Before we dive into the SIP portfolio review, a happy update from my side.

My first book ‘The 80-20 Money Makeover – A Simple Yet Powerful System To Transform your Financial Future’ got published by Harper Collins in April 2024 and is now available online (amazon, flipkart etc) and in all popular book stores near you.

I’ve put together everything I’ve learned over the last 14+ years — my journey to financial freedom, insights from exceptional investors, experience across leading wealth-management firms, and counter-intuitive behavioral learnings from watching real clients make real decisions with real money.

If you’re looking for a simple, step-by-step, practical approach grounded in timeless investment principles and real behavioral science – to help you build wealth and give yourself a meaningful shot at early financial freedom, this book is for you.

The reviews have been very positive with 4.6 star rating in amazon.

If you like my simple approach and earlier writings, I am sure you will find the book useful.

Do check out my book here:

https://www.amazon.in/80-20-Money-Makeover-Transform-Financial/dp/9354899773

Now let’s get back to our review!

Backdrop

I have been running a live Equity SIP portfolio with my own money since Aug-18 with the hope of encouraging you to start yours.

If you are new to the concept of Equity SIPs and want a clear understanding of why and how this whole thing really works, check out my earlier article here.

Here is how it was done:

- Rs 30,000 per month since Aug-2018 till Jul-2019

- Rs 40,000 per month since Aug-2019 till Jul-2020

- Rs 50,000 per month since Aug-2020 till Jul-2021

- Rs 60,000 per month since Aug-2021 till Jul-2022

- Rs 70,000 per month since Aug-2022 till Jul-2023

- Rs 80,000 per month since Aug-2023 till Jul-2024

- Rs 90,000 per month since Aug-2024 till Jul-2025

- Rs 1,00,000 per month since Aug-2025 till Jul-2026

Starting from Aug-25, in line with the plan I had increased my SIP amount by Rs 10,000 (i.e from Rs 90,000 per month to Rs 1,00,000 per month).

If you are interested in how it all began, you can read the story here.

If you don’t have the time to read the original post, here is the plan in a nutshell…

You can check the previous reviews below

- 6 Months review: Link

- 1 Year review: Link

- 1 Year 6 months review: Link

- 2 Year review: Link

- 2 Year 6 months review: Link

- 3 Year review: Link

- 3 Year 6 months review: Link

- 4 year review: Link

- 4 Year 6 months review: Link

- 5 Year review: Link

- 5 Year 6 months review: Link

- 6 Year review: Link

It’s been 7 years now and time for our 13th review (usually done every 6 months)!

(Thanks to my laziness I skipped the last review)

Checklist

- Did you invest every month?

Yup! - Did you increase the SIP amount after every year?

Yup! This August (2025), I have again increased my SIP amount by Rs 10,000 (from Rs 90,000 to Rs 1,00,000) exactly as per plan. - Do you have a long time horizon to even out the ups and downs?

Yup. Another 10-15 years easily. - How did the overall SIP perform?

- Any change in the fund manager?

- Did the fund manager stick to the stated investment style?

- Does the original investment rationale hold?

- Do they continue to communicate their strategy transparently?

- Is the churn low?

- Is the expense ratio reasonable?

- Fund Performance

- Risk

Let us address the questions from 4-12

Performance Check

One of the biggest issues when it comes to performance evaluation is that we are sold equities with the wrong expectations. Mostly the pitch is 12-15% returns over the long run.

So anytime, the performance of our Equity SIP drops below say 12% during the journey (more frequent during the first 5 years), we tend to panic. “The returns are much lower than what I expected. Looks like this is not working. Let me stop my Equity SIP!”.

Historically, when I studied past Equity SIP journeys (here) in India for the last 24+ years from different starting points, I found that all Equity SIP investors inevitably have to go through three painful phases at regular intervals.

