The problem of sudden increase in spending..

Till a few years back, my idea of saving money was simple:

“Spend all that you can and miraculously if there is some money still left at the end of the month – hurray I get to save”

“I would rather spend on things I love, today rather than save for an unknown future” went the voice in me.

My method worked perfectly for me and I did save up a reasonable amount as my spending was mostly less than my salary.

But somehow in recent times, I am finding it more and more difficult to save as my spending pattern has suddenly gone haywire.

Despite my salary going up, there is always a set of new expense cropping up each and everyday out of nowhere and eventually the entire salary is consumed.

My existing technique of saving money is up for a toss!

If you are nodding your head, then you have landed at the right place.

While obviously there is something definitely wrong with my spending habits, somehow most of my friends also seem to go through this problem in recent times.

Spending seems to have suddenly increased out of nowhere.

Is it just us or is there something else happening which is playing havoc with our spending habits?

BJ Fogg has the answer..

To answer this question, let us catch hold of Mr BJ Fogg – a leading Stanford scientist who has done some super awesome research on how to change human habits.

At the end of the day, spending and saving are both habits. Understanding the science behind how habits are formed might give us a possible clue to what is happening.

According to him, for any behavior to happen, a person must have three things happening at the same instant

- Trigger – something that reminds him to do the specific task

- Motivation – some reward (either extrinsic or intrinsic) which motivates him to do the action

- Ability – Ability is all about whether the task at hand is easy to do

Now before you give me that “WTF” look, trust me it isn’t as complex as it looks.

In fact, who better than BJ Fogg himself to explain this in less than 3 minutes

So the whole idea is that if the behavior to be done is pretty difficult (think exercising, investing etc) then we need a high level of motivation and a reminder (trigger).

Vice versa, in cases where the motivation levels are too low, for the behavior to happen, the action needs to be extremely simple enough to do along with a reminder. (think brushing your teeth – no one woke up excited saying – I am going to brush my teeth – hurray!!)

For those who are interested in a detailed explanation – refer to this link here

Now you can apply this perspective to all your habits and behaviors and I am sure you will be surprised.

Try thinking about the trigger, motivation, ability combo in play when you do the following

- Order food in Swiggy

- Hail a cab via Uber

- Order your jeans in Amazon

- Scrolling through feeds in Facebook

Are you able to connect the dots?

Now let us see how the companies, end up either knowingly or unknowingly applying the framework to modify our behavior.

Historically, most of them would work on increasing our motivation like the one below

But there is an issue with motivation – its transitional.

Remember all your new year resolutions of the past years and you know exactly what is the issue with motivation.

So we would do the behavior initially but with time as our motivation wave drops down, our behavior also stops especially if it is tough to do.

That is when these companies hit upon the holy grail of changing our behavior!

Make the behavior outrageously easy..

Instead of the difficult job of motivating the customers to do the behavior, they instead decided to make the desired behavior as easy as possible!

This meant you only needed to induce minimal amount of motivation to make the customer do the desired behavior.

So for the companies it all boiled down to:

How do we make the action outrageously simple to do?

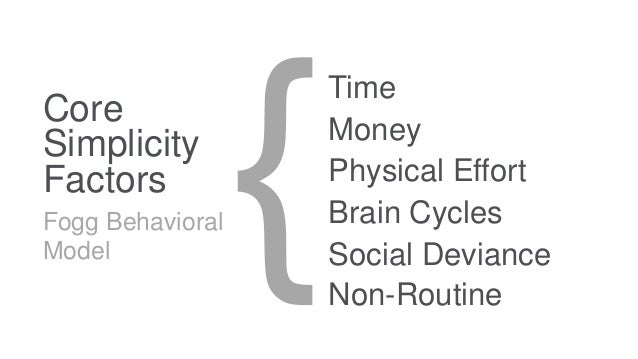

To do this, Fogg suggested tinkering around with what he calls the “Six Elements of Simplicity” (or Ability):

- Time: You have more ability to perform a behavior that takes very little time versus one that takes a lot of time.

- Money: You have more ability to perform a behavior that costs very little money versus one that costs a lot of money.

