid. He wants to plan for his kid’s education (current cost of ~ Rs 8 lakhs for UG at 17 years + Rs 20 lakhs for PG at 21 years), kid’s marriage at 25 years (current cost of ~Rs 20 lakhs ), retirement at 60 years (current cost of ~ Rs 2cr) and purchase his own house after 15 years (current cost of ~ Rs 80 lakhs).

Given the above assumptions (you are free to use your own assumptions) as seen from the snapshot of the financial planner, he will need approximately around 1.02 cr currently for all his major future goals (adjusting the future costs for inflation). Now if he has it already, nothing like it. Else (which is most often the case), the next obvious alternative is to save and invest monthly. Normal SIP (systematic investment plan) means that you assume your investments to be constant every month which is impractical as discussed earlier (in this case he needs to invest approximately Rs 1.06 lakhs per month). Now the top up SIP is where he will increment his investments by 5% every year. Now the amount works to be around Rs 79,000 per month. If the amount is too high, given his salary, then he might need to take a hard look at his individual goals and prioritize on a few goals for the time being .

All of us have different priorities/needs and hence the above example is just to give you a sense of how someone can go about with it. So what are you waiting for. Go ahead and create your own financial plan.

Once you are done, our ability to fulfill our goals boils down to a combination of how much we can save and how well we can invest.

Obviously, the savings part will have to be figured by you.

On the investment part, don’t worry. I have got you covered. In my future posts, I will discuss on how we can go about putting a simple investment process in place.

Hello,

This template is really nice and useful :-).

Can you please help in creating following two templates?

1) Investment tracking template

2) Expense tracking template considering multiple accounts (bank,credit card, etc.)

LikeLiked by 2 people

Thanks Sonal. Let me do some research and get back to you on the investment tracker and expense tracker. My guess is there should be some apps which should be able help you out with this.

LikeLiked by 1 person

Nice blog. Added it to my reading list 🙂 You can also check out freefincal.com for some good planners

LikeLike

Attached file is missing

LikeLike

Not able to open the excel attachment

LikeLike

The attached planner file has been deleted. Please reupload

LikeLike

After i fill required details and click on Calculate, theere comes an error on goal calculations tab. , Did anyone notice it?

LikeLike

Yearly % increase in SIP, this column isn’t being considered, the SIP value isn’t being updated when we update this column.

LikeLike

In this single portfolio(Equity,Debt funds,EPF) mapped to all the goals, How do we keep track of progress of each goal and how to manage Asset allocation for these different goals. Request you to come up with new post on portfolio management for goal based investments with unified portfolio approach.

LikeLike

“One time investment Required” column means you can invest this amount today (and let it grow) instead of SIPs, am I right?

LikeLike

Yes 👍

LikeLike

Hi Arun,

I feel that the Step-up increment in the template is not working as expected. The numbers don’t change at all and stay same. Could you please check. Also, nice content. keep it up

LikeLike

Hi Arun, Is the value given by you in Retirement is the lum sum amount we are expecting to get one time or yearly. Please clarify.

LikeLike

It’s the lumpsum

LikeLike

HI ARUN

very nice blog and very comprehensive financial calculator.

can you try to add the feature of withdrawls in between eg.if i want to withdraw some amt at class 10 or 12 then how to adjust.

LikeLike