- Disappointment Phase a.k.a “I Expected Far More” Phase:

There are intermittent periods where your SIP returns are between 7-10%. While this is not a bad outcome and is better than FD returns, as an equity investor you definitely expected a lot more from your equity SIP. This phase is characterized by the typical “I expected far more” rant. - Frustration Phase a.k.a “My FD Would Have Done Better” Phase:

There are intermittent periods where your SIP returns are between 0-7%. This is much lower than what you would have got in your FDs. This phase is characterized by the typical “My FDs would have done far better” rant. - Panic Phase a.k.a “My Portfolio Value is Lower Than What I Invested” Phase:

Whenever there is a large temporary market fall, which is pretty normal for equity markets (using history as a guide, a 10-20% fall happens almost every year and a 30-60% fall can be expected once every 7-10 years), your SIP returns may even turn negative for a short period of time. As you see your hard-earned money eroding every day, eventually panic takes over and you decide to stop and redeem your entire SIP money. This phase is characterized by “My Portfolio value is lower than what I invested” shock.

What do you do when your SIP is hit by one of these 3 phases (which is a matter of “when” and not “if”)?

Whenever equity returns were low i.e when it hits one of the three painful phases, as naive and counterintuitive as it sounds, patiently continuing your SIP for another 1-3 years led to a dramatic recovery in performance!

If you find this a little difficult to believe (which is to be expected), you can read about why this happens here.

In fact, you can see that even in my Equity SIP journey the same thing has played out:

- 1 Year Returns: -2.2%

- 1 Year & 6 Month Returns: 12.1%

- 2 Year Returns: 8.2%

- 2 Year & 6 Month Returns: 30.1%

- 3 Year Returns: 36.6%

- 3 Year & 6 Month Returns: 33.5%

- 4 Year Returns: 25.6%

- 4 Year & 6 Month Returns: 23%

- 5 Year Returns: 25.4%

- 5 Year & 6 Month Returns: 28.6%

- 6 Year: 30.1%

To add to this, there is always some bad news. If someone had told me back in 2018, that I would have to go through IL&FS Crisis, NBFC crisis, US -Iran problems, US-China Trade war, India-China Border Issues, 3 waves of Covid, US Elections, US Inflation Spike, US Fed rate hikes, US Market crash, Recession concerns, China Crisis, 3 wars, Trump Tariffs, FII Selling etc, most likely I would have never started my SIP!

Source: WhiteOak AMC

To address these 3 tough phases and the never-ending bad news cycle, where I may be tempted to stop my SIP, I created a simple framework, to make sure my short-term expectations were set right, and I can stick to my Equity SIP for the long run.

Now in the last review, based on the 6-month expectations framework that I had discussed in the previous review, the expectations were…

In the next six months, that is on 04-Aug-2025,

I would expect my portfolio (actual investments of Rs 50.4 lakhs) to be between Rs 77 lakhs to Rs 1.3 crs. Any value within this range would be considered normal behavior from my portfolio.

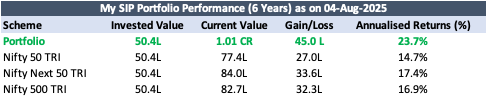

Let us check the results as of 04-Aug-2025,

Great! The SIP portfolio has crossed the 1 crore milestone!

The current SIP portfolio value of Rs 1.01 crs is within our expected range and our SIP has delivered 23.7% returns (XIRR). Overall the performance was far better than the benchmark index Nifty 500 TRI, Nifty 50 TRI, and Nifty Next 50 TRI as seen above. In absolute money terms, our fund selection has added Rs 11-18 lakhs more than what we would have got from the indices.

So both the asset class and fund selection are working much better than expected!

To be honest, this is way more than I expected (my expectation was around 12-15% returns). The key now is not to get carried away by the high current returns and let us continue to focus on the basics – investing regularly every month and keeping things simple.

