Before we dive into the SIP portfolio review, a quick happy update from my side.

My first book ‘The 80-20 Money Makeover – A Simple Yet Powerful System To Transform your Financial Future’ has been published by Harper Collins (one of world’s best and largest publishers) and is now available online (amazon, flipkart etc) and in all popular book stores near you.

I’ve put together everything I’ve learned over the last 13+ years. This includes my own journey to financial freedom, best practices from working at top wealth management firms in India, behavioral insights from observing how real clients behave in different market situations, insights from many books, and lessons from interacting with some of the best investors.

If you are someone looking for a simple, step-by-step, practical approach based on behavioral science to build wealth and take a meaningful shot at early financial freedom, this book is for you!

The initial reviews have been very positive. If you like my approach and content, I am sure you will find the book useful.

You can check out my book here:

https://www.amazon.in/80-20-Money-Makeover-Transform-Financial/dp/9354899773

Now let’s get back to our review!

Backdrop

I have been running a live Equity SIP portfolio with my own money since Aug-18 with the hope of motivating and encouraging you to start yours.

If you are new to the concept of Equity SIPs and want a clear understanding of why and how this whole thing really works, check my earlier article here.

Here is how it was done:

- Rs 30,000 per month since Aug-2018 till Jul-2019

- Rs 40,000 per month since Aug-2019 till Jul-2020

- Rs 50,000 per month since Aug-2020 till Jul-2021

- Rs 60,000 per month since Aug-2021 till Jul-2022

- Rs 70,000 per month since Aug-2022 till Jul-2023

- Rs 80,000 per month since Aug-2023 till Jul-2024

Starting from Aug-23, in line with the plan I had increased my SIP amount by Rs 10,000 (i.e from Rs 70,000 per month to Rs 80,000 per month).

If you are interested in how it all began, you can read the story here.

If you don’t have the time to read the original post, here is the plan in a nutshell…

You can check the previous reviews below

- 6 Months review: Link

- 1 Year review: Link

- 1 Year 6 months review: Link

- 2 Year review: Link

- 2 Year 6 months review: Link

- 3 Year review: Link

- 3 Year 6 months review: Link

- 4 year review: Link

- 4 Year 6 months review: Link

- 5 Year review: Link

It’s been 5 1/2 years now and time for our 11th review (done every 6 months)!

Checklist

- Did you invest every month?

Yup! - Did you increase the SIP amount after every year?

Yup! This August (2023), I have again increased my SIP amount by Rs 10,000 (from Rs 70,000 to Rs 80,000) exactly as per plan. - Do you have a long time horizon to even out the ups and downs?

Yup. Another 10-15 years easily. - Does the overall performance fall within your 6-month expected return range?

- Any change in the fund manager?

- Did the fund manager stick to the stated investment style?

- Does the original investment rationale hold?

- Do they continue to communicate their strategy transparently?

- Is the churn low?

- Is the expense ratio reasonable?

- Fund Performance

- Risk

Let us address the questions from 4-12

Performance Check

One of the biggest issues when it comes to performance evaluation is that we are sold equities with the wrong expectations. Mostly the pitch is 12-15% returns over the long run.

So anytime, the performance of our SIP drops below say 12% during the journey (more frequent during the first 5 years), we tend to panic. “The returns are much lower than what I expected. Looks like this is not working. Let me stop my SIP!”.

Historically, when I studied past Equity SIP journeys (here) in India for the last 23+ years from different starting points, I found that all Equity SIP investors have to go through three painful phases at regular intervals.

- Disappointment Phase a.k.a “I Expected Far More” Phase: There are intermittent periods of time where your SIP returns are between 7-10%. While this is not a bad outcome and is better than FD returns, as an equity investor you definitely expected a lot more from your equity SIP. This phase is characterized by the typical “I expected far more” rant.

- Frustration Phase a.k.a “My FD Would Have Done Better” Phase: There are intermittent periods of time where your SIP returns are between 0-7%. This is much lower than what you would have got in your FDs. This phase is characterized by the typical “My FDs would have done far better” rant.

