This is the 4th post in the “behavioral biases during a bear market” series. You can check out the earlier ones here

- Evolutionary roots and our three-in-one brain!

- Loss Aversion, Cognitive bias and Pattern seeking

- Availability Bias

Choose the correct line?

Let me start by asking you a simple question?

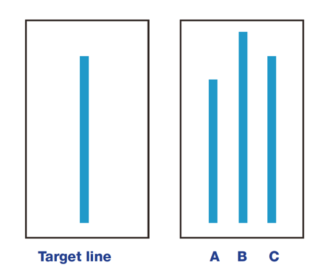

In the above diagram, which of the three lines numbered A,B and C is closest in length to the target line ?

If you answered C, congrats that is the right answer!

Of course, it was outrageously obvious right.

Now before you swear at me for insulting your intelligence, here is the shocker – in a famous experiment conducted in the 1950’s, for the same question majority of the people chose the wrong line.

But how could this be?

Were they actually that dumb..

Enter behavioral economics. Unknown to the participants, there was a secret behavioral trick played on these people which caused them to choose the wrong answer despite the correct answer being very obvious to them.

If you are curious to learn about this powerful behavioral trick read on..

Enter Mr Asch and his experiments..

In the 1950s, psychologist Solomon Asch invited students to participate in a vision test and the students were split into several groups.

Now each group was asked a similar question on the lines of –

Which one of A,B,C lines resembled the line on the left?

But there was a small twist. Only one of the participants in each group was for real. All the others in the group were secretly set up by Asch!

All the participants had to shout their answers aloud in front of the group, but the actors set up by Asch were always made to answer first and the real participant was always the last to answer. In this way, Asch ensured that the real participants listened to everyone’s answers before they gave their own.

During the first part of the experiment, the actors set up by Asch answered the questions correctly and as expected so did 99 percent of the real participants.

But here comes the interesting twist..

In the next part of the experiment, however, Asch secretly asked his actors to deliberately give the wrong answers.

And guess what happened?

When people heard these incorrect answers, they conformed to the majority’s wrong answer more than one-third of the time!

3 out of 4 people ignored what they could see so evidently with their own eyes and answered incorrectly at least once!

You read that right – 3 out of 4 had conformed to the group although they were wrong!

And sadly, only 1 out of 4 could stick to their own views.

The Asch experiment demonstrates that people have a strong urge to conform to the opinion of the group – they would rather be wrong as a group than right as an individual

Everyone is doing it syndrome..

Now while this is an old experiment, scientists have been able to replicate Asch’s results consistently in various other set ups as well. In fact, there is evidence that even chimpanzees have this strong urge to conform.

Also check out this funny video on this pattern repeating in a different context

But why do we conform?

- We want to fit in with the group

- We believe the group is better informed than we are

And from an evolutionary perspective, this makes perfect sense..

When our ancestors were living in tribes and clans, they mostly survived by unhesitatingly following the herd, in the absence of better information. Even if the herd was not correct about which way to run to avoid the predator, an individual if he moves away from the herd would make a more easier target on his own as opposed to keeping with the herd.

Further, we are social beings, and what others think about us is remarkably important for us. In our need for a sense of identity we seek to belong and so easily conform with what others are doing.

This behavioral tendency of ours to conform with the group is referred to as social conformity or social proof.

Uncertainty is the breeding ground for social conformity..

Social conformity is at its highest especially in situations of uncertainty.

When faced with an unfamiliar or uncertain situation, an unsure individual would feel the need to refer to other people for guidance.

Bear markets + Uncertainty = Social Conformity on steroids

Now if you are wondering on what this has to do with investing – enter the bear market. Uncertainty is at its highest for investors spending sleepless nights wondering how long will the fall last and how steep will it get.

So in uncertain periods like these, the easiest and fairly intuitive option is to look around and follow the crowd.

And unfortunately, the crowd usually panics at exactly the wrong time.

What was a useful trait for our ancestors and for us in several other contexts, unfortunately fails us miserably during a bear market.

So our behavioral enemy no 4 during a bear market is Social Conformity i.e our inherent tendency to follow the crowd.

What is the solution?

Now while the obvious solution is not to follow the crowd, it is far easier said than done. So instead of fighting this urge, we need to play along this urge.

I would suggest finding a group of experienced investors or fellow investors to discuss during times of panic. If this sounds difficult, you can take advantage of the internet and identify your “investors to track” list and follow them closely for their views and interviews.

While the intent is not to follow anyone blindly, staying calm and getting a sense of what the sane and experienced guys are doing will definitely be of some help.

And also keep your what-if-things-go-wrong-plan ready. For details you can refer to my earlier posts here and here

As always in the coming weeks, we shall explore the other behavioral enemies and come up with a solution.

Till then, happy investing as always..

For the rest of us, if you loved what you just read, share it with your friends and don’t forget to subscribe to the blog along with the 3500+ awesome people. Look out for some fresh, super interesting investment insights delivered straight to your inbox. Cheers!

If in case you need any help regarding your investments or want me to write about something, feel free to get in touch at rarun86@gmail.com

3 thoughts on “The When-In-Doubt-Follow-Others syndrome”