Now with that out of the way, let us dive into the two funds…

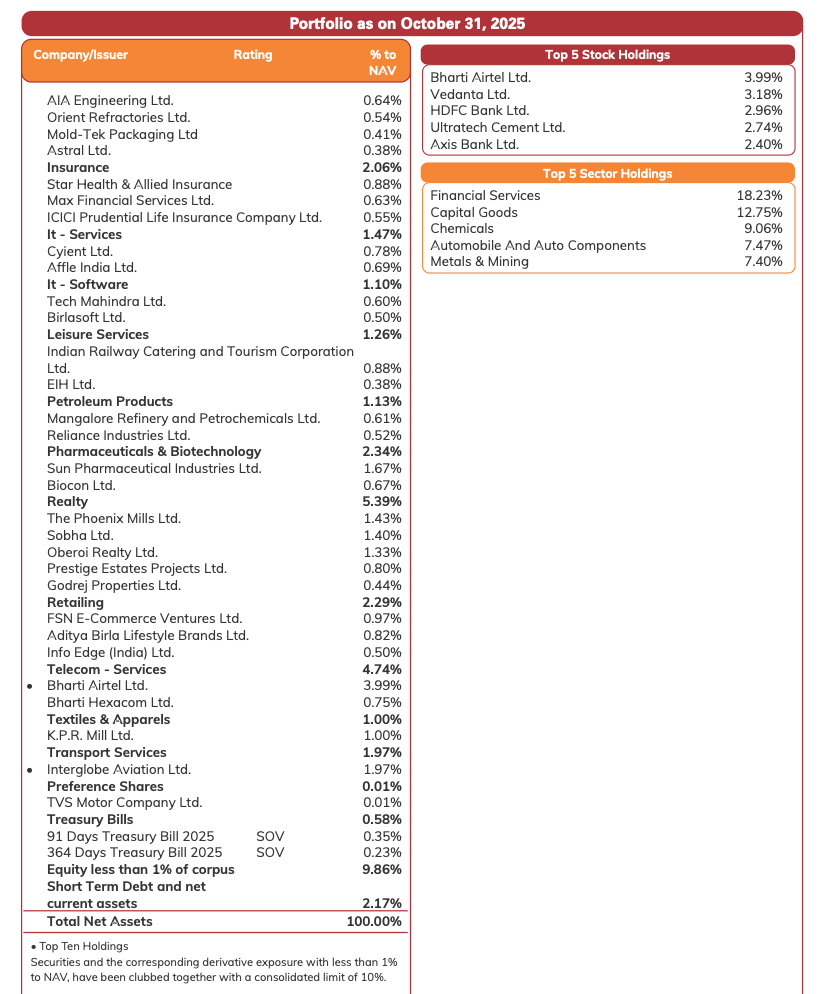

Since the review is a little delayed, I will use the Oct-25 end portfolios for the review.

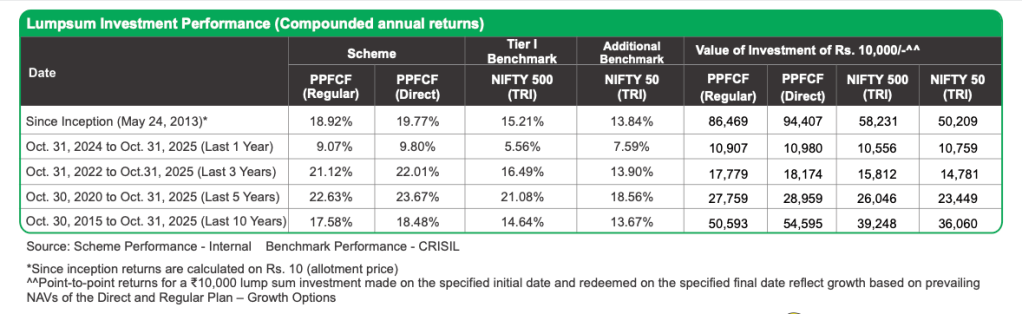

Fund 1: Parag Parikh Flexicap Fund

You can refer to the original rationale here

Latest Factsheet (as on 31-Oct-2025):

High Conviction Portfolio Style Continues…

Original Rationale: The entire fund house just has one single equity fund – and this single fund runs a concentrated portfolio of around 20-25 stocks. So all the resources will be focused on this single fund and shows their conviction and belief. This is a welcome change from the majority of AMCs where they have several funds running different strategies so that at all points in time there will be one fund or the other performing.