- Panic Phase a.k.a “My Portfolio Value is Lower Than What I Invested” Phase: Whenever there is a large temporary market fall, which is pretty normal for equity markets (Using history as a guide, a 10-20% fall happens almost every year and a 30-60% fall can be expected once every 7-10 years), your SIP returns may even turn negative for a short period of time. As you see your hard-earned money eroding every day, eventually panic takes over and you decide to stop and redeem your entire SIP money. This phase is characterized by “My Portfolio value is even lower than what I invested” rant.

What do you do when your SIP is hit by one of these 3 phases (which is a matter of “when” and not “if”)?

Whenever equity returns were low i.e when it hits one of the three failure points in the initial 3-5 years, as blasphemous and counterintuitive as it sounds, patiently continuing your SIP for another 1-3 years led to a dramatic recovery in performance!

If you find this a little difficult to believe (which is normal), you can read about why this happens here.

In fact, you can see that even in my Equity SIP journey the same thing has played out:

- 1 Year Returns: -2.2%

- 1 Year & 6 Month Returns: 12.1%

- 2 Year Returns: 8.2%

- 2 Year & 6 Month Returns: 30.1%

- 3 Year Returns: 36.6%

- 3 Year & 6 Month Returns: 33.5%

- 4 Year Returns: 25.6%

- 4 Year & 6 Month Returns: 23%

- 5 Year Returns: 25.4%

- 5 Year & 6 Month Returns: 28.6%

To add to this, there is always some bad news. If someone had told me back in 2018, that I would have to go through IL&FS Crisis, NBFC crisis, US -Iran problems, US-China Trade war, India-China Border Issues, Covid, US Elections, US Inflation Spike, US Fed rate hikes, US Market crash, Recession concerns, China Crisis etc, most likely I would have never started my SIP!

To address these 3 tough phases and the never-ending bad news cycle, where I may be tempted to stop my SIP, I created a simple framework, to make sure my short-term expectations were set right, and I can stick to my Equity SIP for the long run.

Now in the last review, based on the 6-month expectations framework that I had discussed in the previous review, the expectations were…

In the next six months, that is on 04-Feb-2024,

I would expect my portfolio (actual investments of Rs 34.8 lakhs) to be between Rs 45 lakhs to Rs 78 lakhs. Any value within this range would be considered as normal behavior from my portfolio.

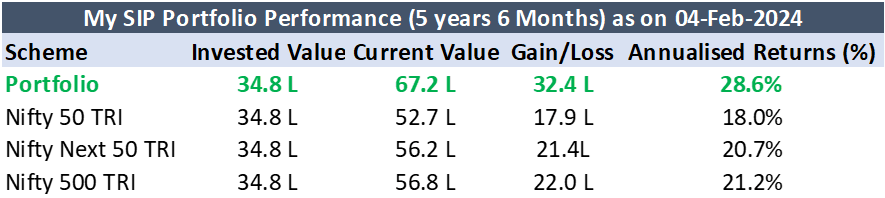

Let us check the results as of 04-Feb-2024,

Great! The current SIP portfolio value of Rs 67 lakhs is within our expected range and our SIP has delivered 28.6% returns (XIRR). Overall the performance was far better than the benchmark index Nifty 500 TRI, Nifty 50 TRI, and Nifty Next 50 TRI as seen above. In absolute money terms, our fund selection has added Rs 10-14.5 lakhs more than what we would have got from the indices.

So both the asset class and fund selection are working much better than expected

To be honest, this is way more than I expected (my expectation was around 12-15% returns). The key now is not to get carried away by the high current returns and let us continue to focus on the basics – investing regularly every month and keeping things simple.

Now with that out of the way, let us dive into the two funds…

Since the review is a little delayed, I will use the April-24 end portfolios for the review.

Fund 1: Parag Parikh Flexicap Fund

You can refer to the original rationale here

Latest Factsheet (as on 30-Apr-2024):

