Last week a friend of mine, who had read my recent rants on the need to focus on risks over returns at the current juncture called me up.

“Dude, shall I cut my equity exposure? Looks like the markets are correcting and as you mentioned valuations are also expensive!”

I am sure most of us are grappling through the same issue. Let us see if we can find an answer to this million dollar question..

I personally think the markets are slightly expensive and the global interest rate scene is extremely uncomfortable for me. So there is an inherent itch in me to play it “cute” – Should I take out some money and park it into safe assets such as debt funds and get back in post a correction.

My first investment mistake..

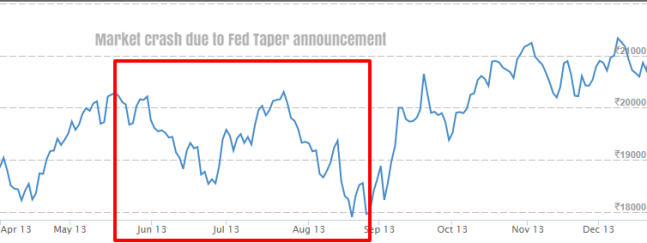

Thankfully, I have already gone through this question 5 years back during the 2013 crash due to taper tantrum. And this is also when I made my first it-can’t-get-dumber than this mistake.

In 2013, around May the US Fed had announced that they were planning to gradually reverse their quantitative easing programme (read as no more money printing).

The Indian equity markets were down by 10% and the Indian currency had moved from 53 to 66 levels! India was classified as fragile 5.

It was the “shit-hit-the-ceiling moment” for me.

Being the dumb me, I poured over various brokerage reports and not to be surprised, all of them scared the daylights out of me.

And if you haven’t guessed it till now – yours faithfully panicked!

Yep, despite all the support system I had in terms of a great organization, access to best fund managers, intelligent colleagues, sophisticated market data and analysis subscriptions which cost a bomb, still I panicked!

I sold of 30% of my equity allocation and stayed in cash. And you know what happened next.

The markets recovered!

And thankfully, I did enter back. But by the time I entered back all my stocks were above my selling price 😦

What was the learning?

Look out for a better market timing model and figure out various factors which impact the equity markets..blah..blah

Grr..not again..but thankfully, common sense prevailed over my intellectual enthusiasm.

The solution was not a better timing model. It was far more simpler as a how-did-it-not-strike-me-earlier-kinda insight stuck me.

I realized that I was still in my 30’s and had a hell a lot more years of earnings and savings to be invested!

This meant that my current corpus was a paltry amount compared to the expected corpus 15-20 years down the line. So the real question was – why all this market timing drama at this stage?

Understanding Human Capital vs Financial Capital..

To help you appreciate the true dumbness of my blunder, let me introduce you the concept of – Human Capital vs Financial Capital

Human Capital is simply the amount of money you are yet to earn using skills, knowledge and experience, over the course of the rest of our lives. The more skills/knowledge/experience you have, the higher your human capital.

In Indian context, assuming most of us retire at around 60 to 65, human capital is what we are yet to earn till we are 60 to 65. So your human capital is at the maximum when we start working and diminishes as we near our retirement.

Financial capital is the inverse of human capital where usually, it’s lower when you’re younger and gradually grows till you reach retirement.

Source: http://pharmacistsfirst.com/pharmacists-most-overlooked-asset/

Now you can clearly see that, my real blunder was that, I had completely ignored the invisible part of my portfolio – my human capital – i.e the savings from my earnings over the next 20-30 years!

If I had framed my portfolio value taking into account my overall potential future portfolio (taking into account my future earnings), my current portfolio size would have been minuscule compared to the 30 years of earnings and savings left.

Suddenly I would have realized that, all I needed to do was to shut the f**k up and focus on saving and investing regularly in the initial stages.

This would have allowed me to keep it simple and stick to a 100% equity portfolio – instead of trying to time the market.

Re-frame your portfolio..

The table tells us how an investment of Rs 10,000 every month which is increased by 5% every year and provides a return of 15% will fare over different time periods.

Refer here for a detailed explanation

The first thing for you to do if you are young is to roughly approximate your portfolio value 15-20 years down the line. (Assuming you want to become financially independent a lot earlier than your 60s)

If you do a monthly investment of Rs 10,000 and assuming that you increase it by at least 5% in every year at 15% expected returns (from equities), you will end up with Rs 80 lakhs in the next 15 years and Rs 1.8 cr after 20 years.

So based on your monthly savings that you currently do, you can have a rough estimate of the portfolio value after say 15-20 years.