Current View: Logic pretty much continues to hold true. They have added another large cap fund – but this will be more a passive plus solution with a portfolio and cost similar to the index. The idea is to attempt slightly better performance via better execution and not stock selection.

As explained in previous reviews, they have have an ELSS fund. But this will be very similar to the Parag Parikh Long Term Equity Fund except for the global exposure (which again is because the regulation doesn’t allow global exposure for ELSS category). One fund each has been added in the Conservative Hybrid category, Dynamic Asset Allocation and Arbitrage category but this is more of a debt-oriented solution.

With Skin in the game…

Original Rationale: Their own employees own around 10% of the scheme

Current View: While this has no prediction capabilities on the future performance (did not work in the case of MOSL Flexicap fund), this improves the trust factor and the intention will be to do the right thing as their money is also invested.

As of 31-Oct-2025, Rs 608 crs (i.e ~0.5%) of the fund is money invested by company employees. (source)

Focused & Simple to track…

The current portfolio has around 31 stocks. The number is slightly increasing given the larger size of the fund. Right now it’s still ok as the top 15 stocks still contribute to around 63% of the portfolio (out of 74% equity exposure) retaining the focused nature of the portfolio.

Transparent and Regular Communication…

Original Rationale: These guys are way ahead of the industry and have phenomenal transparency in communicating their views and processes. They have a good youtube channel (link) where the fund managers regularly communicate their views and also their annual investor meeting is available where they talk about the investment thesis behind their stocks.

Current View: They continue with their frequent communication via their YouTube channel.

No dilution in investment style…

You can find them discussing details on their portfolio here.

The portfolio remains more or less the same with minor changes (moved out of MOSL Financial Services) and the earlier discussed thesis continues.

Low Churn…

The churn is very low at 13% indicating that they are walking the talk of a buy-and-hold strategy.

Fund Managers remain the same…

The fund managers Rajeev Thakkar and Raunak Onkar continue to manage the fund which was my original thesis. So no worries!

Exposure to global stocks has come down due to regulatory constraints…

The fund’s strategy is to provide global diversification via 1/3rd exposure to global stocks. The global equity exposure has come down to 12% levels due to the recent industry-wide restrictions on investing in foreign stocks. This will eventually go back to 30%+ levels once these restrictions are removed. So this is not something under their control and I don’t see this as a worry point.

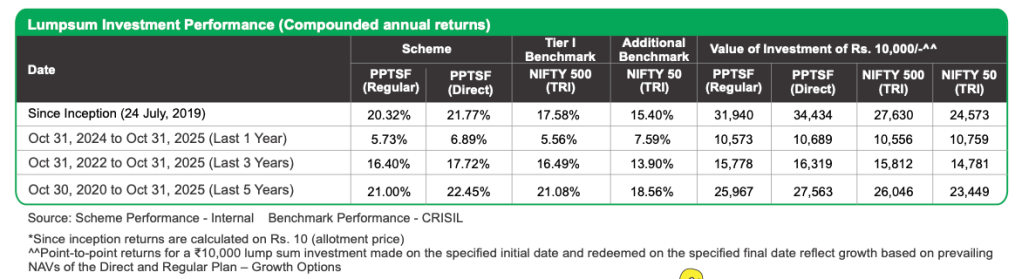

Their ELSS which is a pure Indian equity fund has also delivered strong returns over the last 3 years, which indicates that they are good even with pure Indian equity portfolios. You can check the returns below

Expense Ratio remains reasonable and has been coming down…

Their expense ratio when I started was around 1.4%. Now its at 0.63%. Overall the costs have come down and are pretty low today.