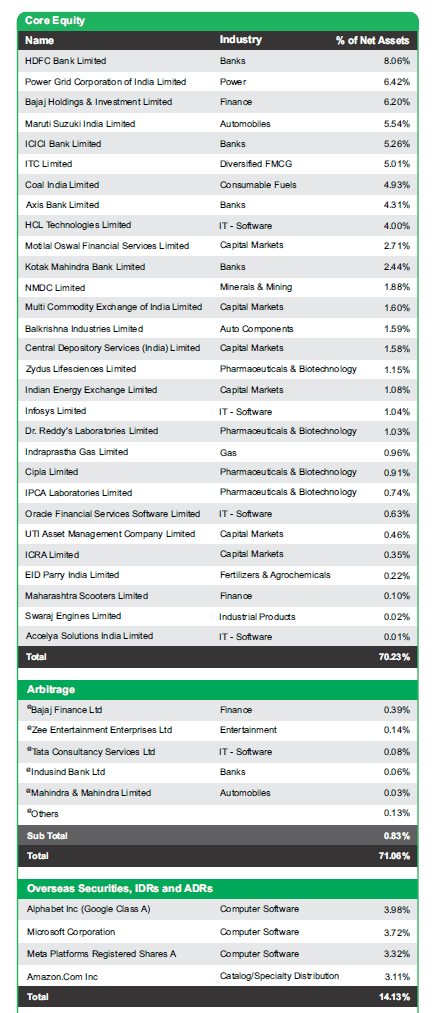

High Conviction Portfolio Style Continues…

Original Rationale: The entire fund house just has one single equity fund – and this single fund runs a concentrated portfolio of around 20-25 stocks. So all the resources will be focused on this single fund and shows their conviction and belief. This is a welcome change from the majority of AMCs where they have several funds running different strategies so that at all points in time there will be one fund or the other performing.

Current View: Logic pretty much continues to hold true. As explained in previous reviews, they have launched an ELSS fund. But this will be very similar to the Parag Parikh Long Term Equity Fund except for the global exposure (which again is because the regulation doesn’t allow global exposure for ELSS category). One fund each has been added in the Conservative Hybrid category, Dynamic Asset Allocation and Arbitrage category but this is more of a debt-oriented solution.

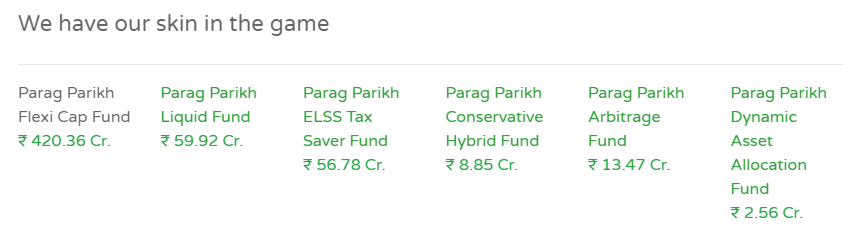

With Skin in the game…

Original Rationale: Their own employees own around 10% of the scheme

Current View: While this has no prediction capabilities on the future performance (did not work in the case of MOSL Flexicap fund), this improves the trust factor and the intention will be to do the right thing as their money is also invested.

As of 30-Apr-2023, Rs 420 crs (i.e ~0.7%) of the fund is money invested by company employees. (source)

Focused & Simple to track…

The current portfolio has around 33 stocks and is very easy to track. The number is slightly increasing given the larger size of the fund. Right now it’s still ok as the top 15 stocks still contribute to around 69% of the portfolio retaining the focused nature of the portfolio.

Transparent and Regular Communication…

Original Rationale: These guys are way ahead of the industry and have phenomenal transparency in communicating their views and processes. They have a good youtube channel (link) where the fund managers regularly communicate their views and also their annual investor meeting is available where they talk about the investment thesis behind their stocks.

Current View: They continue with their frequent communication via their YouTube channel.

No dilution in investment style…

You can find them discussing details on their portfolio here.

The portfolio remains more or less the same with minor changes and the earlier discussed thesis continues. The major addition has been Kotak Mahindra Bank (2.4%) which is in line with their usual style of buying good companies when they go through temporary problems.

Low Churn…

The churn is very low at 3% indicating that they are walking the talk of a buy-and-hold strategy.

Fund Managers remain the same…

The fund managers Rajeev Thakkar and Raunak Onkar continue to manage the fund which was my original thesis. So no worries!

Exposure to global stocks has come down due to regulatory constraints…

The fund’s strategy is to provide global diversification via 1/3rd exposure to global stocks. The global equity exposure has come down to 14% levels due to the recent industry-wide restrictions on investing in foreign stocks. This will eventually go back to 30%+ levels once these restrictions are removed. So this is not something under their control and I don’t see this as a worry point.