- Physical Effort: You have more ability to perform a behavior that requires little physical effort and strain versus one that requires a lot of physical effort and strain.

- Mental Cycles: You have more ability to perform a behavior that is not mentally fatiguing or challenging versus one that is.

- Social Deviance: You have more ability to perform a behavior that is socially acceptable versus one that isn’t.

- Non-Routine: Your ability to perform a given behavior will change over time, and will have a greater ability to perform behaviors that are routine (versus behaviors that are non-routine).

So the task for the companies is simply to pick each and every item of the 6 simplicity factor and figure out how to simplify them with respect to the behavior that they want to induce.

End of the day, if they design – quick and physically/mentally easy behaviors that don’t cost a lot of money or violate any social norms – they have a winner at hand!

Amazon’s quest for “make it outrageously easy to buy and spend”

Let us take the example of Amazon and see how they went about simplifying their required user behavior – “to make them shop and spend on Amazon”:

1.One Click Patent

One of Amazon’s first patents was the “1 click patent”

The core of the proposition is that when you sign in on Amazon and you go to buy something, you can just press one button and presto – the thing is bought.

This means that there are fewer steps to ordering, which is less time-consuming and what is termed “friction-less”. Amazon patented that process back when it was just a little online bookseller in 1997.

Now for us in India – the 1 click equivalent is the COD – Cash on Delivery!

2.Shift to app version from desktop version

Gradually with higher discounts when you use the app version vs the desktop version, they slowly made us get comfortable with using the amazon app in the phone. This makes perfect sense as accessing amazon over the phone is extremely easy and solves the issue of time (can be accessed anytime) , physical effort (simple thumb action), mental effort (no thinking required), social deviance (desktop is not the in-thing), non routine (anyway all of us are staring at our mobile screens all day long)

3.Credit Cards solve the money issue

With our credit cards linked, the worry or thought of whether we have money in account balance has also been addressed.

4.One day delivery

The one day delivery for Prime members makes it even more simpler than actually going out to a physical store and buying (imagine the time & physical effort involved).

5.Triggers

Add to this the constant triggers of

- Notifications

- New discount sales announced

- Ads on other sites which remind us of the products that we are looking

- Recommendations based on our viewing/buying history and similar people’s buying activities

6.The mind blowing future of convenience

If this was not enough, look at what the future holds

This is exactly what BJ Fogg calls simplifying Ability!

Conclusion: Ease of buying & spending will be taken to its extremes

All biggies have joined the party..

And this is just one company. Imagine what is going on in Apple, Google, Facebook, Uber, Netflix and millions of other companies etc

All companies have hit upon on this idea of making our making our buying and spending outrageously easy.

No wonder in recent times, our spending pattern has gone for a toss!

Do you think we seriously stand a chance in controlling our spending urges against an onslaught such as this.

And the corollary to this is that – Saving money is going to get more and more difficult as spending money gets more and more easy

In a nutshell

- Spending pattern for most us has gone for a toss in recent times

- BJ Fogg behavior model indicates that for any behavior to happen we must have 1)Motivation 2) Ability 3)Trigger occurring at the same instant

- Companies have realized that trying to increase motivation to make us spend is a difficult ask

- But there is a low hanging fruit – Ability; i.e to make the behavior as simple as possible and hence negate the requirement for a high level of motivation

- Amazon has been doing it successfully over the years

- With several companies (Apple, Google, Netflix, Uber, Flipkart, Ola, Swiggy etc) joining the bandwagon, our spending and buying pattern has gone for a toss – with several impulsive purchases

- Going by the same trend, in future our ability to buy and spend is incrementally going to become more and more easier. This simply means more spending and less saving!

The million dollar question is – Can we really put up a fight and control our spending impulses against these giants who are after our wallets day in and day out?

Hang on till the next week for the answer..

Happy investing 🙂

If you found what you just read useful, share it with your friends and do consider subscribing to the blog along with the 1800+ awesome people, so that you don’t miss out on next week’s post. Of course additionally you also get some super interesting investment insights delivered straight to your inbox. Cheers 🙂

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments

One thought on “This behavioral scientist has the surprising answer to our spending habits”