Significant outperformance over 10+ years…

As on 31-Oct-2025,

As seen above, the 5 years and 10 years performance indicates significant outperformance against the benchmark. The fund is doing good as per my expectation.

Growing Fund Size needs to be monitored…

As the fund has done really well, a lot of investors have started to notice this and the inflows have been pretty strong. The fund’s size is now Rs 1.26 lakh crs (vs ~84,000 crs a year back) which is pretty large and the pace of increase is also very fast.

In terms of their portfolio construct, I am noticing two effects of this large inflows

- Higher Cash Allocation as deployment may be taking time

- Mid & Small cap allocation which used to be 20-30% of the portfolio in the past has dropped to 6% of the portfolio.

Early signs of larger size, leading to slight modification of the strategy are starting to emerge. But the concentrated nature of the portfolio continues with top 15 stocks accounting for around 63% of the portfolio. The low churn historically and global exposure which can go upto 30% provides some buffer to handle the larger size. Larger Size has also led to lower costs which is a plus.

Right now, it’s early days but I will continue to keep a close watch on this.

Cash Allocation has Increased – Personally not a big fan of cash calls!

In Oct 2018 they had a cash allocation of around 28%. I personally don’t prefer fund managers taking cash calls and hence had mentioned this as a concern. But as the markets corrected in February and March 2020, they had deployed the entire cash into equities. While it did work out well last time, this is a double edged sword and can backfire anytime. In my view, asset allocation calls are better left to the investor.

Right now the cash allocation is around 26% which is a lot higher than my comfort levels. I am worried on this aspect. Historically, there are a lot of fund managers who burnt their hands trying to take cash calls. Whatever you may call this, this is effectively trying to time the market – which generally doesn’t end well.

Here are some of my concerns…

1) 74 percent equity but “no opportunities” to deploy further

If the existing 31 stocks are good enough to keep deploying incremental flows into, why can’t they increase weights by even 0.5–1 percent in some of these stocks and take equity exposure closer to 90–95 percent?

It’s hard to reconcile the ability to keep buying these stocks with new flows but not scale up the same positions meaningfully.

2) ELSS fund at 86 percent equity contradicts the Flexi Cap stance

The same team runs the ELSS fund with far higher equity allocation. This suggests that the Flexi Cap’s large AUM and not just valuations may be limiting deployment.

3) If there are no opportunities, why not stop lumpsum inflows?

Sideways markets over the last year and meaningful corrections in many mid and small caps should normally create opportunities. If they still see none, the logical move is to at least discourage lumpsums – a step many AMCs have taken in similar phases. “No opportunities to deploy” versus “continue accepting all inflows” is confusing.

4) A further market upmove creates a deployment dilemma

If markets rise from here (which is a very plausible scenario), deployment becomes even harder.

It will directly contradict the current stance that valuations are unattractive.

This is a real risk as it will become difficult to deploy post that. The fund could end up with high cash, rising markets, and limited ability to close the valuation gap without chasing prices.

I will wait till the next review and if this continues, I will need to re-evaluate my decision.

Overall View

The cash allocation of 26% is getting me worried. While everything else is as per original thesis, I am not a big fan of cash calls as it generally doesn’t end well.

For now I will continue with my SIP in Parag Parikh Flexicap Fund. But I will want to re-evaluate this decision for the next review depending on how the cash levels pan out.

Fund no 2: ICICI Prudential India Opportunities Fund

The primary thesis (refer here) was based on the fund manager Naren. Here is a snapshot of why I like him

- 31+ years of Market experience covering 3 cycles

- 15+ years of fund management experience

- Robust long term performance track record

- Consistent Investment Style = Value investing + Contrarian + Evaluating Cycles + Top Down (using the big picture to arrive at stocks to invest in) + Bottom Up

- Macro overlay + takes advantage of cycles

- Knowledge of credit markets and credit cycles – its interplay with equities

- Ability to withstand and stick to investment process during occasional periods of short term under performance