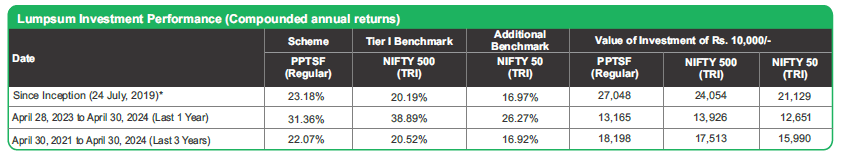

Their ELSS which is a pure Indian equity fund has also delivered strong returns over the last 3 years, which indicates that they are good even with pure Indian equity portfolios. You can check the returns below

Expense Ratio remains reasonable and has been coming down…

Their expense ratio when I started was around 1.4%. During the last review, it was 0.77%. Now it has further reduced to 0.62%. This is great. The lower the cost the better for us!

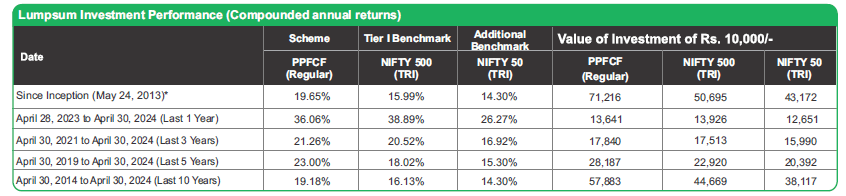

Significant outperformance over 10+ years…

Here is how the fund has performed in the past

As seen above, the 5 years and 10 years performance indicates significant outperformance against the benchmark. The fund is doing good as per my expectation.

Cash Allocation has Increased – Personally not a big fan of cash calls!

In 2019 they had a cash allocation of around 14%. I personally don’t prefer fund managers taking cash calls and hence had mentioned this as a concern. But as the markets corrected in February and March 2020, they had deployed the entire cash into equities. While it did work out well last time, this is a double edged sword and can backfire anytime. In my view, asset allocation calls are better left to the investor.

Right now the cash allocation is around 15% which is higher than my comfort levels. But I guess I will have to live with this as of now.

Growing Fund Size needs to be monitored

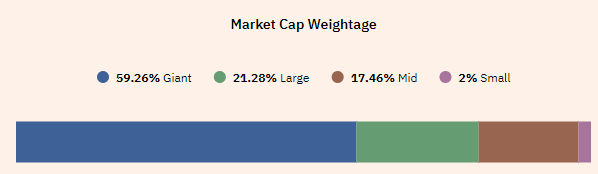

As the fund has done really well, a lot of investors have started to notice this and the inflows have been pretty strong. The fund’s size is now Rs 64,000 crs (vs ~41,000 crs during last review) which is pretty large and the speed of increase is also very fast.

In terms of their portfolio construct, I am noticing two effects of this large inflows

- Higher Cash Allocation as deployment may be taking time

- Mid & Small cap allocation which used to be 20-30% of the portfolio in the past has dropped to 14% of the portfolio.

Early signs of larger size, leading to slight modification of the strategy are starting to emerge. But the concentrated nature of the portfolio continues with top 15 stocks accounting for around 69% of the portfolio. The low churn historically and global exposure which will go to 30% provides some buffer to handle the larger size. Larger Size has also led to lower costs which is a plus.

Right now, it’s early days but I will continue to keep a close watch on this.

Overall View

Overall, my thesis remains intact and I will continue with my SIP in Parag Parikh Flexicap Fund!