This would put in perspective your current portfolio and will help you put possible market corrections in the right perspective.

For Eg: The moment I put my current entire 100% equity portfolio as a % of the final value after 15 years it works out to be just around 6%. With this sudden shift in frame, the answer to “Should I act cute and try asset allocation strategies with just 6% of my targeted corpus” becomes obviously simple.

A lot of us (I am no exception) end up doing this mistake of overthinking, analyzing and trying to act extra cute during the initial years of wealth building where in reality, its predominantly our ability to earn and save which really matters initially.

Keep it simple..

Since my friend is in the same boat as me, our solution became a lot simpler.

Let us not act cute. We shall just stay put and ride the volatility out (however painful it may be).

Also if we don’t test and understand our behavior (ability to withstand declines) now at a smaller corpus, then at a larger corpus it may become too late.

But obviously as our portfolio grows in size, we will reach a point in time, where the returns from our portfolio is much larger than the incremental savings. This is the point where an SIP or monthly investing does little to address overall portfolio volatility (as the 100% equity portfolio has significantly grown in size and a 50% temporary decline like that in 2008 can emotionally derail us from equities forever. You can read more about this here)

So I have a simple thumb rule – only when my portfolio size crosses 5 times my yearly salary will I start attempting to be cute and implement an asset allocation strategy. (You can fix your own cut-off no based on the no of years of salary you wont mind seeing in red during a temporary (hopefully) market decline). Logic being at a larger size, protecting my existing portfolio becomes as important as making it grow!

Till then, let the people with large corpus of money worry about asset allocation, market timing etc while we relax, focus on our careers and continue investing regularly.

Summing it up

- In your 20’s and 30’s, a long investment time horizon & large human capital are the biggest advantage you have

- To take advantage of this, go for a equity heavy portfolio (assuming you have your short term requirements sorted through safer avenues such as fixed income funds, FD etc)

- A high equity allocation also comes with the caveat that you must be mentally prepared for a 50% correction once in 5-7 years, 25-30% correction once every 3 years and 10% correction every year (all these are rough estimates and not cast in stone)

- Your portfolios might look risky because of high equity exposure, however, if you take into account the potential future portfolio size, the current portfolio will usually be minuscule in the context of future portfolio size

- So even if your investment capital falls by 50%, if you frame it as a % of your total expected future portfolio, the fall would only be a few % points because you still have another 20-30 years of human capital left

- Your ability to earn and save dwarfs the loss in your portfolio

- So, in the initial stages of your investing, focus on things under your control – career & earnings, spending & savings pattern, regular investing and hanging on to the portfolio (not getting knocked off by intermittent scary declines)

- During initial stages of wealth building, don’t complicate life by getting into the nuances of market timing, asset allocation calls etc (which you will save for another day when your investment portfolio has grown reasonably large)

- Try and automate your savings & investing habits to large extent – keeping decisions to the minimum

Happy investing folks 🙂

If you loved what you just read, share it with your friends and don’t forget to subscribe to the blog along with the 3500+ awesome people. Look out for some free super interesting investment insights delivered straight to your inbox. Cheers 🙂

Disclaimer: All blog posts are my personal views and do not reflect the views of my organization. I do not provide any investment advisory service via this blog. No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view, and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments

Well Written and explained!. My lessons learn and this is my summary.

-Never predict for a Bear while you are in a bull. CHeating in this relationship will cause a mega Burn.

-Also never be the pig and get slaughtered. Always take profit whenever comfortable and get back in when you feel ready. This way you can balance your emotions again.

http://www.MooMooCoo.com

LikeLike

Thanks a ton Dr Koh 🙂

LikeLike

Nice

LikeLike

Thanks 🙂

LikeLike

Dude,

Fantastic right up.Been following you for quite some time now.Big fan!.

hope you strike out on your own very soon.

LikeLike

Thanks bro..and may your words come true 🙂

LikeLike

Nice article but even when we are in 20s or 30s, 100% asset in equity is not advisable. There is something called ‘Sequence of Return Risk’ which has to be managed as well.

LikeLike

Sequence of return risk, matters a lot when you don’t have an income and want to live of your current investments (say retirement). But when people are young, and there is a bear market for the next 3-5 years, it becomes favorable as we get to gradually build our portfolio at lower levels. But that being said, the real risk is if we can hold on to a 100% equity portfolio given the large declines it can face during the journey. Based on an individuals ability to withstand the falls, he or she can take a call on the equity exposure.

LikeLike

Very nice article…and apt for all categories if people

LikeLike