- Well read

- Investment Gurus – James Montier, Howard Marks, Michael Mauboussin

- Deploys checklists for investing – inspired from Atul Gawande’s Checklist Manifesto

- Communicates strategies and thought process regularly on public forums (making our lives a lot more easier)

To play the contrarian style, you need to be willing to look wrong often in the short term, before the mean reversion takes place. This means you need the support and trust from both the AMC and investors. Naren’s experience and stature allows him the rare luxury to take near term pain and stay patient till the contrarian call plays out (which a lot of new fund managers will never have as the short sighted industry won’t let them survive)

Portfolio Positioning – Contrarian Concentrated Portfolio…

It is a reasonably concentrated fund with top 10 stocks accounting for 47% of the portfolio and 20 stocks accounting for ~68% of the portfolio. Overall it has around 71 stocks.

Reasonable AUM size at Rs 33,000 crs (vs Rs 25,000 crs during last review) implies reasonable flexibility to manage the portfolio across market caps.

Currently, the fund has mid and small cap exposure at around ~23%

Current Portfolio

Overweight: Financial Services, Technology, Energy, Pharma

Underweight: Consumption

Valuations are reasonable…

Price to Earnings Ratio: 21.2 (25.8 vs for Nifty 500)

Price to Book Ratio: 2.9 (3.7 vs for Nifty 500)

(source: value research)

Historically the valuations for the fund were much lower than index PE providing significant valuation rerating potential which also has played out. Valuations currently are not extremely cheap but still look reasonable vs index.

Skin in the Game

There is hardly any investment from the fund manager into this fund. This is disappointing. But right now, I will live with this.

Low Expense Ratio

The expense ratio is low at around 0.65% (vs 0.63% in Aug-24).

Portfolio Churn is moderate

Portfolio Churn is neither too high nor too low at 63%. Given the part tactical nature of the portfolio, I expect this to be around this range.

Performance has seen a significant turnaround in the last 5 years

The fund was launched on 15-Jan-19.

What was my view way back on Aug-20…

The performance then was nothing to write home about. To be honest it was really bad.

This is what I wrote in my review back then:

This is in line with all value oriented fund managers under performing. If you notice all the celebrated value oriented fund managers before 2013 – Prashant Jain, Anoop Bhaskar, Quantum Mutual Fund, Sankaran Naren, Anand Radhakrishnan etc are underperforming big time. The new breed of Quality oriented fund managers have been strong performers in the last 7 years. I expect mean reversion to play out sometime similar to what happened to value oriented fund managers previously and the quality oriented managers to go through their lean patch.

What happened after that?

Post that there was a significant pick-up in returns (not that I knew about the timing) and thankfully the thesis has started to play out. Due to the strong returns since Oct-20, now the fund has started to outperform both in the 3Y, 5Y time frame and Since inception (15-Jan-2019). This is yet another reminder of why patience is a must when you take part in contrarian funds.

Overall, while the initial few years tested our patience as value style was out of favor, post Oct-20 the fund saw a significant turnaround in performance and comfortably outperforms the benchmark by 5% annually since inception (21% for the fund vs 16% for benchmark).

That being said, this fund is not for the fainthearted and will have a significant performance differential with indices in the short term (negative and positive) given the divergent (60% of the portfolio is different from the benchmark Nifty 500 – also called by a fancy name “active share”) and concentrated portfolio of out of favor stocks.

Overall View

Overall, my original thesis remains intact, and I would want to play the contrarian style via Sankaran Naren.

Things Under My Control – Time & Discipline

Now while I have no control over the markets, the biggest determinant of my future portfolio thankfully is still under my control – Time + Discipline

Time – I have easily a 10-15 years time frame. This would take care of most of the near-term volatility and I can ride it out.

Discipline – To save and invest consistently, come what may. Call it the pressure of social accountability, I have continuously invested (from 30K per month in 2018 to 1 lakh per month today) and have increased the amount every year.

I continue to focus on the above two – Time and Discipline and hopefully in 10-15 years should have a good enough outcome.