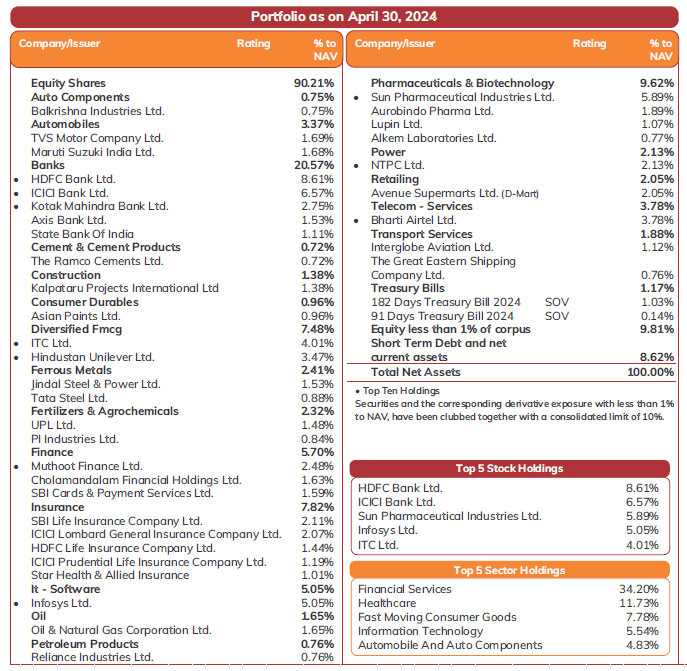

Fund no 2: ICICI Prudential India Opportunities Fund

The primary thesis (refer here) was based on the fund manager Naren. Here is a snapshot of why I like him

- 31+ years of Market experience covering 3 cycles

- 15+ years of fund management experience

- Robust long term performance track record

- Consistent Investment Style = Value investing + Contrarian + Evaluating Cycles + Top Down (using the big picture to arrive at stocks to invest in) + Bottom Up

- Macro overlay + takes advantage of cycles

- Knowledge of credit markets and credit cycles – its interplay with equities

- Ability to withstand and stick to investment process during occasional periods of short term under performance

- Well read

- Investment Gurus – James Montier, Howard Marks, Michael Mauboussin

- Deploys checklists for investing – inspired from Atul Gawande’s Checklist Manifesto

- Communicates strategies and thought process regularly on public forums (making our lives a lot more easier)

To play the contrarian style, you need to be willing to look wrong often in the short term, before the mean reversion takes place. This means you need the support and trust from both the AMC and investors. Naren’s experience and stature allows him the rare luxury to take near term pain and stay patient till the contrarian call plays out (which a lot of new fund managers will never have as the short sighted industry won’t let him/her survive)

Portfolio Positioning – Contrarian Concentrated Portfolio…

It is a reasonably concentrated fund with top 10 stocks accounting for 45% of the portfolio and 20 stocks accounting for ~63% of the portfolio. Overall it has around 65 stocks.

Reasonable AUM size at Rs 19,000 crs (vs Rs 11,000 crs during last review) implies reasonable flexibility to manage the portfolio across market caps.

Currently, the fund has reduced its mid and small cap exposure to 20% vs 28% exposure 6 months back).

Current Portfolio – Gradually increasing ‘Quality’ stocks…

Investments were predominantly into sectors that were going through near term pain thereby providing attractive valuations. Some of the positions have already started to play out. There seems to be a gradual increase in ‘quality’ companies – HDFC Bank, Kotak Bank, FMCG etc as the valuations have started to correct.

Overweight: Financial Services (increased from 25% to 35%), Pharma

Underweight: IT

Valuations have optically gone up due to an increase in quality names…

Price to Earnings Ratio: 24.6

Price to Book Ratio: 3.7

(source: value research)

Historically the valuations for the fund were optically very cheap compared to index PE providing significant valuation rerating potential which also has played out. Valuations have now started to optically look higher given the increase in ‘quality’ oriented companies. PE ratio at 24.6 times (vs 23.1 for Nifty 50) is also reasonable. This is not a concern as it needs to be put in the context of the contrarian investing style (buy out of favor good stocks). My personal view is also that quality companies are getting attractive and becoming contrarian opportunities.

Skin in the Game

Last year this number was significantly high. But not much skin in the game (roughly 6 crs as on 30-Sep-23) now as per the latest report. This is disappointing.

Low Expense Ratio

The expense ratio is low at around 0.59% ( 0.72% in Aug-23).

Portfolio Churn is moderate

Portfolio Churn is neither too high nor too low at 78%. Given the part tactical nature of the portfolio, I expect this to be around this range.

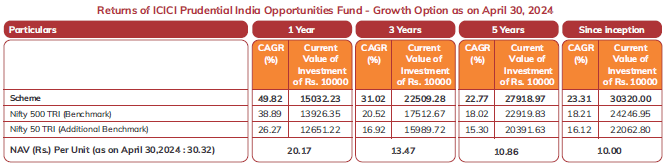

Performance has seen a significant turnaround in the last 3 1/2 years

The fund was launched on 15-Jan-19.

What was my view way back on Aug-20…

The performance then was nothing to write home about. To be honest it was really bad.

This is what I wrote in my review back then:

This is in line with all value oriented fund managers under performing. If you notice all the celebrated value oriented fund managers before 2013 – Prashant Jain, Anoop Bhaskar, Quantum Mutual Fund, Sankaran Naren, Anand Radhakrishnan etc are underperforming big time. The new breed of Quality oriented fund managers have been strong performers in the last 7 years. I expect mean reversion to play out sometime similar to what happened to value oriented fund managers previously and the quality oriented managers to go through their lean patch.

What happened after that?

Post that there was a significant pick-up in returns (not that I knew about the timing) and thankfully the thesis has started to play out. Due to the strong returns since Oct-20, now the fund has started to outperform both in the 3Y, 5Y time frame and Since inception (15-Jan-2019). This is yet another reminder of why patience is a must when you take part in contrarian funds.

Overall, while the initial few years tested our patience as value style was out of favor, post Oct-20 the fund saw a significant turnaround in performance and comfortably outperforms the benchmark by 5% annually since inception (23% for the fund vs 16% for benchmark).

That being said, this fund is not for the fainthearted and will have a significant performance differential with indices in the short term (negative and positive) given the divergent (63% of the portfolio is different from the benchmark – also called by a fancy name “active share”) and concentrated portfolio of out of favor stocks.

Overall View

Overall, my original thesis remains intact, and I would want to play the contrarian style via Sankaran Naren.

Things Under My Control – Time & Discipline

Now while I have no control over the markets, the biggest determinant of my future portfolio thankfully is still under my control – Time + Discipline

Time – I have easily a 10-15 years time frame. This would take care of most of the near-term volatility and I can ride it out.

Discipline – To save and invest consistently, come what may. Call it the pressure of social accountability, I have managed to invest Rs 30,000 every month for the first 1 year, Rs 40,000 every month for the 2nd year, Rs 50,000 every month for the 3rd year, Rs 60,000 every year for the 4th year, and Rs 70,000 every month for the current year.

I continue to focus on the above two – Time and Discipline and hopefully in 10-15 years should have a good enough outcome.

Next 6 Month Return Expectation

I had discussed a new framework to set expectations for equities as an asset class here. Since it involved too many numbers and is slightly complex, I simplified it from the previous review. This will make it easy for you to do a rough mental math and set the right expectations from your SIP portfolio.

The rough math goes like this,

For my Rs 80,000 SIP, in the next six months, I will add Rs 4.8 lakhs (Rs 80,000 x 6 months) to my current SIP portfolio. But I have already accumulated around ~Rs 67.2 lakhs as of 4-Feb-2024 (Just to make sure the six-month review timelines are kept the same). Put together, I will have a portfolio of ~Rs 72 lakhs after the next 6 months (not accounting for portfolio returns).

This Rs 72 lakh is like a lumpsum amount going forward as the entire amount is exposed to equity market ups and downs.

Based on historical data, the 6-month 90% probability return range for equities has been anywhere between -20% to +40%. So, you basically, multiply your portfolio value by 0.8x and 1.4x to get the 6-month future expected value range. As simple as that!

Applying this to Rs 72 lakhs we get a 6-month outcome range of Rs 58 lakhs to Rs 100 lakhs.

Summing it up,

In the next six months, that is on 04-Aug-2024,

I would expect my portfolio (actual investments of Rs 39.6 lakhs) to be between Rs 58 lakhs to Rs 100 lakhs. Any value within this range would be considered normal behavior from my portfolio.

That being said, if there is a large market crash (which I obviously can’t predict), then my portfolio can fall much more than this. It is reasonable to expect one or two major crisis events every ten years (covid crash of 2020 is a good reminder of this).

I have a 10-15 year time frame for my SIP. This means I have another 20 to 30 six-month periods to stay invested. Even if I lose out on a few periods, going by the history of equities, the majority of six-month periods will be in my favor and I most likely end up with a good return experience over the long run.

Similarly, you can start building reasonable volatility expectations over the next 6 month period for your SIP portfolio.

The key idea is to stay for long-term returns, one six-month period at a time!