Next 6 Month Return Expectation

I had discussed a new framework to set expectations for equities as an asset class here. Since it involved too many numbers and is slightly complex, I simplified it from the previous review. This will make it easy for you to do a rough mental math and set the right expectations from your SIP portfolio.

The rough math goes like this,

For my Rs 1,00,000 SIP, in the next six months, I will add Rs 6 lakhs (Rs 1,00,000 x 6 months) to my current SIP portfolio. But I have already accumulated around ~Rs 1.01 crs as of 4-Aug-2025 (just to make sure the six-month review timelines are kept the same). Put together, I will have a portfolio of ~Rs 1.07 crs after the next 6 months (not accounting for portfolio returns).

This Rs 1.07 crs is like a lumpsum amount going forward as the entire amount is exposed to equity market ups and downs.

Based on historical data, the 6-month 90% probability return range for equities has been anywhere between -20% to +40%. So, you basically, multiply your portfolio value by 0.8x and 1.4x to get the 6-month future expected value range. As simple as that!

Applying this to Rs 1.07 crs we get a 6-month outcome range of Rs 85 lakhs to Rs 1.5 crs.

Summing it up,

In the next six months, that is on 04-Feb-2026,

I would expect my portfolio (actual investments of Rs 56.4 lakhs) to be between Rs 85 lakhs to Rs 1.5 crs. Any value within this range would be considered normal behavior from my portfolio.

That being said, if there is a large market crash (which I obviously can’t predict), then my portfolio can fall much more than this. It is reasonable to expect one or two major crisis events every ten years (covid crash of 2020 is a good reminder of this).

I have a 10-15 year time frame for my SIP. This means I have another 20 to 30 six-month periods to stay invested. Even if I lose out on a few periods, going by the history of equities, the majority of six-month periods will be in my favor and I most likely end up with a good return experience over the long run.

Similarly, you can start building reasonable volatility expectations over the next 6 month period for your SIP portfolio.

The key idea is to stay for long-term returns, one six-month period at a time!

Summing it up

The whole idea is not to ask you to pick these 2 funds. That is irrelevant. The actual intent is to show you that investing can be simple provided you get your behavior right and encourage you to save and invest consistently across your working careers.

If you follow this simple plan, you will end with a terrific outcome over the long run irrespective of which equity fund you pick (as long as you don’t mess it up big time).

When I started 7 years back, the possibility of reaching Rs 1 cr via this SIP so soon was not a part of my wildest imagination and now it seems so doable! Even for someone like me, who has been a part of some reputed wealth management firms and have done millions of boring presentations on the power of compounding, it’s been extremely difficult to truly wrap my head around the power of compounding until I finally experienced it.

So the only way to truly appreciate the power of compounding is to start your own Equity SIP and get to experience it firsthand over the next 10-20 years!

I honestly think if we plan our money well, then it can make a huge difference to our lives and the people around us. The idea behind this blog is that in a small way, if I can help you make good money decisions today, they can compound into something meaningful over the long run.

Ok, sentiments aside – the next review will be on Feb-2026.

See you, folks. As always Happy Investing!

If you have any feedback (good or bad) you can mail me at 8020investor@gmail.com.

You can also check out my other blog articles here

You can also check my old articles in the FundsIndia blog: https://www.fundsindia.com/blog/category/mf-research

If you loved this post, share it with your friends and don’t forget to subscribe to the blog here

thanks for the update,, I read somewhere you has added old bridge fund,, do you track it separately?

LikeLike

It is absolutely great that you increased your investment allocation to almost Rs. 1 lakh per month. And that you got more than 24% CAGR return from your disciplined approach.

LikeLike

Hi Arun,

excellent book and I bought and read it. learned a lot despite me investing in markets for 30 years. especially how to handle bubbles and bursts. thank you. I used to invest through FI and now moved to direct only funds. interacted with Srikanth few times and now using thier prime investor site for some reserch and insights

all the best with book

Srini

LikeLike