Summing it up

The whole idea is not to ask you to pick these 2 funds. That is irrelevant. The actual intent is to show you that investing can be simple and encourage you to save and invest consistently across your working careers.

If you follow this simple plan, you will end with a terrific outcome over the long run irrespective of which equity fund you pick (as long as you don’t mess it up big time).

In fact, over the next 2-3 years, this simple Equity SIP plan has a high chance of reaching Rs 1 crore (if we get 10-12% returns from hereon).

When I started 5 1/2 years back, the possibility of reaching Rs 1 cr via this SIP so soon was not a part of my wildest imagination and now it seems so doable! Even for someone like me, who has been a part of some amazing wealth management firms and has done millions of boring presentations on the power of compounding for god knows how long, it’s been extremely difficult to truly wrap my head around the power of compounding until I finally experienced it.

So the only way to truly appreciate the power of compounding is to start your own Equity SIP and get to experience it firsthand over the next 10-20 years!

I honestly think if we plan our money well, then it can make a huge difference to our lives and the people around us. The idea behind this blog is that in a small way, if I can help you make good money decisions today, maybe I can someday create a big difference in your lives over the long run.

Ok, sentiments aside – the next review will be on Aug-2024.

See you, folks. As always Happy Investing!

If you have any feedback (good or bad) you can mail me at rarun86@gmail.com.

You can also check my articles in the FundsIndia blog where I write more regularly – https://www.fundsindia.com/blog/category/mf-research

You can also check out my other blog articles here

If you loved this post, share it with your friends and don’t forget to subscribe to the blog or Twitter or linkedin along with the 11,000+ awesome people. Look out for some fresh, super interesting investment insights delivered straight to your inbox.

Really encouraging to see you to continue with your SIP (in fact increasing the allocation every year) with your conviction and getting super results. Nice, candid and real performance.

LikeLike

Really encouraging to see you to continue with your SIP (in fact increasing the allocation every year) with your conviction and getting super results. Nice, candid and real performance.

LikeLike

Thanks Kamal 🙂

LikeLike

Hi Arun,

I have been doing sip along with you. unrealised profit in ppfas is 35L+

LikeLike

I have been following you. It is indeed simple, rewarding and cut a lot of irrelevant noices.

Do you recommend to book some profits if one find 1.4x after 6 months to buy more when one find 0.8x after 6 months?

LikeLike

Hi Arun

when is the next blog is coming out?

LikeLike

Hi Arun. So if one were to start their investment journey today via SIP mode in Mutual Funds, can they start it with the same two funds in which you are investing. Or let me put it another way, if you were to start your journey today (SIP mode), will you invest in the same two funds or your choice will be different? Please do respond as I am planning to and you response will be of great help to me. Really looking forward to what you have to say on this.

LikeLike

i am starting this month with these two what do you say wanna start

LikeLike

And if you will choose different funds, which two will they be?

LikeLike

I came across your original blog sometime in 2018 when you said you are gonna start the 30k SIP in these 2 funds. At that time, 30k seemed like a huge amount for me to put it in SIP. But i wanted to check how your investment was doing (and whether you are really continuing). But I lost track of your blog and couldnt find it. I used to think about it over these years and finally today i found the blog, from your youtube interview.

In these 5 years, i have also started SIPs for about 40k, in 10 different mutual funds. I’m strictly against the idea of having just 2 or 3 funds. My intention is to continue it atleast till Apr 2030 and surely beyond. Till now i have accumulated around 30lacs from an investment of 16laks (aveg cagr of 34%). My goal is to have 1 C by 2030.

Lot has happened in the last 5 years and its good to see you continuing this journey and updating here too. Will surely keep track of this blog from now and lets see how life goes from here.

Raj.

LikeLike

Hi Arun, thanks for documenting this SIP journey. I’m planning to track your fund picks in my portfolio . Do you see any risk in S Naren retiring in the short term?

LikeLike

hello arun i learned about your journey but i noticed that the funds that you were investing from starting i.e. parag parikh long term equity and icici prudential large mid cap fund changes to parag parikh flexi cap and icici prudential india opportunity fund but didn’t document that or i missed it can you please reply about this?

LikeLike

Hi Arun

Please share your thoughts on 6 years investment journey ASAP

LikeLike

Still eagerly waiting for the Aug 2024 update.

LikeLike